Translated by Andrew Vanburen from 夫戰勝攻取,而不修其功者凶,命曰費留「孫子兵法」(中文翻譯,請看下面)

“TO CLAIM VICTORY in easy times is easy, but to not fail when times are difficult is often impossible. And to conquer undefended territory is simple, but to protect it is much more challenging.”

Thus spoke military strategist Sun Tzu some 2,500 years ago, and one can make a strong argument that his advice is still applicable on battlefields of a more financial nature in modern-day Hong Kong.

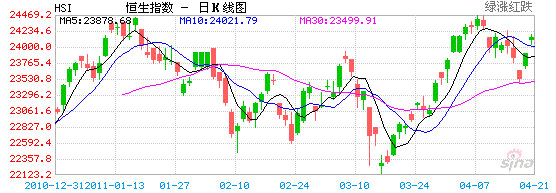

The stock market here has been topsy-turvy of late, to say the least, with cheerleaders clamoring for attention on the sidelines rooting on their respective shares, with the net effect being seemingly undecipherable cacophony.

Investing in the stock market is akin to playing cards. When you have a winning hand, it’s often best to lay low and not bet the house, because this often leads to those sharing your poker table to quickly stand up with an exasperated gasp and leave to find a less challenging game.

This is also echoed in Sun Tzu’s analects about the difficulty of holding onto a vanguard position, because as soon as you plant your side’s standard, everyone and their aunt are focused on one thing and one thing only... Your flag billowing in the breeze on coveted territory.

And that is when you become Target No.1.

Immediately after winning a skirmish, Sun Tzu advises all victorious field commanders to take stock of the situation with a sober and calculating demeanor, solidify your beachhead and avoid premature triumphalism.

Rather than capturing a hectare of turf from the enemy, solidify your position before coveting yet another hectare for conquest. You will find that this strategy, while slower than a blitzkrieg approach, will ultimately result in greater victory.

Cooler heads always prevail, whether on the field of battle or the main floor of the Hong Kong Stock Exchange. It is the battalion drunk with early success that rushes in with a foolhardy confidence which is most likely to be wiped out in the ensuing firefight.

The Hong Kong Stock Exchange has been around since 1866, and has 1,421 listed firms with a combined market capitalization of nearly three trillion US dollars.

The massive size of this capital market, despite being located in such a pintsized “city-region,” means that day in and day out, there are thousands of people making money, and a slightly smaller number also losing money (judging by the recent performance of the benchmark Hang Seng Index).

But the secret is, and pardon me if this sounds a bit too militaristic for market talk: “Keep your friends close and your enemies closer” (Sun Tzu).

With such a massive market running full steam five days a week, it is hard to keep true to Sun Tzu’s advice, so perhaps the best way to execute an effective battle plan is to at least know the difference between market-based movement and speculative seismic activity.

They say you can’t predict earthquakes, but seismologists are getting closer and closer to doing just that.

But as for seismic activity from speculative sorties, that needs to be a phenomenon which successful investors can predict even before the ground starts shaking... or housepets begin getting themselves lost en masse.

Like Charlie Munger of Berkshire Hathaway, I am a huge believer in lists, checklists to be precise, and all important undertakings should not begin without creating and consulting them.

Take pilots for example. Other than heads of state, I would agree that pilots have some of the most important jobs in a country’s economy. If they fail, then they may very well perish... along with several hundred innocents sitting behind him or her in the main cabin.

But how often, I wonder, do even the most seasoned pilots get just a little bit complacent (or lazy) and fail to go over the preflight checklist before lifting off?

This would not be a bad habit for stock market investors out there to emulate.

Before opening up your billfolds and betting on a stock, do the math, and check off your checklist.

What sectors are in a growth-stage? Which counters have the lowest P/E ratios in the sector? Is Stock A’s low P/E justified? Is Stock B expansion oriented or dividend oriented? What macroeconomic buoys on the horizon must be kept watch over?

After checking off these items, then it is a lot safer to fire up the jet engines.

See also: INVESTING TIP: To Become A Market Expert, Ditch The Media

夫戰勝攻取,而不修其功者凶,命曰費留「孫子兵法」

(文: 黃國英, 豐盛融資資產管理部董事)

近日股市,氣勢如虹,情緒亢奮,gogogo之聲,不絕於耳。股市如打牌,有勢時,銳不可擋,贏錢如斬瓜切菜,但正如高乘駿兄所講:「順境時贏不難,但要做到逆境時不輸,一點也不容易。」孫子提倡大勝後,要「修其功」:勝後守成、整固,變得更為謹慎,不可以衝動,打無把握、無着數之仗(「故曰:明主慮之, 良將修之。非利不動,非得不用,非危不戰。主不可以怒而興師,將不可慍而致戰。合於利而動,不合於利而止。)

在股市中浸淫夠廣,總會試過贏到自己唔信。但一如張化橋所言:「古今中外,做生意而發達的大有人在,而炒股票而發達的只是極少數。」原因是gogogo之後,得意忘形,冲昏頭腦,不值博的機會,也亂搏廿四。運總會盡,牛終變熊,將所勝嘔凸,世之常態。單靠炒股票,有幾多散戶身家多過2007年時,實是懷疑。嘔凸,在「孫子兵法」中,稱為「費留」。

要避免「費留」,可參考股神拍擋蒙格的心法:檢查清單(check list)。一般人心目中,最英明神武的職業,飛機師肯定佔一席位。不論所駕駛的,是民航客機還是戰機,機師的責任,都是無比重大,輕則身繫數百人命,重則肩負國家安危。所以機師們都是百中選一的精英,體能與心智都在極高水平。但實際行動時,機師卻會用一種看似最愚蠢的方法:檢查清單,來保証飛行安全無誤。何解?蒙格指出,即使才華過人、經驗豐富,飛行員決不忘記使用清單。因為智者千慮,必有一失,尤其當險情出現時,如無清單指引,逐項檢查,容易隨意援引經驗,當成結論,落得機毀人亡。蒙格進而建議,投資者也應仿效此法,自訂檢查清單,並養成常時核對的習慣,方可在意外事件中,轉危為機。

刻下市旺,屬盲拳打死老師傅格局,再強行花心機「發掘」機會,多是枉然,倒不如買定離手,趁機備妥危機保命清單。正如飛行員,也會在基地度清度楚,才手提清單出戰;斷不會飛飛吓,失速迴旋先開始諗:「弊,唔對路,要檢查乜嘢呢呵?」下述炒賣保命清單,現時看似多餘,但到出事時取用,就不致手忙腳亂。

炒賣倉位三大保命法,是為技術分析(TA)保命法、注碼保命法以及工具保命法。先說TA保命法,就是以價止蝕。那價該設在何處,可參考Bruce Kovner心法:The market shouldn’t go there if you are right.例如執筆時(21/4)如看淡兗州煤(1171),覺得中央限價風險,備受忽略,萬一中央忽然出招,會步中煤能源(1898)後塵,加上大市氣氛過熱,應有調整。市價為$29.85,前新高為$31.3,按Bruce Kovner心法,如看法正確,股價理應不會再創新高。所以淡倉止蝕,可放在$31.8。何不置於$31.3?因怕僅僅假突破。多加五毫,如上破則不容置疑。

請閱讀: 提升投資功力 首戒依賴傳媒