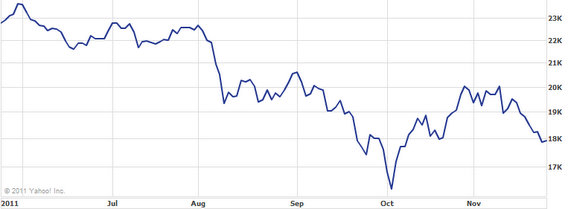

HONG KONG’S stock market has been in a tailspin for the past several months, not unlike its peers around the region and world.

Some IPO sponsors could be blamed for the relative failures of recent mainboard newcomers and the market slide, with five well-known banks falling under scrutiny.

A Chinese-language piece in Sinafinance said that the Hong Kong Monetary Authority (HKMA) had focused its attention on JP Morgan Chase & Co, UBS AG, HSBC Holdings PLC, Royal Bank of Scotland Group and Deutsche Bank AG.

The market watchdog first announced on Friday that the five global financial institution powerhouses had exhibited “various inefficiencies and inadequacies” in due diligence, prospectus disclosure, transparency and other areas of work typically assigned to IPO sponsors.

The HKMA said it had completed its initial inquiry into the five lending institutions activities and would release its findings in due course – with perhaps the lack of an immediate announcement on the outcome helping push up shares nearly 2% on Monday and another 1.2% on Tuesday.

But it also certainly may have had something to do with the benchmark Hang Seng index slumping 1.4% on Friday, the report added.

The HKMA went on to say that the review of the five foreign financial institutions was conducted between the final quarter of 2010 and the second quarter of 2011.

Economic Jealousy?

According to data provided by the Hong Kong Securities and Futures Commission (SFC), a total of 73 enterprises were accepted to perform IPO sponsoring activities in Hong Kong during the period under review.

However, the Commission added that of the total revenue garnered by the 73 sponsors, the five lending institutions under scrutiny managed to claim 39% for themselves.

Somewhat indicative of the fact that Hong Kong regulators may be more interested in spreading the wealth among local banks for the lucrative IPO sponsorship market is the fact that the five most successful banks -- all foreign -- were singled out for scrutiny.

Initial reports indicate that some sponsors performed “unsatisfactorily” when conducting due diligence reviews, including aspects such as the resolution of contradictory data, suspicious information, fact-checking integrity and other areas of concern.

Sinafinance added that during the period under review it was also found that there was a serious shortage of due diligence file records in the possession of candidate sponsors, which should have set of alarm bells at an earlier stage in the process.

A HKMA spokesperson added in a statement that the role of IPO sponsors and underwriters is “extremely critical” to the healthy operation of any capital market as well as serving the best interests of all investors.

“The Monetary Authority expects all listing sponsors to properly discharge their duties and responsibilities, and display a clear undertaking of the rules regarding timely and thorough compliance with all regulatory requirements, so as to serve the ultimate interests of investors and maintain market integrity in a sound way,” the spokesperson said.

See also:

Shareholders Blast NEW WORLD DEVELOPMENT Share Offer

GREENTOWN Chairman, How Can You Face Shareholders?