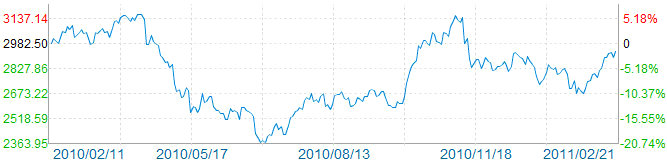

CHINESE SHARES shrugged off another hike in the reserve requirement ratio (RRR), with the benchmark Shanghai Composite closing up 1.12% at 2,932.25, marking a three-month closing high.

The central bank announced over the weekend a 50 basis-point hike to 19.5% to take effect this Thursday.

Government regulators have repeatedly said that pursuing "stable growth" -- codeword for preventing bubbles and curbing inflation -- was top priority, and this latest increase in the RRR is yet another attempt, along with three interest rate hikes in the past four months, to keep too much money from flooding the market.

But higher domestic fuel prices announced by Beijing and strong performance from property and construction materials shares lifted the bourse today and helped nullify the negative impact from the RRR rise.

In a Chinese language piece in SinaFinance, analysts said the market not only had the weekend to digest the hike in the minimum amount of money that lenders must keep on hand, but also had expected the RRR increase for some time.

Thanks to the increase in local fuel prices authorized by the government today, now at record highs, major listed petrochemical firms responded in synch.

LandOcean Energy Services (SZA: 300157) rose 6.61% to 68.50 yuan while China Oilfield Services Ltd (SHA: 601808) added 3.73% to 26.42.

Meanwhile, peer firms Xinjiang Zhundong Petroleum Technology Co Ltd (SZA: 002207) rose 2.44% to 21.00 yuan, PetroChina Co Ltd (SHA: 601857) was up 1.12% at 11.71 and China Petroleum & Chemical Corp. (Sinopec Corp) (SHA: 600028) added 1.42% to 9.27.

A statement from a leading economic official today throwing departmental support behind strong and fast growth of the domestic hotel and tourism industries also sent shares soaring.

Sichuan province-based Emei Shan Tourism Co Ltd (SZA: 000888), Wuhan Sante Cableways Group (SZA: 002159) and Tibet Tourism Co (

Peer firms Guilin Tourism Co Ltd (SZA: 000978) was up 9.37% to 14.00 yuan, Huangshan Tourism Development (SHA: 600054) added 7.84% to 19.40, China International Travel Service Co Ltd (CITS) (SHA: 601888) rose 7.61% to 29.57 and Lijiang Tourism (SZA: 002033) closed up 6.85% at 32.74.

A reported announcement from the Ministry of Housing and Urban-Rural Development that the country plans to construct 10 mln government-subsidized residential units in 2011 – up 72% year-on-year -- for the urban and rural poor this year send construction and construction material shares higher across the board.

China Fiberglass Co Ltd (SHA: 600176) rose 6.14% to 27.14 yuan, Jiuding New Materials (SZA: 002201) added 6.66% to 13.45 and Wuhu Conch Profiles and Science Co Ltd (SZA: 000619) closed up 2.87% at 10.39.

See recent: CHINA SHARES Surge 2.5% On Financials, Property; Brokerages Steal Show