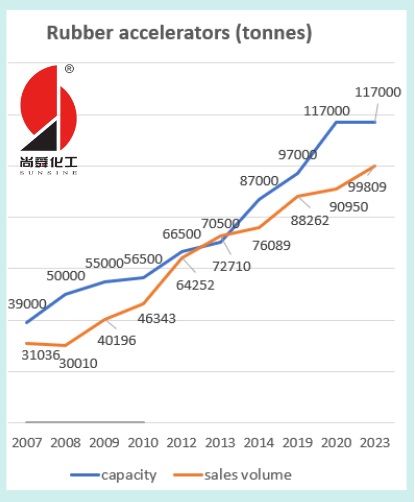

China Sunsine's profitability has not been a straight line up but it obsessively expands capacity regularly in order to secure greater market share. |

|

Rubber accelerators (RAs) are vital because they help to "harden" rubber from hours to minutes. China Sunsine's ascendency China Sunsine started producing RAs in 1994. |

In the first half of 2024, 52,636 tonnes of RAs were sold, 12% up year-on-year, representing a capacity utlisation of 90%.

Sunsine rode on the growing global vehicle population. It filled the gap created when the incumbent top RA producer Flexsys quit to double down on its insoluble sulphur business, and some RA factories in China were shut down for pollution.

With a RMB 24m government grant, Sunsine has devised a green production method of MBT, the feedstock for most RAs.

Competition

Casualties were high in the RA industry.

The early leaders (Tianjin No.1 Organic Chemical Plant, Zhenjiang Zhenbang Chemical Industry Co., and Northeast Auxiliary) have been replaced by Yanggu Huatai and Tianjin Kemai.

Yanggu Huatai

Yanggu Huatai was listed in 2010 on the Shenzhen Stock Exchange. It is the world's largest anti-scorching agent producer and China’s largest insoluble sulphur producer.

In July 2018, Huatai acknowledged Sunsine's leadership in RAs.

In March 2019, Huatai scrapped a plan to produce 10,000 tonnes of rubber accelerator TBBS.

Earlier in January, Sunsine received approval for trial production for its 30,000-tonne TBBS project.

Huatai has likely capped its RA capacity at 40,000 tonnes to channel resources to the anti-scorching agent market.

Tianjin Kemai

Tianjin Kemai failed thrice to list in Shanghai. Its 2022 bid to join the over-the-counter National Equities Exchange and Quotations fell through too.

Kemai's profit pales when compared to Sunsine's, despite its 70,000-tonne RA capacity. It suffered financial losses in 2020 (when COVID-19 struck) while Sunsine made RMB 219m.

|

2020 |

2021 |

|||

|

Kemai |

Sunsine |

Kemai |

Sunsine |

|

|

Sales (RMB m) |

1,170 |

2,334 |

1,920 |

3,725 |

|

Profit (RMB m) |

(8) |

219 |

178 |

506 |

pages 1-1-133, 134 of 1653577319_671701.pdf (neeq.com.cn)

Puyang Weilin 濮阳蔚林

Puyang Weilin, the largest among small RA producers, failed to get listed in 2011. Its dismal net profit margin (%) reflects cost as well as scale disadvantages.

|

Sunsine |

Huatai |

Kemai |

Weilin |

|

|

2019 |

14.4 |

9.2 |

n.a. |

3.5 |

|

2020 |

9.4 |

6.5 |

(0.7) |

1.5 |

|

2021 |

13.4 |

10.5 |

9.3 |

(3.0) |

|

2022 |

16.8 |

14.7 |

n.a. |

(5.8) |

|

2023 |

10.7 |

8.8 |

n.a. |

(6.8) |

阳谷华泰近五年主要财务指标对比分析 (qq.com), 蔚林股份近五年主要财务数据指标对比分析 (qq.com)

Pages 1-1-185, 186 of 1653577319_671701.pdf (neeq.com.cn)

Insoluble sulphur and antioxidants

Unlike with RA, Sunsine faces strong competition in insoluble sulphur (IS) and antioxidants.

|

Price (RMB per tonne) |

|||||

|

2021 |

2022 |

2023 |

1H2024 |

change |

|

|

Insoluble sulphur |

8,251 |

7,918 |

6,535 |

6,276 |

-24% |

|

Antioxidants |

20,390 |

24,203 |

18,315 |

16,834 |

-17% |

|

Rubber accelerators |

21,843 |

22,845 |

19,648 |

19,823 |

-9% |

|

Overall |

18,821 |

20,237 |

16,633 |

16,393 |

-14% |

In 2022, Sunsine and Yanggu Huatai added 30,000 tonnes and 40,000 tonne of IS capacity respectively. These caused IS price to plunge 24% between 2021 and 1H2024.

