HONG KONG-listed Value Partners is looking for acquisitions in Southeast Asia, Taiwan and the PRC.

“It has to be the right business, at the right price and the right partner. There aren’t as many acquisition targets in this part of the world,” said Jimmy Chan, CEO of Hong Kong-based Value Partners.

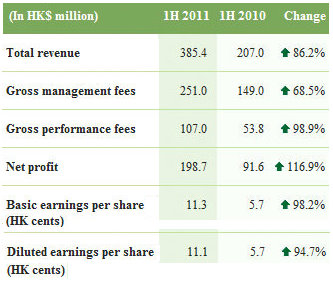

The asset management group with a market cap of over 5.5 bln hkd and assets under management (AUM) of over 8.9 bln usd is feeling very confident these days after its interim net profit surged 117% year-on-year to nearly 200 mln hkd.

Value Partners Group Ltd (HK: 806) operates as an independent, value-oriented asset management group with a focus on Greater China and the Asia-Pacific region.

The company manages seven authorized funds and manages or sub-manages five non-authorized funds under the Value Partners and SAM brands; and offers management or sub-management services to four white label or co-branded funds, including one MPF fund.

Incorporated in 1991, its investor base is made up of institutions, corporates, statutory authorities, university endowment funds, charitable foundations, high net worth individuals and retail investors.

In the January to June period, the firm’s top line surged ahead 86.2% year-on-year to 385.4 mln hkd thanks to the rise of management fees and performance fees to 251.0 mln and 107.0 mln, respectively.

The stellar bottom line performance was primarily attributable to the increases in performance fees and management fees resulting from higher assets under management (AUM).

“For the financial markets, the first half was a period clouded by anxiety over the ‘big picture’ -- investors worried over whether the world’s economy would suffer a ‘double-dip’; whether the Chinese economy was heading for a hard landing and whether the debt troubles in Greece and elsewhere could crash the financial system,” Mr. Chan said.

“We have continued to apply deep-value principles to invest through a stock-by-stock approach, and our portfolios have held firm despite the huge volatility and numerous false signals from the market. In the first half of the year, our flagship Value Partners Classic Fund grew by 1.2%; for reference, the Hang Seng Index fell by 0.8% while MSCI China Index gained 0.9%.”

The Hong Kong-listed firm added that with its strong brand and expanded distribution channels, it continued to attract significant capital inflow to its funds.

Net first-half subscription amounted to 901 mln usd compared to 319 mln a year earlier.

Total AUM as at 30 June 2011 stood at 8.9 bln usd, representing an increase of 57.1% over the year-earlier balance.

“In the past six months, we recorded resilient fund performance and good fund inflow, notwithstanding the volatile market environment. Stepping into the second half of 2011, however, the Eurozone debt crisis has continued to spread and the political fallouts over raising the debt ceiling in the US have led to global sell-offs and knock-on effect across Asian stock markets,” CEO Chan said.

The company added that it believes global uncertainties will remain as it will take considerable time and effort for the US and certain European countries to deleverage their respective economies.

“Amid market panic, we would like to reiterate it is important that investors do not over-react. Almost always, those who panic would regret it later. So far our investors have remained calm, and net fund flow to our funds since the beginning of the second half has remained positive,” Mr. Chan said.

While investors search for growth and sound finances globally, Value Partners said it sees a continual shift of investment assets from the developed countries to emerging markets, with China and the Renminbi being “big winners.”

“Naturally, China-related stock markets will benefit from this trend and we believe Value Partners will be one of the beneficiaries. As part of this effort, we have been looking for opportunities to build our business in Greater China.

“We have been talking to potential partners to establish a licensed mutual fund company on the mainland, but we have not yet decided on our choice of partner and the approval process will also take considerable time.”

Value Partners also just announced an SME financing JV in the southwestern Chinese city of Chengdu.

The JV is 90% owned by VP and 10% by the Chengdu government with total capital of 300 mln yuan and will provide small loans to SMEs in Chengdu only.

“As the government outlined its policy to develop the western regions in its twelfth five-year plan, Western China is set to be a key driver of the mainland’s economy. We see an unfilled demand of small to medium size enterprises for small loans as major commercial banks tend to focus primarily on more sizeable businesses,” said Mr. Chan.

JP Morgan currently has an ‘overweight’ call on Value Partners with a 5.00 hkd target price.

See also: BULL RUN: HK Shares To Rise 25% Over Next 12 Months, Says CLSA