Company Overview

Link to StockFacts company page. |

||||||||||||||||||||

1. KORE just celebrated its second anniversary since listing on 9 November 2017. What are some of KORE’s notable developments since listing?

• Since listing, the Manager has strengthened its portfolio with the strategic addition of three quality accretive assets in key growth markets. These are: (i) The Westpark Portfolio in Seattle, Washington; (ii) Maitland Promenade I in Orlando, Florida; and the latest acquisition of (iii) One Twenty Five in Dallas, Texas.

• The acquisitions not only strengthened KORE’s portfolio in terms of income resilience and diversification but also increased KORE’s exposure and footprint into three leading technology and business hubs in the United States.

2. Tell us more about KORE’s key growth markets.

• KORE focuses on key growth markets in the US, many of which are largely driven by technology and innovation. Its eight key growth markets are Seattle, Austin, Denver, Dallas, Houston, Orlando, Atlanta and Sacramento. In these markets, the economic, population and employment growth significantly outpaces that of the US average and the average of gateway cities, such as New York, Washington DC, and Los Angeles.

• Over the last few years, people, particularly millennials, have been moving away from gateway cities for tax savings, more affordable housing, better schools and a better quality of life while finding places where they can retain a great live-work-play environment. Employers in turn have also relocated to these key growth markets where talent is found.

• Cities like Seattle, Austin, Denver, and Dallas – where KORE has a presence - provide that quality of life, affordability and live-work-play environment they are looking for.

• In the first 9 months of 2019, KORE leased a total of 608,000 sq ft, or 14.3% of the portfolio, speaking to the strength of our leasing team on the ground and the robust demand dynamics in these key growth markets.

3. What is the tenant composition of KORE’s portfolio and its growth drivers?

• As at end September 2019, KORE’s portfolio comprises a diversified tenant base with over 36% of the total composition by net lettable area from the fast-growing technology and medical & healthcare sectors.

• According to ComTIA’s Cyberstates 2019 report, the technology sector is the third largest economic sector of the US economy with an estimated direct contribution of 10.2%. The sector is also a major driver of office rent growth yearon-year, with the strongest increase seen in markets such as Seattle and Austin, where KORE owns five properties.

• KORE’s business campuses in the technology hubs of Seattle, Austin and Denver contribute over 50% of the REIT’s cash rental income (CRI). The strong office demand and rent growth also saw the REIT recognize positive rental reversion of 13.4% to date.

4. In addition to KORE’s unique exposure to the technology sector, what are some of KORE’s other competitive strengths?

• KORE has a very low tenant concentration risk. As at end of September 2019, KORE’s top 10 tenants contribute only 21.2% of CRI and comprise 18.1% of its portfolio’s net lettable area. The largest tenant only contributes 3.7% of CRI.

• KORE’s weighted average lease expiry (WALE) of 4.1 years also allows for quicker dollar cost averaging, and in the fast growing key growth markets that KORE is in, positions it well to quickly and effectively capture rental rate increases, resulting in positive rental reversions.

• With KORE’s management team spread across Singapore and the US, it provides us with an edge when it comes to investor management in the region, while facilitating our US asset management programme.

5. Could you elaborate on KORE’s financial performance and capital management over the years.

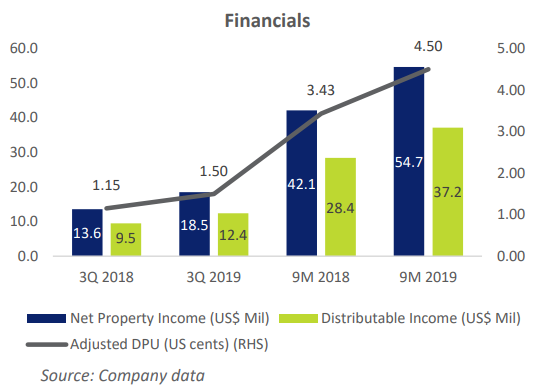

• Since listing, KORE has achieved its IPO forecasts. In the first year from listing date to 31 December 2018, the REIT achieved a DPU of 6.22 US cents, 2% above its IPO forecast adjusted DPU. As at 30 September 2019, KORE achieved DPU of 4.50 US cents for 9M 2019, 31.2% above 9M 2018 and 23.3% above IPO forecast adjusted DPU.

