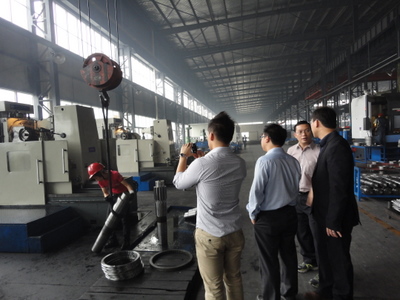

I JOINED several fund managers and analysts from China and Singapore on a visit to World Precision Machinery’s Danyang-based facilities last week as part of Financial PR/Aries Consulting's 'Discover the Dragon' series of company visits.

I had heard much about the company’s prowess – it is a leading powerhouse of metal stamping equipment in China.

First, a bit about Danyang ( 丹阳市). Located in Southern Jiangsu Province, it has a population of 900,000.

Situated in the Yangtze Delta Economic Zone and between Shanghai and Nanjing, Danyang has successfully utilized its location to promote foreign trade and attract investors for its booming industrial sectors.

For most of us, that was our first exposure to this company – and the machinery industry.

We met Mr. Shao Jian Jun, CEO of World Precision Machinery, who has built up the Group into a leading supplier of stamping machines and related components in China with 8% share of the domestic market.

Under the “World” trademark, World Precision offers more than 200 models in 2 product segments - ”Conventional” and “High Performance and High Tonnage”.

They cater to the needs of a myriad of industries including automotive, railway and white goods.

Customers include the likes of Haier, Honda, BYD, Geely Automobile, Sony and LG, along with recent customers China CNR Corp and Magna Cosma.

Indeed, the Group can boast of a strong and diversified customer base in the PRC and around the globe.

Machinery of international standard at competitive prices

As the pioneer of stamping machine industry, World Precision Machinery is one of the few Chinese manufacturers that took the initiative to introduce high precision machining equipment from PAMA Group of Italy.

This enables World Precision Machinery to match its product quality with the imported machines, and stand out from the locally made products.

In another effort to boost its product quality, World Precision has entered into a technological alliance with Aida Engineering, a global leader in capital equipment.

“Continuous enhancement in quality production is the core concept of our business and the ultimate goal that we strive to achieve…” said Mr Shao.

“It is the key driver for us to differentiate ourselves from our competitors and, more importantly, provide us the leading edge to ride on the industrialization boom and deliver promising business growth in the near future.”

Strong Order Book and Sustainable Margin

‘I am proud to say that World Precision has always been able to produce and deliver high quality stamping machines with international standards at cheaper costs compared to imported machines,’ said Samuel Ng, CFO of World Precision Machinery.

‘That’s why we have the strong support of both new and existing renowned customers in China and around the globe, and we can generate greater profitability levels by maintaining strong sales orderbook and achieving better margin than our competitors in the market.”’

In China, demand from home appliance, auto and railway sectors has intensified, and benefited the machinery industry.

Mr. Shao believed that the Group is well placed to capture opportunities from industrialization and strong auto sales and booming consumption in the PRC.

As of April 2011, the Group has clinched an orderbook of RMB428 million with a delivery period of 3 – 9 months.

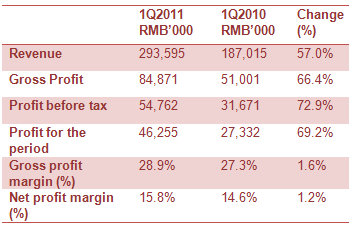

The key financial highlights of the Group for 1Q2011 (As of 31 March, 2011) are in the table on the right.

Investment merits

- Stamping machines are a key component in the production processes of a myriad of industries namely automotive, railway and white goods. It’s an irreplaceable input.

- As China is transforming into being the world’s supplier of manufacturing equipment, the stamping industry plays an increasingly important role. World Precision Machinery will be able to drive its earnings growth from the surging demand in high growth sectors in China.

- In China’s sustained industrialization, there should be a need for quality machinery at cheaper prices compared to imported machines. Think World Precision Machinery.

- The Group is planning to build a new manufacturing facility in Shenyang with the aim of enhancing its production capacity, extend its geographical reach and expand its customer base in the northern China region. World Precision is hungry for more market share.

Management expects more contracts wins in the locomotive sector after securing the railway contract with China CNR Corp.

This is a high growth sector that serve as the potential catalyst to drive better-than-expected margins and more orders for World Precision Machinery.

Recent story: WORLD PRECISION MACHINERY, BIOSENSORS, SHIPPING: What analysts now say....

This stock has gained a lot of publicity recently. I saw 3-4 research reports over the past few months. And more media too.

No smoke without fire. It pays to study a little more.