THE INFLATIONARY operating environment has been squeezing corporate profits. Over half the companies listed in Singapore reported an erosion of gross margins in the last quarter, but World Precision Machinery is an exception.

The leading PRC stamping machine player had improved its 2Q2011 gross margins by 4.3 percentage points to 27.8% and net earnings were up 65% at Rmb 54.9 million. Revenues grew 35.9% to Rmb 365.7 million.

World Precision Machinery is a high-growth company, said CEO Shao Jianjun at an investor meeting yesterday (Wed).

”The company’s growth will be driven by sales of our computerized numerical control (CNC) machines,” said Mr Shao.

About two-thirds of its revenues come from manufacturing high-performance high-tonnage machines that are usually customized, such as CNC machines.

Another one third come from manufacturing conventional machines that are mass-produced, manually operated and with a simple structure.

Mr Shao explained that unlike other stamping machine players, World Precision Machinery adopts an integrated business model that produces all the parts that it can as long as doing that is more cost competitive than purchasing the component from the market.

About 90% of its components are made in-house, with processes from smelting, molding to assembly.

It is also highly disciplined in controlling the cost of resources such as labor and raw material input.

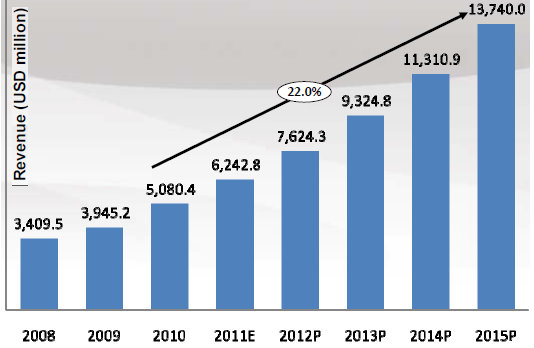

The result is top quality products at small price premium, which has enabled the company to grow its market share. Its top line has been growing at about 30% to 40% a year, compared to the industry growth of about 20%.

Its order book as at 5 Aug was Rmb 254 million.

Below is a summary of questions raised by investors at the meeting and the management’s replies.

Q: How does World Precision Machinery compare with Japanese competitor Aida?

Mr Shao: We are not as expensive, and we can provide 24-hour round the clock after-sales service. This is something that they cannot do in China. We are making Aida's mid-range products. We are about 20 years behind global standards (but this is an indicator of our company’s growth prospects). To keep abreast with technology, we have a capex budget of Rmb 50 million per year for equipment upgrade.

Q: Why do you want a plant in Shenyang?

Mr Shao: Our new plant in Shenyang is a collaboration with the local government. Steel prices are lower in the Northeast, compared to in Shanghai. The area is a large national industrial park and houses many key manufacturers in China.

It is very expensive for us to ship our products from our factory near Shanghai to the Northeast. With a factory there, we will have no problem with after-sales service. By being closer to the customer, we can get more orders and save on transport costs.

We have paid for 264,923 sq meters of land there, and intend to build a sizable factory with an area of 65,000 sq meters (100 mu).

We intend to have a total four factories there eventually. Two of size 65,000 sq meters and two of 30,000 sq meters.

Total capital investment, including land, building and equipment, is budgeted at Rmb 500 million.

Phase I is expected to complete by 2H2012, with an estimated annual production output of Rmb 300 million, which is more than what we generated in revenues during 2Q2010.

Q: For the machines that you sell through distributors, do you have problems with order cancellation?

Mr Cheng: Order cancellation is rare. We do not sell consignments as the distribution agent can easily find another customer for the conventional products. High-end products are customized, so deposits are as high as 30% to 60%. We only need to retool high-end products to resell them.

Q: What is your greatest risk?

Mr Shao: Over expansion is a risk. We are looking at our expansion plan very carefully. Our products are in constant demand as many factories shut down and many new factories are being built all the time.

Q: Are any of the other leading PRC players in stamping machinery listed?

Mr Cheng: No.

Q: What is your current interest rate?

Mr Cheng: We pay 6.5%, the benchmark rate.

Related story: CHINA PRINT POWER, WORLD PRECISION MACHINERY: Latest Happenings...