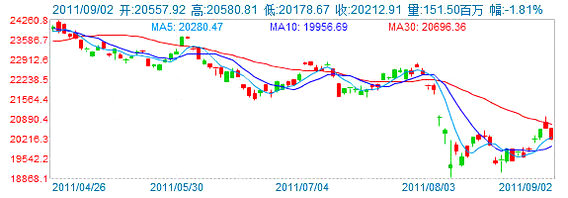

HONG KONG’S benchmark Hang Seng Index enjoyed its second straight winning week, adding 3.2% to finish at 20,212.91.

However, most of the weekly gains were spoilt by a 1.8% selloff on Friday.

And analysts aren’t too upbeat on shares going forward as most of the positive interim earnings have already been released and factored in.

Sentiment was dampened in Hong Kong today by the heavy selling pressure in New York on Thursday as well as in Tokyo today.

The Financial Sector Sub-index and the Property Sub-index, both heavily weighted and represented within the main benchmark index, fell 1.22% and 2.60% today, respectively, adding to the overall downward pressure on the day.

A Chinese language piece in Sinafinance said that all eyes in Hong Kong were on Washington, as the US Labor Department is scheduled to release its August jobless figures later today.

Investors were not particularly sanguine on the possibility of a big jump in employment in the world’s biggest economy which of course puts a crimp on export-dependent Mainland China as well as Hong Kong.

Major movers today included consumer goods trader Li & Fung Ltd (HK: 494) which shed 6.74% to close at 13.84 hkd.

The PRC’s top finished aluminum and alumina firm Chalco Ltd (HK: 2600) dropped 4.85% to finish at 5.1 hkd, while the Mainland’s No.1 collier China Shenhua Energy (HK: 1088) lost 4.40% to 34.75.

Peer energy resource firms fared poorly as well on expectations of slowed demand on economic uncertainties.

China Coal Energy (HK: 1898) was down 3.58% at 9.97 hkd, Petrochina Co Ltd (HK: 857) lost 3.49% to 9.67 and CNOOC Ltd (HK: 883) finished 3.26% lower at 15.44.

A market watcher from Sun Hung Kai Financial said: “We have seen an impressive turnaround for Hong Kong shares these past two weeks, rising from around 19,000 to hit a high of around 21,000.

“But investors should be wary of any sustainability of this half-month run, which was primarily driven by the raft of generally upbeat interim earnings releases. Corrections in the near term should be expected.”

Another analyst from Shenyin Wanguo Securities agreed.

“Now that the celebration over first half earnings is over and the net upside digested by the market, I would expect investors to once again turn their attention to problems external to Hong Kong.

“These of course include budgetary and jobless situations in the US as well as chronic debt burdens in the EU, with France and the UK’s unique problems likely to come more into focus. This should put a damper on bourses in the US and EU and likely impact shares in Hong Kong once again.”

See also:

BAOFENG: PRC’s Top Slipper Co 1H Sales Surge 30% To Nearly 600 Mln Yuan

VST Holdings: IPads, China Market Propel 1H Sales