CHINA PRINT Power Group Ltd (HK: 6828), currently listed in Singapore and principally engaged in printing books and manufacturing specialised products, has announced the details of its proposed dual primary listing on Hong Kong's Main Board.

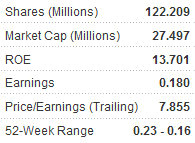

China Print Power intends to offer 39 m shares (comprising 30 m new shares and 9 m vendor shares), subject to re-allocation, 90% of which will be offered under the placing (comprising 26.1 m new shares and 9 m vendor shares), while the remaining 10% (i.e. 3.9 m new shares) will be offered to the public as part of the public offer in Hong Kong.

The offered shares will be priced within a range of 1.36-1.56 hkd each. Assuming the offer price is 1.46 hkd per share (being the mid-point of the offer price range), net proceeds from the issue of new shares under placing and public offering will be approximately 31.1 mln hkd.

The public offer in Hong Kong begins on 28 June 2011 (Tuesday) and ends at noon on 4 July 2011 (Monday). The final offer price and the allotment results will be announced on 11 July 2011 (Monday).

Dealing in the offered shares of Print Power is expected to commence on the Hong Kong's Main Board on 12 July 2011 (Tuesday) under the stock code 6828. Shares will be traded in board lots of 2,000 shares. Yuanta Securities (Hong Kong) and VC Capital are the joint sponsors and VC Brokerage is the sole bookrunner and lead manager of the listing.

Serving and building client relationships with international publishers, book traders and retail stores, China Print Power group has a diverse international customer base covering Europe, North America and Asia. Most of its major customers have been working with the group since 2002.

In addition, the company has been steadily expanding to a more diverse and sustainable customer base over the past three years and has secured major purchase orders with international clients from the US, UK, France and Germany.

Mr. Sze Chun Lee, CEO and Executive Director of Print Power, said, "Over the years, the group has been devoted to expanding its customer base by use of cost efficiency, competitive pricing, high resiliency and advanced technology to provide high quality and efficient services to respond to different customer needs. We strongly believe that the steady rise in our customer base is the result of our good efforts."

As early as 2000, China Print Power began to engage in the production of special products and initiated its book printing business in 2001. To further tap into the PRC market, the firm obtained a printing licence issued by the Guangdong Press and Publication Administration with a permitted scope of the printing of packaging of decorative printing products. With such a printing license, the firm is allowed to manufacture and distribute non-publication specialised products in the PRC.

In terms of capacity, China Print Power has a total of twelve printing presses, one automatic casing-in binding machine and two sets of CTP equipment at a cost of approximately 4.5 mln hkd.

Located in the He Yuan High Technology Development Zone, He Yuan City, Guangdong Province, the company's He Yuan facility possesses a site area of approximately 104,349 sq.m.

"We are optimistic about industry prospects. The PRC sales revenue of the specialized products has amounted to about HK$500,000. With the sustained economic growth, rising average disposable incomes and higher living standards, we believe that high-end specialised products have tremendous potential in the PRC market. Therefore, the group will leverage its dedicated strength in printing and production expertise and experience in specialised products to identify potential customers, and strive to seek new business opportunities," Mr. Sze concluded.

See also: CHINA PRINT POWER Grossly Undervalued, Says French Shareholder

Excerpts from analyst reports...

BOCOM: CHU KONG PIPE started ‘BUY’ on order book

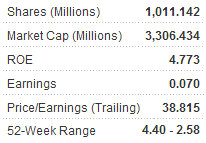

Bocom International said it is initiating coverage on CHU KONG Petroleum and Natural Gas Steel Pipe (HK: 1938) with a BUY call and a target price of 4.5 hkd (corresponding to 2011 P/E of 12x) given a strong order cycle for the largest LSAW steel pipe producer in China in terms of production capacity.

Chu Kong, whose products are widely used in the construction of oil and gas pipelines, has four production lines in Panyu, Guangzhou and Jiangyin, Jiangsu Province, with a total capacity of 1.45 mln tonnes.

“Its production lines under construction could release capacity of over two mln tonnes, of which capacity of longitudinal welded pipe production accounts for some 1.8 mln tonnes. Chu Kong Pipe is likely to maintain its leading position in the domestic LSAW steel pipe production market,” Bocom said.

FY11 results to see sharp growth on huge orders Orders on hand have reached 396,800 tonnes by end of March 2011. It is expected that Chu Kong could complete around 300,000 tonnes of LSAW steel pipe production in 2011, up 60% y-o-y in 2010, implying a sharp growth in its FY11 earnings.