The market of 6PPD, the main antioxidant, is crowded -- Sinochem with 140,000 tonnes, Shanxi Jinteng 40,000 tonnes, and Nanjing Chemical and Sunsine 30,00 tonnes each. ASP of antioxidants declined 17%.

In contrast, price contraction of RA was a mild 9%.

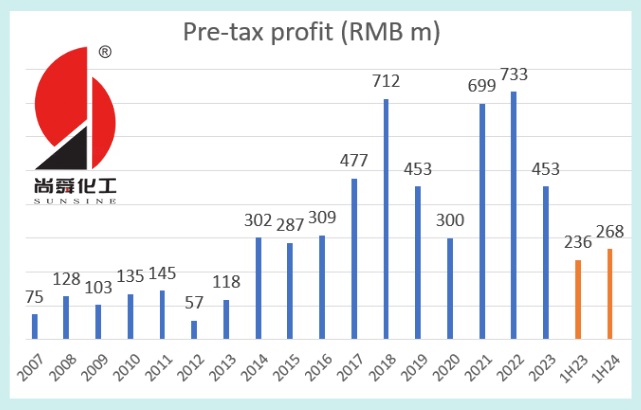

Profit fluctuation

Two main factors influence Sunsine's profit.

First, as RAs are priced on a cost-plus model, profit climbs on rising raw material prices, and declines conversely.

Second, as the tyre industry is slow-growing, Sunsine lowers prices to sell the output from new RA capacity to grow its market share.

Over time, profit grew with expanding sales volume and better production methods.

It's worth highlighting that the doubling of rubber chemical sales between 2013 and 2023 was realised with an almost unchanged headcount.

|

Year |

Headcount |

Rubber chemical sales (tonnes) |

Per-capita (tonnes) |

|

2013 |

2,134 |

98,345 |

46.1 |

|

2014 |

2,186 |

108,973 |

49.9 |

|

2015 |

2,084 |

114,572 |

55.0 |

|

2021 |

2,249 |

195,405 |

86.8 |

|

2022 |

2,193 |

186,153 |

84.9 |

|

2023 |

2,116 |

206,996 |

97.8 |

In the past 17 years, Sunsine has been profitable through multiple raw material price cycles.

A decline lasted not more than a year except for the consecutive drop in 2019 and 2020 (when COVID-19 struck).

With 1H24 pre-tax profit being 14% higher year-on-year, a rebound is likely after last year’s decline.

Financial discipline

With RMB 264m net IPO proceeds in 2007 as the only injection, Sunsine's equity surged by a whopping RMB 3,510m and cash rose to RMB 1,751m by end-June 2024, after paying RMB 936m as dividends. (Bank loans were repaid in 2016.)

|

End-2007 |

End-2023 |

30 June 2024 |

|

|

Capacity (tonnes) |

44,000 |

254,000* |

254,000 |

|

Equity (RMB m) |

469 |

3,927 |

3,979 |

|

Cash (RMB m) |

230 |

1,688 |

1,751 |

*comprising 117,000 tonnes for RA, 77,000 tonnes for antioxidants and 60,000 tonnes for IS

Sunsine has been active in buying back its shares.

The first share repurchase was on 7 September 2008. On 9 May 2017, the company sold 27.65m shares (equivalent to 55.3m after the stock split effective 29 November 2019) for RMB 85.98m vs RMB 31.35m cost.

Share repurchase resumed in 2018 and by 30 June 2024, 27.52m had been bought for RMB 61.7m.

Prospects

The slow-moving tyre industry will gather speed as more gasoline vehicles transit to EVs fitted with larger tyres for their weight.

China is top in car export, after overtaking South Korea, Germany, and Japan in successive years starting in 2021. Chinese cars are also produced offshore for cost considerations and market access.

When Chinese cars become affordable to more people, demand for RAs rises on higher tyre sales.

Based on Sunsine's IPO prospectus, in 2005 none of the world’s top ten tyremakers was Chinese. Zhongce is now ranked ninth and Cheng Shin (from Taiwan) tenth.

In 2022, 35 of the world's top 75 tyremakers are Chinese, comprising 32 homegrown and three acquired (Pirelli, Kumho, and Prometeon). They were joined by four from Taiwan.

Sixteen Chinese tyremakers have set up 25 bases overseas (20 in Southeast Asia for access to natural rubber) with a combined capacity for 180m tyres, a sizable amount compared with the global output of 2,388m units in 2023.

|

Conclusions A number of developments has contributed to Sunsine's success:

|