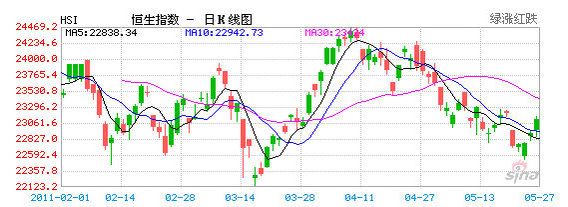

HONG KONG’S benchmark Hang Seng Index lost 0.3% on the week but ended with a 0.95% surge on Friday led by upstream oil plays to close at 23,118.07 as investors looked for bargains amid the recent protracted selloffs.

Meanwhile, the Shanghai Composite Index which tracks A and B shares in the PRC capped off its worst trading week in nearly a year, losing 5.2% over the past five days, with a 0.97% drop on Friday to finish at 2,709.95.

A Chinese language piece in Sinafinance said that capital markets on both sides of the de facto border separating the Special Administrative Region of Hong Kong and its giant neighbor Mainland China were buffeted all week by fears of even tighter measures by the People’s Bank of China, the PRC’s central bank.

Gloom was exacerbated after forecasts by China’s National Bureau of Statistics (NBS) earlier in the week said that prices for a wide range of vegetables “rose considerably” in 50 major metropolitan areas in mid-May thanks to major droughts afflicting broad swathes of the country’s harvesting heartland.

The NBS added that the country’s CPI, its broadest measure of inflation, may surge to a 34-month high for this month.

Investors in the know routinely keep a close eye on food prices, knowing full well Beijing’s obsession with controlling prices for staples -- via firm interest rate action if necessary.

Meanwhile, upstream petroleum H-shares (PRC-based firms listed in Hong Kong) led the charge on Friday thanks to recent recoveries in global oil prices.

Spurred on by the crude recovery, upstream PRC giant CNOOC Ltd (HK: 883) rose 2.03% on Friday to 19.06 hkd.

PRC peer Petrochina Ltd (HK: 857) led Friday’s rebound, jumping 3.80% to 10.94 hkd as shareholders raised stakes after learning that parent company China National Petroleum Corp (CNPC) had boosted its holding in the firm with plans to make similar buybacks down the road.

Financial sector plays also bounced back Friday amid bargain hunting and alluring valuations.

Industrial & Commercial Bank of China (HK: 1398, ICBC) rose 1.77% to 6.34 hkd thanks to what many investors still consider its attractive valuation versus historical 12-month multiples.

Friday’s recovery was also boosted by a flurry of short-covering in Hong Kong as short sales measured by volume increased to over 10% of total market turnover earlier this week.

Property plays – one of the most capital-reliant sectors -- finished the week strong on bargain hunting amid a week dominated by concern over an upcoming season of tighter credit action from Beijing on heightened inflationary worries.

Cheung Kong (Holdings) Ltd (HK: 1) closed Friday up 1.70% at 199.40 hkd, while Henderson Land Development Co Ltd added 1.55% to 52.55.

Meanwhile, Sun Hung Kai Properties Ltd (HK: 16) rose 1.02% to 118.80 hkd.

With the month coming to a close, analysts say the bulk of investors will be nervously monitoring central bank action in Beijing amid an excepted surge in the CPI for May.

See also:

HK WEEKLY WRAP: Index Loses 0.3% This Week, Up 0.2% Today

XTEP, CHINA AUTOS: What Analysts Now Say...