Translated by Andrew Vanburen from 國航: 準備起飛? (中文翻譯,請看下面)

CHINA’S COMMERCIAL carriers are expected to see tremendous growth going forward as the country is likely to account for over 25% of the 800 mln additional passengers taking to the skies between 2009 and 2014.

Air China Ltd (HK: 753; SHA: 601111), the country’s flagship carrier, is certain to grab more than a fair share of this travel boom business.

In 2010, there were 138 mln passenger trips in China, with the rate rising an average of 16% annually over the past decade.

Domestic air travel in China is now the second busiest in the world, while air freight business is among the world’s top five.

Counting the PRC and Hong Kong together, the two have accounted for a full third of recent global air travel growth, and there seems no slowdown in sight for flights originating from or flying to destinations in Mainland China.

Rapid growth for China’s commercial air travel sector has been a specific goal of economic planners for some time.

Mr. Li Jiaxiang, head of the Civil Aviation Administration of China (CAAC), announced in February that China would spend 228.2 bln usd to add 45 new airports and purchase 700 new aircraft over the next five years which would raise the total number of airports in the country to 220.

Mr. Li also predicted that China’s domestic airline industry would grow between 12-13% this year.

His enthusiasm is matched by statistics from international aviation research bodies that predict China’s commercial aviation sector will produce average annual growth of 10.8% over the next four years, becoming the fastest growing market in the world.

For this reason, China’s flagship commercial carrier – Air China Ltd – is definitely worth watching.

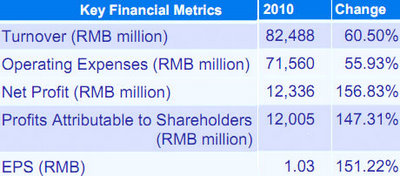

Air China’s 2010 net profit jumped 150% to 12 bln yuan, which equals 1.03 yuan per share.

The Beijing-based carrier said its 2010 results were the best in its 23-year history as a company.

Performance was boosted by a 60% increase in ticket sales and a 62.5% jump in cargo revenue.

In addition, the strengthening Chinese yuan is good news as with every 1% appreciation of the currency, the carrier earns an additional 600 mln yuan in revenue.

Aviation fuel typically accounts for 40% of the operating costs of Chinese carriers.

Therefore, upside volatility in fuel prices certainly can take a toll on a carrier’s earnings, unless handled properly.

Let’s take a look at how Air China has performed in this regard.

Its jet fuel costs last year reached 24.1 bln yuan, up 66.6% year-on-year, making up 33.7% of total operating costs.

The surge in jet fuel costs was mainly due to the oil price hike, increased fuel consumption resulting from more flying hours and the consolidation of Shenzhen Airlines’ results. During the period, Air China continued to exploit cost saving measures and maintain its cost advantages.

Although jet fuel prices rose almost 40% year-over-year in 2010, the company maintained a competitive cost-level as compared to its peers within the Chinese airline industry.

In 2010, Air China recorded a fair value gain from fuel derivative contracts amounting to 1.95 bln yuan, of which 1.97 bln related to a fair value write-back. The decrease in fair value write-back was 14 mln yuan, mainly due to the contracts settlement.

Last year, the company's exchange gains were 1.92 bln yuan, an increase of 1,650.6% from 2009, primarily due to the appreciation of the Renminbi against the US Dollar.

Air China’s Board recommends the payment of a final dividend of 0.1182 yuan per share for the year ended 31 December 2010, totaling approximately 1.523 bln yuan based on the company’s total issued shares of 12,891,954,673 (Hong Kong and Shanghai).

Major economic indicators in North America and the EU continue to show signs of improvement, which is very good news for international business and vacation travel, and Air China is expected to win a healthy portion of travel between the PRC and these two regions.

As for the ongoing crisis in Japan, Air China’s management estimates that if the nuclear scare there remains unresolved for a full year, the Beijing-based carrier’s top line will shrink by between 1-2%. Therefore, management is keeping a close eye on developments in Japan.

