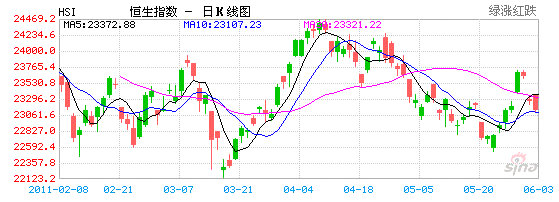

HONG KONG’S benchmark Hang Seng Index edged down 0.7% on the week, with a 1.31% plunge today to finish at 22,949.56 on anxiety over further rate action from Beijing over the three day weekend, with analysts saying all eyes will remain fixated on China’s central bank.

Meanwhile, the Shanghai Composite Index, which tracks A and B shares in the PRC, ended Friday up 0.84% at 2,728.02 on bargain hunting, finishing 0.7% higher for the week.

Investors in Hong Kong-listed shares are traditionally skittish on the eve of extended weekends, and this one is no exception, with Dragon Boat Festival observed on Monday.

But this holiday is unique in that markets in both the Special Administrative Region (SAR) of Hong Kong and its giant neighbor, the People’s Republic of China, will both take Monday off.

Therefore, according to a Chinese-language piece in Sinafinance, investors on both sides of the de facto border are especially skittish amid such scenarios, believing it is the “perfect storm” during which the People’s Bank of China -- the PRC’s central bank -- typically launches interest rate hikes, often after market close on Friday.

Leading the downward spiral today in Hong Kong were property developers, one of the most credit-reliant sectors in Hong Kong’s economy, with the Property Sub-index losing a full 2.04% today.

Close on real estate developers’ heels today were lenders, with the Hang Seng’s Financial Institution Sub-index – the heaviest component of the Hang Seng by weighted capitalization -- falling nearly a full percentage point in anticipation of either higher prime lending rates or a heightened reserve requirement ratio.

PRC-based lenders listed on both bourses have not only boosted anxiety and selloffs this week on inflation-taming credit tightening concerns, but also on a stream of reports giving varying accounts of how economic and financial regulators planned to facilitate the settling of provincial and municipal arrears.

Agricultural Bank of China Ltd (HK: 1288), one of China’s “big-four” state-owned lenders and the last to list, shed 1.6% today, to 4.36 hkd which tallies to a weekly selloff of 5.6%.

The fact that major swathes of Mainland China’s agricultural heartland were suffering through severe droughts did nothing to assuage fears over further central bank action to stymie inflation, as Beijing deems food price stability as a proxy for social stability.

China Construction Bank Corp (HK: 939) lost 1.9% today, the top major-lender laggard for the Hang Seng on Friday.

Meanwhile, Bank of China Ltd (HK: 3988) closed down 1.2% to 4.04 hkd, shedding 4.5% on the week, the second-worst lending-laggard behind Agbank.

But analysts says investors are wise to not discount banks, as many overreactions to on-the-ground economic and financial realities are dependent on a financial sector clean bill of health.

Another reason for today’s selloff was the technical correction for energy plays.

China Shenhua Energy Co Ltd (HK: 1088) gave back 6.4% to close at 35.8 hkd, earning it the dubious top dropper honor in its sector on the Hang Seng today.

It surely must have come as a bit of a shock as the behemoth coal play – which constitutes nearly 80% of the PRC’s energy fuelstock – had added some 20% over the past 15 trading sessions, fueled by the “energy deficit” story in Mainland China.

Sinafinance says that the prospect of a long three-day weekend will certainly be little consolation to investors in both Hong Kong and the PRC, as most anticipate some credit tightening from Beijing amid ongoing inflationary concerns.

See also:

HK WEEKLY WRAP: Index Down 0.3%, Crude Leads Friday’s 0.95% Bounce