FORELAND FABRICTECH'S CFO, Simon Wong, was at CIMB Securities yesterday (July 26) to demonstrate to investors just what difference technology makes to their business of manufacturing fabrics.

Before a crowd of about 30 to 40 investors, he threw a glass of water on an open umbrella made of fabric produced by Foreland.

Amazingly, clear floral patterns began emerging on the umbrella fabric before the very eyes of the audience.

“These umbrellas are very popular with South Koreans and Taiwanese,” he said.

Next, he demonstrated Foreland’s fabric that cuts off electro-magnetic waves. He wrapped his mobile phone in a shirt with anti-electro-magnetic function.

A phone call to his mobile phone, which was just shown to be able to receive a phone call, returned the telco operator message, “Caller unavailable” on speaker.

“Anti-electro-magnetic fabric is good for pregnant women and workers in hospitals,” he said.

Growth potential in functional umbrella fabrics

“We see much growth potential in functional umbrella fabric because of our price advantage,” he added.

For example, Japan-imports cost Rmb 17 to Rmb 18 per yard compared to Rmb 12 to Rmb 13 for Foreland's fabrics of similar quality and function or better.

Foreland is headquartered in Dongshi, the PRC capital of umbrella manufacturers.

Umbrella manufacturers there had been using high-grade fabrics imported from Taiwan or Japan.

Today, they have a most cost-effective substitute product for the same price with Fulian fabrics of similar or better quality and functionality.

“This is the result of our continuous effort on R&D,” said Simon.

Foreland’s “Fulian” is an award-winning industrial brand of functional fabric products used to manufacture apparel under various reputable brands in the PRC, including “Li-Ning”, “Anta” and “Edenbo”.

In 2009, it was hit by the financial crisis and there was adverse drop in demand for high-grade functional fabric.

At that time, it was given a choice of producing the cheaper grades, or taking a cut in earnings.

It decided retain its market position as a producer of high-grade fabrics and FY2009 net earnings fell by 70% year-on-year. The second half of that year, it forayed into umbrella fabric.

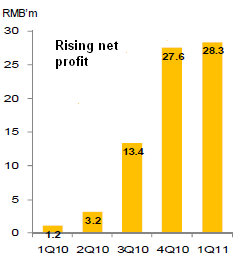

The good news is: Earnings have recovered sharply and steadily since 1Q2010, and past competitors who decided to switch to the low-end market disappeared.

Foreland recently completed the facade of a new factory sitting on 76,000 sq m of industrial land, more than twice the size of its existing facility.

Simon expects production to start in 2H2011, and this will take annual capacity to 58 million yards.

Its 1H2011 results will be announced on 12 Aug after trading hours.

Below is a summary of questions raised at the meeting and Simon’s replies.

Q: How do you deal with rising cost of raw materials and labor?

Our revenue has increased more than cost of sales. Rises in cost are shared between all players in the supply chain.

Q: Why are you ramping up production capacity when your utilization is not fully utilized?

Utilization reached 88.3% in 1Q2011. Utilization of 88% to 95% is the practical maximum, because we need downtime for machine maintenance. We are rejecting orders with good margins and selling prices. As long as the economy is good, we expect demand for high-grade functional products. All the umbrella manufacturers are asking for Fulian fabric.

Q: Is there competition for your products?

There are very few like us who produce quality functional fabrics for apparel manufacturers. This is because of our R&D, capex and years spent in accumulation of technical know-how. For umbrella fabric, we have customer feedback our quality is better than Taiwanese imports and our being in Dongshi makes logistics more convenient for them.

Q: What is your capex going forward?

When the factory facade is completed, we need to buy production lines. We are looking for financing to fund this and plan to issue Korean Depositary Receipts. It is not easy to get approvals for new textile factories, but as an established player, we can obtain new land.

Q: The business prospects look excellent. But after what happened to China Gaoxian, how do you assure investors there are no skeletons in accounting and corporate governance?

We will visit Singapore often to talk to investors. We will invite analysts to visit our factory. We pay dividends, unlike many companies with accounting issues. We can't stop other companies from bad practices.

Q: Who is your external auditor?

Baker Tilly Singapore

Q: How much of your revenue is from traders?

Q: How much of your revenue is from traders?

Apparel manufacturers 40%

Umbrella producers 50%

Traders 10%

Q: Why this structure?

Export involves many customs procedures and traders are middlemen who levy commission. We satisfy the overseas market by selling directly to manufacturers. Domestic demand is growing rapidly. Our strategy does not depend on customer profile, but on margins and how the particular order can optimize our production efficiency.

Q: What is our order book visibility?

We obtain a signed contract one to two months before delivery. That is the confirmed order book. However, each year, we have production planning with customers for the upcoming 9 to 12 months' requirements. So we are able to foresee strong orders in the second half of this year.

Related story: FORELAND, ASL MARINE, TIGER AIRWAYS: What Analysts Now Say

Comments

It looks kinda fishy to me. There are so many cheap PRC stocks. Why did investors want to pay a premium for one cheap PRC company?