AS THE Markets in the PRC break for the extended four-day Tomb Sweeping holiday, and before trading resumes on Wednesday, now is a good time to take a deep breath and make an assessment of where shares might be headed this month as we begin the second quarter.

And ever since the Shanghai Composite -- the benchmark index tracking PRC-listed A and B shares – broke through the crucial 3,000 point level in November, the past four months have seen rangebound trade mainly on the southside of 2,900.

And just in time for the resumption of trading in Shanghai and Shenzhen, for the fourth time in six months, Beijing announced today it is tightening credit to help stem inflationary worries in the country, saying it will hike the one-year lending rate to 6.31% from 6.06% beginning Wednesday, just as share trading returns from a four-day layoff.

A Chinese language piece in Sinafinance said that despite lingering concerns over additional central bank action on the interest rate and reserve requirement ratio fronts, the core financial strength of blue chips and the response of proxy players in the mid-cap categories should help lift the index over 3,000 and keep it there.

This is especially since companies listed in Shanghai and Shenzhen must report full-year earnings by end-April.

The key to any sustained rise in the Shanghai Composite has to rest in large part with the financial sector, especially listed lenders.

A detailed analysis of recent index fluctuation has almost always correlated with the performance of banks on any given trading day.

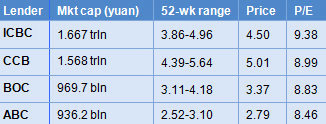

The average year-on-year revenue growth rates for listed banks that have already announced is over 20%, which is very impressive in any given year, and due to the relatively low average price-to-earnings ratios for the sector, lenders will not only provide upside to the overall market but should not be overlooked for their individual investment merits.

However, one can’t blame investors for underplaying the possibility of a sustained run for financial stocks, as recent history has shown the sector to run out of gas relatively quickly. This was especially true in 2010 when the sub-index was literally all over the map.

Of the 20 A-share listed lenders in the PRC last year, only China Everbright Bank Co Ltd (SHA: 601818) saw healthy year-on-year valuation growth, with its peers all showing declines, with some even falling by over 20%.

But PRC banks are known for having financial statements seemingly far removed from the reality of their share valuations.

Their low P/Es are in sharp contrast to the high double-digit equivalents for listcos on the SME board and the one-and-a-half year old ChiNext Board (aka: GEM Board).

Therefore, it is practically a given that the big funds will flow into many of these underpriced lenders in the current quarter, and given the financial sector’s heavy weighting on the Shanghai Composite Index, the 3,000 level will likely be a new strong point of support.

Point in case is Agricultural Bank of China which in the second half last year completed the largest IPO in history, raising 22.1 bln usd in a dual listing in Shanghai and Hong Kong, yet its PRC-listed shares as of the most recent trading day (April 1) have a paltry P/E ratio of just 8.5 times!

Low hanging fruit like ABC and other peer lenders, including fellow members of the Big Four commercial Chinese banks (ICBC, China Construction Bank and Bank of China), will all be too tempting to ignore and we expect their buy-ins to lift the benchmark index this month.

That being said, investors ignore at their peril the unresolved natural-cum-manmade disaster still unfolding in Japan, the world’s No.3 economy.

It is also wise to keep a close watch on the scale and regularity of any new credit controlling moves coming from the People’s Bank of China as although further tightening is likely, the extent to which the central bank is willing to go to ease down inflation – real or potential – is important to monitor.

Finally, the recent bailout proposal for Ireland is somewhat reassuring but the lingering sovereign debt crises plaguing the continent are far from over, as is general anxiety over the sluggish recovery underway in the US.

See also: HK WEEKLY WRAP: Hang Seng Up 2.8% On Rosy Results