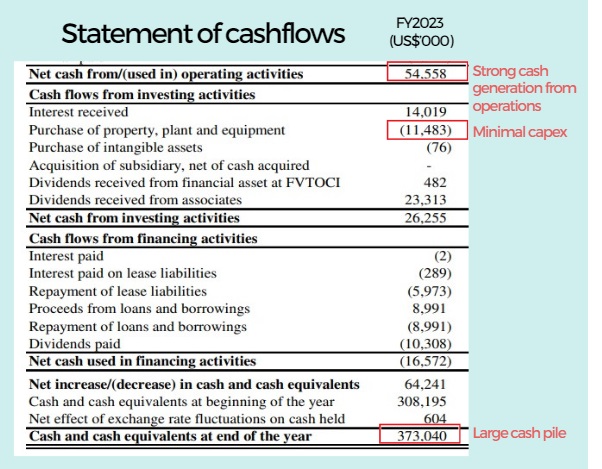

| • China Aviation Oil has a very long history on the Singapore Exchange, having listed way back in 2001 and a few years later filing for bankruptcy on huge losses from speculative options trading. Soon after, it was resuscitated financially and led by a new board. • The Covid pandemic dealt a blow to its business which depends on aviation travel. With domestic and international travel picking up pace, CAO’s supply volume of jet fuel should rise accordingly. • Its business has been low in capex and high in cash generation, leading to a cashpile which is about 64% of its current market cap (S$787 m). • However, margins are thin from operating a cost-plus model whereby it earns a fixed margin for every unit of fuel it supplies. Read more what Phillip Securities says below.... |

|

• CAO also markets jet fuel to airports outside China, and engages in international trading of jet fuel and other oil products, as well as carbon credits. |

Screenshot of a section of CAO's cashflow statement for 2023. The cashpile of US$373 m is the equivalent of S$505 million, or 64% of its current market cap (stock price: 91.5 cents).

Screenshot of a section of CAO's cashflow statement for 2023. The cashpile of US$373 m is the equivalent of S$505 million, or 64% of its current market cap (stock price: 91.5 cents).

Excerpts from Phillip Securities' report

Analyst: Peggy Mak

• The results beat our estimates by 22%, due to stronger-than-expected contributions from 33%-owned SPIA.

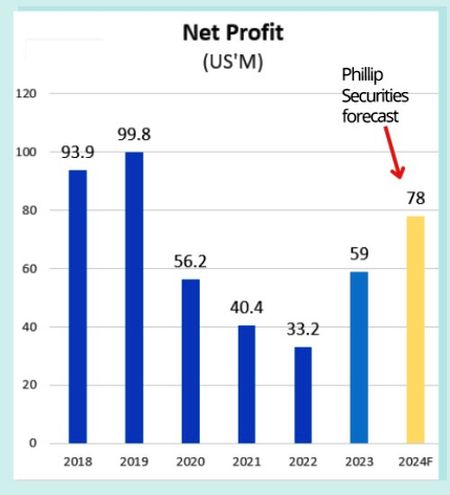

• Net profit rebounded 75.5% due to |

|||||

The Positives

• Gross profit per metric ton jumped to US$2.53 in FY23 (FY22 US$1.75/mt). The margin in 2H23 was 145% higher YoY at US$3.78/mt.

This was achieved through engaging in more end-to-end sales, sourcing products from refinery for delivery to the airline customers.

This is compared to the typical low-margin back to back oil trading transaction. Higher volume also helps to lower unit fixed cost.

This is compared to the typical low-margin back to back oil trading transaction. Higher volume also helps to lower unit fixed cost.

• Contributions from 33%-owned associate Shanghai Pudong International Airport Aviation Fuel Supply Co Ltd (SPIA) grew 61% to US$31mn.

SPIA also paid US$23mn to CAO in FY23, 9.5% higher YoY.

We expect a higher payout in FY24e after the strong FY23.

The Negative

•Provided for impairment of US$12mn for goodwill (US$3.4mn) and investment in an associate (US$8.7mn), thus lowering net profit.

Peggy Mak, research manager, Phillip SecuritiesOutlook Peggy Mak, research manager, Phillip SecuritiesOutlook Volume is expected to continue to improve as China further restores bilateral flights that were cut during the pandemic. Its US jet fuel supply operation would also benefit from resumption of US-China flights to 100 round-trips at end March. Maintain BUY and raised DCF-derived TP to S$1.05 (WACC 15%, terminal growth 1%). We have also lifted our FY24e net profit estimates by 17% to account for a higher profit per ton. |

Full report here.