Excerpts from latest analyst reports...

CIMB lifts target price of CHINA MINZHONG to $1.85

Analyst: Ho Choon Seng, CFA

2Q11 core net profit of Rmb156m (+37% yoy) was in-line with our expectations, forming 33% of our FY11 core estimates and consensus.

H11 core net profit of Rmb209m (+36% yoy) represents 44% of our FY11 core estimate and consensus. The strong profit growth was driven by the 40% yoy jump in revenue, underpinned by higher sales volume and higher processed vegetable ASP.

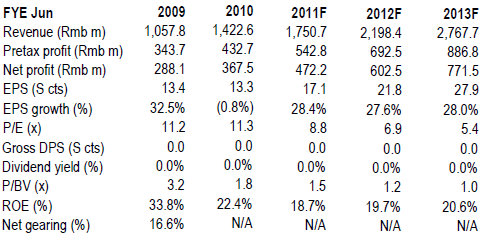

FY11-13 EPS estimates remain relatively unchanged as we adjust our interest and gross margin assumptions. We expect the earnings momentum to continue as the shift towards higher-value product continues, with higher volumes to come from maturity of existing cultivation land, and production commencement from newly-acquired land.

Target price lifted to S$1.85, based on 7x CY12 P/E, roughly 10% premium to closest peer China Green (904 HK), (from S$1.65, based on 6.3x CY12P/E, 10% premium to HK and Singapore peer average).

We price Minzhong at a premium due to its stronger earnings growth momentum. Catalysts include further sets of good results.

Kim Eng Research says FORELAND could be due for re-rating

Analyst: Yeak Chee Keong

A laggard playing catch‐up. Profits have only started to pick up from 3Q10, but the improving ASPs and customer orders confirm the recovery. Foreland said it has sufficient orders to be kept busy up till 3Q11. Along with new capacity, there is a high possibility for it to revert to pre-crisis earnings in FY11.

Due for a re‐rating. If Foreland does recover to pre‐crisis level in FY11, it would translate to FY11 PER of about 3x. In addition, the stock is currently trading below its book value and supported by net cash per share of S$0.036. It could be due for a re‐rating.

Could dual listing be on the cards? Frustrated by what is seen as depressed valuation in the Singapore market, other S‐chips textile‐related companies such as China Gaoxian and China Taisan have sought dual listing to boost their valuations. We would not be surprised if Foreland decides to embark on a similar route.

Recent story: HU AN CABLE, ERATAT LIFESTYLE, FORELAND FABRICTECH: What analysts say now....