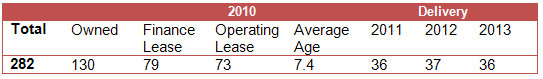

In addition, thanks to incoming and inked orders, Air China’s long-haul fleet is being rapidly expanded, which will enable to carrier to reach out into more overseas markets with greater ease, with total fleet size reaching 282 aircraft by the end of 2010.

Air China’s Hong Kong-listed shares have been holding a cruising altitude around the 7.4 hkd level for quite some time, after hitting their 52-week high in November at 11.64 hkd.

I see the stock reaching 9.87 hkd in the next cycle and recommend accumulation.

See also: SHENZHEN STORIES: Air Hostess Sees Industry Taxiing For Major Takeoff

國航: 準備起飛?

(文: 何慧韻, 股票分析师)

據國際航空運輸協會預計,2009至2014年期間所增長的8億名旅客中,超過四分一來自中國市場,增長率為10.8%,位列全球首位。

2010年中國各航空公司的客運量達1.38億人次,過去10來以年均16%的速度增長。國內航線方面,預計已升至全球第二;貨運可晉身全球五大,內地與香港合計的貨運量增長,已佔期間全球增長量的三分一,可見內地航空業的發展一日千里。

內地航空業增長迅速,而中央亦已制定發展大方向,民航局局長李家祥曾表示,在「十二五」期間,內地要新建56個、改遷16個及擴建91個機場,總投資額近人民幣5,000億元,並預計內地航空業今年增速將達12%至13%。國際航協預料,未來4年,內地的國際航空客運量將保持年均10.8%的增速,從而成為全球增長最快的市場。內地航企發展前景仍大,龍頭國航(0753)業績增長仍值得期待。

國航去年純利120.05億元人民幣,按年增長1.5倍,期內航空運輸業務收入782.09億元,大升62.6%,客運收入佔總收入的82.6%,達681.38 億元,升59.6%;貨運收入去年升幅高達86.6%,至100.72 億元,佔總收入12.2%。 另外,人民幣每升值1%,會為該公司帶來6 億元收益。人民幣匯價屢創新高,國航身為是龍頭股,受惠最大。

巿場關注油價上漲對航企的影響,研究國航的業績,去年其航油成本達到240.96 億元,大升66.6%,佔總經營費用的33.7%。公司表示,目前通過燃油附加費補償80%的燃油成本增幅,亦會以對沖合約進行航油套期保值,去年公司的航油對沖合約收益為19.54 億元,同比減少29.2%,由於沿用08年的合約,去年未有新簽訂原油期權合約,而公司在09 年和10 年的套期實際交割量佔年度航油消耗的比例分別為52.59%和28.2%,所有之前簽訂的合約會在今年12 月31 日前完成交割。

近來歐美國家的主要經濟指標持續改善,反映復甦進度理想,國際旅遊消費需求增加下,以歐美的長途航為主,國際航佔比最大的國航最受惠。至於日本核危機對集團的影響,管理層估計,假如日本核危機問題持續1年,國航收入會減少1%至2%,而公司對日本航線的運力調整有效至6月底,將繼續監控事態發展。

另外,集團今年開始會陸續接收多架寬體機,機隊結構大幅改變,有利營運國際航線,並希望拓展國際航線佔業務的比重,而現時國際航班佔比45%。今年有36架飛機付運,當中9 架為A330 和波音777的寬體客機,其中有16架舊機退役,全年淨增飛機20架,其中包括10架大型客機。截至去年底,該公司有282 架飛機。

國航近期在7.3元上下徘徊,自去年10月26日高位11.64元跌至2月底低位7元,累跌達4.64元,反彈黃金比率0.618倍計,目標可達9.87元,建議分段收集。

請看: 勝獅業績強勁,前景仍不俗