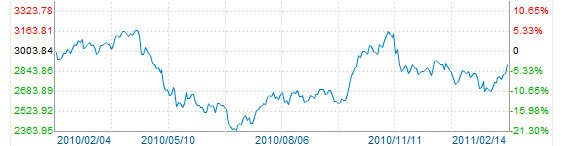

CHINA’S BENCHMARK Shanghai Composite Index began the first full trading week of the Year of the Rabbit by leaping 2.54% today to close at 2,899.13 on bullish performances by financial and real estate counters.

Brokerages were the real stars today, with two large houses even rising by their daily upside limits, said a Chinese language piece in SinaFinance.

CITIC Securities (SHA: 600030) closed up 10.02% at 13.83 yuan while GF Securities (SZA: 000776) added 9.99% to finish the day at 48.88 yuan.

CITIC’s shares spiked today after it released a research report saying it was “very bullish” on market prospects over the next two months, with news of the report circulating among traders early in the morning session and providing sustained support throughout the trading day.

The report held that all of the macroeconomic measures implemented of late by Beijing – including three rate hikes in four months along with higher reserve requirement ratios for the nation’s lenders – have all been essentially absorbed by the capital markets and were reflected in current valuations.

It also speculated that any major downside drivers over the remainder of the first quarter would not be domestically-sourced, but would come from overseas such as ever-present risks including rising global oil prices, further sovereign debt crises arising in Europe or additional quantitative easing measures by major economies including the US.

This set off hopes of a climb-back in valuations and that Chinese shares may have hit their near-term bottom and were ready for a sustained rebound.

This sparked speculation that an imminent bull run and the higher daily turnovers would bring a windfall to securities trading institutions, whose bread and butter is the commissions that frenzied market activity brings along.

GF Securities added in its own report that market reaction to the more positive sentiment being forecast by analysts is resulting in a palpable upturn, and a sustained upswing was now more likely than not.

However, it said daily trading turnover still lacked the capacity to bring about a long-term increase in the benchmark index at this point.

Sinolink Securities Co Ltd (SHA: 600109) followed with the trend, with its shares jumping 7.6% to close at 16.01 yuan.

Meanwhile, banks and real estate firms, both major beneficiaries of more bullish borrowing and bolder re-investment sentiment, saw virtually across-the-board gains today.

China Everbright Bank Co (SHA: 601818) added 4.38% to 4.05 yuan, Industrial Bank Co Ltd. (SHA: 601166) rose 3.50% to 27.18 and China Merchants Bank Co Ltd (SHA: 600036) was up 4.33% at 13.26.

Meanwhile, Bank of Ningbo Co Ltd (SZA 002142) rose 3.79% to 12.86 yuan and Bank of Beijing Co Ltd (SHA: 601169) added 3.18% to close at 11.99.

See also:

CHINA SHARES: Year Of Rabbit Gets Rate Leap On First Trading Day