HONG KONG’S benchmark Hang Seng Index finished the week up 0.9%, breaking a four-week losing spell.

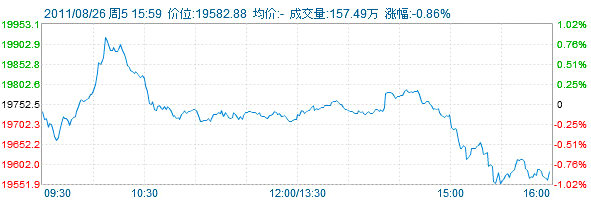

But shares still managed to shed another 0.86% on Friday to close at 19,582.88.

Analysts expect investors to continue taking cues from the state of the US economy as well as the evolving political situation in North Africa.

A Chinese language piece in Sinafinance said today’s lowest trading turnover seen in a month was evidence of the weeks-long skittish wait-and-see attitude adopted by most buyers and sellers of Hong Kong-listed shares, especially ahead of a major speech by the US Fed chairman.

More volatile counters with higher beta assignments represented most of the losses today while healthy earnings from large cap Mainland Chinese lenders and other blue chips helped ease the downturn in trading on Friday.

Analysts said that today’s sluggish trading activity was also largely due to anticipation ahead of an annual speech to be made later tonight (Hong Kong time) by US Federal Reserve Chairman Ben Bernanke.

Investors are fully aware that the Fed chairman used the occasion last year to launch the second quantitative easing (QE2), and there is talk that a QE3 of an underdetermined scale is in the cards.

Regardless of the context of Bernanke’s speech in just a few short hours, analysts say Monday morning will in large part be a direct response to his decision, as well as any major developments in the North African political uncertainty.

Just after Bernanke announced QE2 a year ago, the benchmark Hang Seng Index began a steady, sustained rally, adding 20% in a little over two months.

But since then, the index has erased these gains, and is down some 21% since late last year.

As mentioned, big-cap lenders helped prevent Hong Kong shares from having a fifth consecutive losing week.

Industrial and Commercial Bank of China (HK: 1398; ICBC) the largest Bank of China's "Big-Four" state-owned commercial banks, finished up 1.44% today at 4.92 hkd following news that its interim earnings came in at record levels on strong interest income.

Other large caps making news today included footwear giant Belle International (HK: 1880), which finished up 3.21% at 15.42 hkd after saying its first half net profit rose 29% y-o-y to 2.0 bln yuan.

However, these gains were tempered by selloffs among major insurers.

Ping An Insurance Group Co (HK: 2318) lost 3.43% today to finish at 60.5 hkd, while domestic peer China Life (HK: 2628) was down 1.74% at 19.18.

A market watcher from Hong Kong-based Ample Finance also felt that investors were holding back from major decisions until they could digest what the US Fed chairman would announce later today.

“Early next week there will be much clearer direction, with the current bias toward holding shares and general pessimism.

“That being said, most would bet against a new QE3 being announced tonight and either way, Monday will be an interesting day,” he said.

See also:

What Bear Market? 11 IPOs Eye 77 Bln Hkd In Sept, Including Hongguo

COMTEC SOLAR: HK-Listco's 1H Profit Soars 48.1% On Vibrant Wafer Sales