Translated by Andrew Vanburen from Investor Express

THERE ARE at least three reasons to take cheer if you are a holder, or prospective holder, of Chinese A shares.

First, credit is now easier to come by in the country.

Second, the world’s largest economy just reported better-than-expected job figures.

And finally, the benchmark Shanghai Composite Index is at a dismal 2,360, down nearly 30% from April levels, making a near-term comeback all the more likely.

Credit where credit’s due

The decision by the People’s Bank of China to ease credit in the country by lowering the reserve requirement ratio (RRR) by 50 basis points may have been widely anticipated, but it still produced a palpable uptick in sentiment in the market, pushing up the Index 2.3% on Thursday.

Many of the country’s leading enterprises, especially some of the heavy hitters in the beleaguered property development sector, have been cash-starved for much of this year, and the lower RRR will certainly be taken as good news.

Also, rumors circulating earlier this week about a proposed “International Board” being launched sooner rather than later – a proposal that would allow overseas enterprises to list in the PRC – were dismissed by officials.

This development, or rather the clarification of the status quo, should be seen as a boost to the market because stability is always favored over change on any bourse, however officials did say the board's eventual launch was an "inevitability."

Upside surprise in US

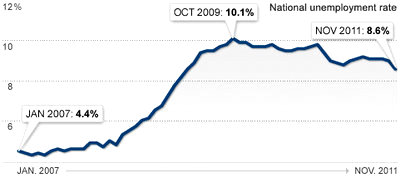

The US Labor Department announced on Friday that unemployment in the country slipped to 8.6%, a major improvement from October’s 9% and the lowest rate since March of 2009, which helped US shares finish their best week in months.

Despite Mainland China’s ongoing campaign to shift the economy away from an overreliance on export-led growth to a more concerted effort to fully tap the huge domestic market at its doorstep, Beijing has encountered more than a few hiccups along this path given the decades-long dependence on the generosity of US shoppers.

Therefore, any resurgence in the US economy is not only good news for exporters, but also supports the greenback – which in turn keeps Chinese products overseas cheap and maintains the value of the massive holdings of US debt that Beijing sits on.

It also means that Washington may be a bit more confident (if perhaps not capable) of lending a hand to crumbling national debts in the EU, in which six central banks (sans China) decided to join hands and pledge financial support to keep the eurozone afloat.

However, recent history may prompt some to keep their champagne on ice because sharp blips up or down in US labor statistics often mean nothing more than a significant chunk of jobless citizens have run out of unemployment benefits and simply stopped looking, effectively taking themselves off the labor stats grid.

What goes down...

As the saying goes, what goes up must always come down (unless it achieves orbit).

Although not consistent with Newtonian physics, the opposite is also true where capital markets are concerned.

Therefore, the fact that the Shanghai Composite -- the benchmark Index for A- and B-shares listed in Shanghai and Shenzhen – is down nearly 30% from its 2011 high in April can only mean that the likelihood of a near-term bounceback is more likely than not.

Also, the Hong Kong Stock Exchange, which typically trades lower than its dual-listed peers in the PRC, has been surging back of late, and analysts expect A-shares to jump on board the recovery wagon sooner rather than later.

However, one area to keep an eye on is the electricity generating sector as power producers continue to lobby Beijing to allow ceilings on electricity tariffs to be raised amid sharp increases in prices for thermal coal – the chief feedstock in the country’s power plants.

See also:

ALEX WONG: Nothing Wrong With Thinking Long

Money Troubles? Five Well-Known HK IPO Sponsors Under Scrutiny