• KORE remains prudent in its approach towards capital management. As at 30 September 2019, the weighted average term to maturity of the REIT’s debt was 3.0 years with an all-in average cost of debt of 3.74% per annum.

• KORE also has no refinancing requirements until November 2021, and 100% of its US dollar-denominated borrowings remain unsecured, providing the REIT funding flexibility.

6. Are the US tax reforms still a risk and cause for concern for investors?

• The US Treasury has previously indicated that the final regulations under Section 267A would be released by June 2019. However, no statement of the final regulations has been released to date and the US Treasury has not provided an updated timeline on when it expects the final regulations to be issued.

• In consultation with our tax advisors, we view that the regulations, in their current form, could potentially allow KORE to revert to its original tax structure, which would see tax savings for the REIT.

• KORE will provide an update on developments, if any, in due course.

7. Could you comment on US’s economic and office market outlook? Can KORE leverage on any opportunities?

• US GDP grew 2.1% in 3Q 2019, extending the US’s longest economic expansion on record. The unemployment rate remained low at 3.5% in November 2019 with notable gains in the healthcare and professional and technical services sectors.

Within the key growth markets that KORE operates in, continued growth over and above the national average is also expected. Management believes that these positive demand drivers should continue to provide support for the office markets in KORE’s key growth markets and first choice submarkets.

• In its September 2019 national office report, Costar projected an average rental growth of c.5% in the submarkets that KORE operates in. The report showed a vacancy rate of 9.7%, the lowest US office vacancy in more than a decade, following solid rebounds in absorption and strong leasing activity.

The technology sector continued to be a major driver of growth y-o-y, with the strongest increases occurring in markets such as Seattle and Austin. Asking rents rose 6.6% in Austin and 6.2% in Seattle, ranking them first and third in the US respectively in terms of 12 month asking rent growth. These two cities make up approximately 50% of KORE’s portfolio’s CRI.

8. Looking ahead, what are some key areas that KORE will be focusing on to for its growth plans?

• KORE has and will continue to be focused on our strategy of pursuing value accretive acquisitions in first choice submarkets of key growth markets, with positive economic and office fundamentals that outpace the US national average.

• Looking ahead, we will maintain our prudent stance towards capital management, along with our proactive leasing efforts to capture rental escalations and positive reversions upon expiry of leases.

9. What was the reason behind the re-organization of KORE’s US asset manager recently?

• In September 2018, we announced the possibility of a potential reorganisation of KORE’s US asset manager. Following the announcement, Mr Peter McMillan III, Chairman of Keppel Pacific Oak US REIT Management, and Mr Keith D. Hall formed the Pacific Oak Companies, which include Pacific Oak Capital Advisors LLC.

• The reorganisation and transition of the Core Plus Team to Pacific Oak Capital Advisors LLC has since been completed, and following the transition, KORE continues to receive the full support of the Core Plus Team with no change to the scope of asset management functions provided by the team that has been in place since the IPO.

10. What is KORE’s value proposition to its shareholders and potential investors?

• We believe that KORE provides investors with the opportunity to participate in a distinctive and well-diversified US office REIT with unique exposure to key US growth markets driven by innovation and technology.

• As a US office REIT listed in Singapore, there are significant tax benefits for Asian investors in KORE, whereby they can participate in the growth of the US office market without being subject to withholding taxes, provided they submit valid tax documentation.

• KORE has a tax efficient structure for holding US properties that minimises tax payable, resulting in more distributable income to Unitholders.

First published on SGX website

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials. This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research.

For company information, visit https://www.koreusreit.com/en/

Click here for 3Q FY2019 Earnings Announcements