Benefits from robust development of oil & gas pipeline construction Around 85% of the firm’s products are LSAW steel pipes which are specifically used for oil and gas pipelines. China has been consuming a huge volume of energy recently and the construction of oil and gas pipelines is robust.

According to the government’s plan, the length of the country’s oil and gas pipelines will be increased to 150,000km by 2015 and 210,000km by 2020 from the current 77,000km. If it is taken into account the construction of pipelines in urban areas, construction of oil and gas pipelines could see a CAGR of over 15% in the next 5 to 10 years.

“LSAW steel pipes are ideal materials for the construction of oil and gas pipelines given their stable quality and high reliability. The robust construction of China’s oil and gas pipelines will benefit the company’s LSAW steel pipe production business,” Bocom said.

Leading skills and technology in LSAW steel pipes production Chu Kong Pipe is the first domestic company to engage in LSAW steel pipe production business. With years of experience, the company possesses advanced technology and resources.

“It is the only company to possess both the UOE and JCOE production lines in China. Its LSAW steel pipes obtain certifications from numerous institutions including API, Shell and DNV,” Bocom said.

Risk alert Overseas orders might drag down earnings. Since 50% of the orders on hand were from overseas, a change in overseas orders could drag down its earnings.

“Chu Kong Pipe is a leader in China’s LSAW steel pipe production and is undergoing rapid expansion. With abundant orders on hand, it is expected that the firm could achieve a growth of over 60% in its production in 2011.”

EPS for 2011/2012 could reach RMB0.32/0.39, corresponding to 2011/2012 P/E of 8.5x/7.0x.

See also: CHU KONG, COMTEC SOLAR: What Analysts Now Say...

GUOCO: TECHTRONIC ‘BUY’ on product innovation

Guoco Capital Ltd said it is restating its BUY on power toolmaker Techtronic Industries (HK: 669) with a target price of 13.50 hkd thanks to an innovative product line which helps it stay competitive despite strong exposure to the stagnant US market.

“We reiterate our positive view on Techtronic despite a weak US housing sector,” Guoco said.

Techtronic’s share price performance has remained stagnant, ranging from 9.31-9.58 hkd over the past month.

“We attribute this to mixed messages from the counter’s exposure to the US market. In the macro view, negative news flow dominated US housing as new home sales in US fell in May for the first time in three months. In the micro view, Techtronic’s strategy in gaining market share through innovative products has remained intact,” Guoco said.

The brokerage added that Techtronic management is optimistic on Christmas sales this year.

“We have checked with our channel as it reported positive feedback on Techtronic’s sales order momentum over the next three months. We reiterate our positive view on the firm as we believe its earnings growth is underpinned by specific market share expansion and gross profit margin improvement.”

Guoco added that the reason for market share gain is Techtronic’s ability to launch innovative products amid a weakening US property market.

“Lithium ion power tools are shining examples proving Techtronic’s innovative ability. The firm rolled out this revolutionary product in 2009, roughly one year ahead of competitors like Stanley and Black & Decker. We believe Techtronic could benefit from first mover advantages in the coming two years, as customers tend to buy new products compatible with existing lithium ion batteries.”

Guoco added that Techtronic management expects to roll out around 300 new products that will contribute some 30% of total revenue in 2011. According to management, revenue growth in the first four months of 2011 was on track.

“Compared to 2010, they are confident to achieve a higher revenue growth rate for 2011. Our earnings model has conservatively assumed a 10% revenue growth for 2011, same as the previous year, while assuming another 10% revenue growth in 2012 fuelled by new products rollout.”

Given the above revenue growth assumptions and also benefits from ongoing strategic spending cuts, Guoco expects the company’s EBIT margin to expand to 6.9% in 2011 and 7.3% in 2012. As a result, the company’s EPS will reach $0.89 in 2011 and $1.10 in 2012, implying a 2-year EPS CAGR of 36%.

“The counter is currently traded at 10.3x 2011 PER and 8.4x 2012 PER, which we think is undervalued given its strong growth prospects. We maintain our BUY rating on Techtronic with 6-month target of 13.50 hkd based on 15x 2011 PER.”

It added that key downside risks include slower than expected US recovery and failure to pass on rising raw material and labor costs.

See also: BRIGHT WORLD, BROADWAY, TELECHOICE: What Analysts Now Say...