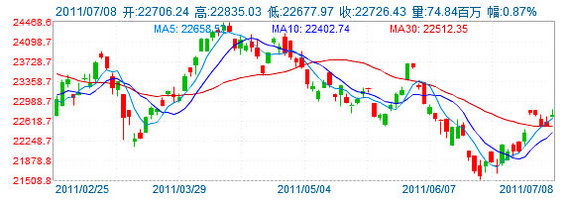

HONG KONG’S benchmark Hang Seng Index added 1.5% on the week, closing Friday up 0.87% at 22,726.43 on strong PRC-based (H-share) performance.

However, all eyes will be on the PRC’s June CPI figures, due out tomorrow.

Today ends the third straight positive trading week for the Hong Kong stock exchange.

Large-cap counters in the real estate development and financial sector led today’s rally on a raft of upbeat news from property plays, according to a Chinese-language piece in Sinafinance.

The Hang Seng’s heavily-weighted Financial Sector Sub-index added 0.64% today to finish at 32,189.94, while the equally important Property Sector Sub-index did even better – closing up 0.90% at 28,827.68.

Meanwhile, the Industrial Sector Sub-index, heavily populated with H-shares, rose 1.10% to 13,246.41.

Property plays ended the week strong on robust sales figures.

China Resources Land Ltd (HK: 1109) led the property party, charging ahead 3.36% to 15.38 hkd, while Sino Land Co (HK: 83) added 1.89% to 12.94.

China Overseas Land & Investment Ltd (HK: 688) rose 1.87% to 17.46 hkd after announcing that sales last month rose over 100% year-on-year to 12.1 bln hkd.

Wharf Holdings (HK: 4) rose 3.07% to 55.4 hkd, Sun Hung Kai Properties Ltd (HK: 16) added 1.37% to 118.3, Swire Pacific Ltd (HK: 19) was up 0.62% at 113.1 and Henderson Land Development Co Ltd (HK: 12) closed 0.30% higher at 50.05.

Hong Kong-listed property developers also took a cue today from Shanghai-listed Poly Real Estate Group Co Ltd (SHA: 600048), the PRC’s No.2 developer, which announced that first half sales were up 81.4% year-on-year to 39.5 bln yuan, with June sales alone rising 79%.

Financial sector counters also finished the week on the upside following yesterday’s fully-expected interest rate hike of 25 basis points.

Bank of Communications Co Ltd (HK: 3328) leapt 2.66% to 6.94 hkd, Industrial & Commercial Bank of China (ICBC; HK: 1398) added 1.38% to 5.87, China Construction Bank Corp (HK: 939) rose 0.48% to 6.3 and fellow Big-Four lender Bank of China Ltd (HK: 3988) was 0.27% higher at 3.73.

Fellow financial sector play China Life Insurance Co Ltd (HK: 2628) rose 0.92% to 27.5 hkd.

Sinafinance cited an analyst with South China Finance as saying: “Yesterday’s 25 basis point interest rate hike from Beijing was fully expected, with some of the pressure taken off credit for further such short-term adjustments.

“But with tomorrow’s release of June inflation figures, I think there is upside resistance, with near-term trade probably hovering between 22,500 and 22,800.”

See also:

MINTH, GREAT WALL MOTORS, BYD Facing PRC Auto Slump: What Analysts Now Say...

BYD: HK-Listed Automaker To Work With Intel, Buffett Staying Put