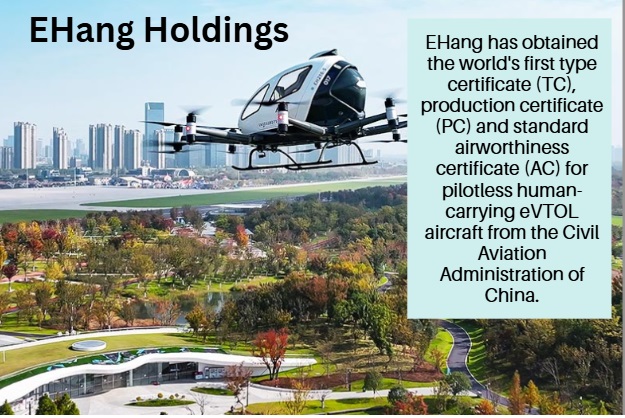

• Visitors to China can encounter glimpses of its cutting-edge tech such as service robots that deliver orders to hotel rooms, drones that deliver food, and hotel rooms with voice-activated systems that control air-conditioning, curtains, etc. One innovation that will be very exciting is pilotless flying taxis -- known as electric vertical takeoff and landing (eVTOL) aircraft. China's EHang Holdings is the No.1 player globally, having achieved approval in 2024 to mass-produce its EH216-S eVTOL after conducting thousands of test flights.  • On land, if Tesla leads in robotaxis and self-driving technology, EHang reigns in the eVTOL space -- well ahead of its US peers (Joby Aviation and Archer Aviation). • EHang is listed on Nasdaq, where it does not appear to receive as much coverage and investor attention as its US peers. Its valuation (US$1.4 billion market cap, stock price US$19.34) is, not surprisingly, much more attractive, as DBS Research points out. Read excerpts of a DBS initiation report below .... |

Excerpts from DBS Group Research report

Analysts: Jason SUM, CFA & Zoe ZHANG

| EHang Holdings Taking flight first, shaping the skies next • First certified passenger eVTOL globally, securing a multi-year commercialisation lead versus peers

• Autonomous, low-cost aircraft offers superior economics for operators vs peers • 3-year revenue CAGR of c.52%, non-GAAP profitability expected in FY27F, ahead of Western rivals • Initiate with BUY, USD28 TP; solid risk/reward given lower dilution risk and cheaper valuation vs peers |

||||

Investment Thesis:

First certified, first ahead.

EHang is the only eVTOL player in China with type certification for passenger services, giving it a multi-year head start over competitors.

Its aircraft are priced well below both domestic and Western peers, are fully autonomous unlike most peers.

EHang Founder, Chairman & CEO : Huazhi Hu • Born in 1977. • Holds a degree in computer science from Beihang University, a prestigious aviation and aerospace institution in China. • Founded EHang in 2014. • Owns 27.8% stake in EHang but controls 79.0% of EHang’s aggregate voting power (due to its dual-class share structure) |

Full autonomy eliminates pilot costs and frees up an extra passenger seat, boosting operator economics.

With strong integration into China’s EV and drone supply chains, EHang enjoys a clear structural cost advantage.

It also benefits from a growing flight-data moat, as every additional flight enhances safety validation, operational efficiency, and regulatory trust.

Growth and profitability with scale. We forecast a three-year revenue CAGR of c.52% (FY24–27F), underpinned by EH216-S deliveries supported by robust backlog.

Production capacity at Yunfu is being expanded to 1,000 units annually by end-2025 to meet demand.

The VT-35, slated for certification in 2027, will enable inter-city travel, while new EH216 variants for firefighting, logistics, and emergency response broaden applications and create additional growth levers.

We expect EHang to reach non-GAAP profitability in FY27, ahead of Western peers, driven by positive operating leverage and reduced R&D intensity.

Execution and market access will drive the stock. Near-term share price performance will hinge on order wins, EH216-S deliveries and backlog conversion.

The next re-rating will hinge on EHang’s ability to expand into overseas markets in Asia and the Middle East as regulatory frameworks open up.

In China, wider vertiport roll-out, policy support, and adoption of new variants will be key markers of scalability.

| We initiate with a BUY rating and a 12-month target price of USD28 (45- 50% upside), based on 13x FY26F EV/Sales, cross-checked with DCF. Compared with listed peers, EHang offers a more attractive risk/reward profile given its clear lead in commercialization, lower dilution risk and cheaper valuation. Key Risks Slower adoption of eVTOLs, execution risks in scaling production, and potential safety incidents that could undermine credibility. |

Full report here.