Excerpts from latest analyst reports....

CIMB says Keppel Land is oversold, rates it 'outperform', target price $4.73

Analyst: Donald Chua

• China concerns discounted; oversold. KepLand trades at a hefty 35% discount to RNAV and 1.2x P/BV, a wide margin below its historical mean levels. We believe the stock is oversold with China concerns largely discounted.

• Townships in China. While 25% of its RNAV comes from China, the resilient mass market/township segment makes up 70% of its total China land bank by GFA. We believe there is structural demand for affordable mass housing where price growth should be sustainable.

• Market neglecting its other core units. OFC (Singapore office) is now 90% pre-leased which should crystallise capital values. MBFC PH 2 (66% pre-leased) is due to be completed in 2012.

We believe KepLand will monetise these assets in the next two years and capture substantial NAV gains in the process. If so, there is a chance for special dividend payouts.

DMG says STX Europe to cut down stake; news is positive

Analyst: Jason Saw

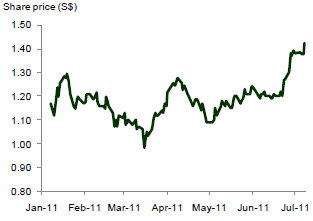

Placement removes overhang risk; a stock to own. STX Europe, the major shareholder of STX OSV, has agreed to sell 215.6m of its shares (18.3% of total shares) to OZ Management (Och-Ziff) at S$1.33/share, 6.3% below its closing price.

Post placement, STX Europe will remain as the major shareholder with a 50.75% stake and OZ Management will own 20.0% of STX OSV.

We believe the overhang risk has been cleared by the placement and believe share price could continue to re-rate on improving demand for high-end newbuilds offshore support vessels (OSV).

We re-iterate BUY with a TP of S$1.89 based on 11x FY11F P/E.

CIMB says CWT is 'building a commodities logistics empire' ; target price $1.71

Analyst: Daniel Lau

Commodities logistics driving our profit forecasts (S$m)

• Noble in the making? Leveraging its experience in coal supply chain management for coal majors, CWT has ventured into coal trading in Indonesia. Management has also been active in resource-rich Africa and Mongolia. CWT’s latest acquisition of base metals trader MRI, could propel the group into a major commodity trader in time to come.

• Investments to bear fruit in 2H11. Coal trading in Indonesia is gaining traction; newly set-up commodities futures brokerage will be fully operational by 3Q11; new warehousing

capacity will begin to contribute from 3Q11 onwards. CWT has also concluded its acquisition of MRI, which will commence significant contributions to CWT’s bottomline

• War chest to fund expansion. CWT has net cash of S$104m. It can raise another S$700m, by our estimates, if it monetise its 3.3m sf of warehousing capacity by 2013.

NRA Capital says HMI has a 'very compelling growth story' but ....

Analyst: Lee Khai Chian

FY11 results announcement is due for release by the end of August. While we are likely to see a better set of FY11 results than the previous year, we doubt it will have much impact on the share price as the profit to equity might be too small, if not negative.

The share price might remain stagnant until the company achieves sizeable earnings. This could only happen in FY13. However, bear in mind that HMI has a very compelling growth story. Any sign of RSH business (Regency Specialist Hospital located in Bandar Seri Alam, Masai, Johor Bahru) turning to black earlier than expectation might drive the share price higher.

Growth for RSH could be exponential. The counter is currently trading at 2.2x price-to-book. We do not have a rating for this counter.