WITH SEVERAL stocks to choose from currently at below 1x price-to-book, the Hong Kong bourse is a virtual “playground” for major investors with money to buy in bulk, says a Chinese-language piece in Sinafinance.

The market watcher for the online financial journal said that one stock in particular stood out for its on-paper affordability.

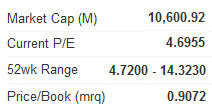

Guangzhou Shipyard International Co Ltd (HK: 317: SHA: 600685) -- southern China’s biggest integrated shipbuilder in South China with shipyards in Guangzhou and Foshan -- is the only firm in its sector listed in Hong Kong.

Founded in 1954 as a unit of China State Shipbuilding Corporation, it has been listed in Hong Kong since 1993.

Guangzhou Shipyard’s current price-to-book ratio is just 0.91, just over half the sector average of 1.71.

But with a very busy order book for the next three years or so locked in, if someone were to ask me which shipyard looked attractive, I would definitely count this one in, the report cited the market watcher as saying.

Guangzhou Shipyard’s first half operating income of 3.98 bln yuan was well above the year-earlier figure of 2.89 bln.

The company is scheduled to report third quarter results on October 27.

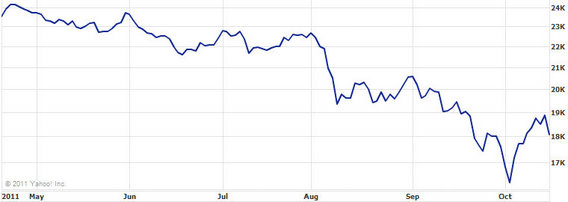

This current bear market is like a virtual playground for cash-rich investors, whether institutional or private, as there are a lot of choices in the sub-one price-to-book category, the report said.

In Hong Kong, there are currently several options in the less-than-single-digit P/B territory to choose from, with sectors sporting such opportunities ranging from heavy industry to consumer stocks.

There are even some banking counters that are in the neighborhood of 1x P/B and therefore fit this description and should also not be overlooked, the report added.

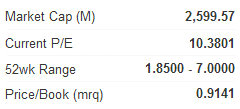

Haitong International Securities Group Ltd (HK: 665), which itself serves the needs of both institutional clients and individual investors, is also worthy of mention.

The financial institution has had a very vibrant balance sheet.

In the first six months of this year, Haitong reported net cash inflow from operating activities was 481.8 mln hkd against 91.9 mln a year earlier.

The brokerage is also not timid regarding its expansion plans, announcing earlier this year that it was “willing to pay what’s needed” to attract top banking talent from western financial institutions.

Haitong International, which came into being in 2009 when Haitong Securities purchased Hong Kong-based Taifook Securities, hopes to boost its investment banking division staff by 50-100% from the current 75-strong team.

If Hong Kong’s benchmark Hang Seng Index were to return to the 22,000-24,000 neighborhood, there is no reason not to believe that counters like Guangzhou Shipyard and Haitong International could see a doubling in their valuations, the report said.

However, there are important differences between the two that investors should take into careful consideration.

After getting to the doubled valuation level – assuming both do in the first place – their continued growth trajectories are of a different ilk.

Haitong is almost certain to continue generating wealth in any market as orders will always be coming in.

However, Guangzhou Shipyard will always have to deal with issues of oversupply, depreciation, commodity price fluctuation, global trade pattern irregularities, order book building and the state of the global economy.

But then again, one breakout order for the shipbuilder could send income through the roof.

Therefore, Guangzhou Shipyard and Haitong are from completely dissimilar sectors and appeal to very different investment philosophies.

But at the end of the day, the report said they share a very important similarity: both have price-to-book ratios below one.

See also:

CHINA’S 2011 GDP To Slow, But Remain Above 8%

Counting The Costs Of Living In SHENZHEN