Heng Long International's crocodile tannery business target of takeover

A RARE established business in Singapore may be on the verge of a buyout, and its shares have awakened from their long-drawn slumber.

As of April 19, the stock of Heng Long International was trading around the 26-cent level. It has since climbed to 43 cents, for a 65% gain in less than a month.

Heng Long is one of the world's 5 top-tier tanneries of crocodilian leather and operates out of Defu Lane 7. It supplies to the world’s top luxury goods conglomerates such as LVMH and Richemont.

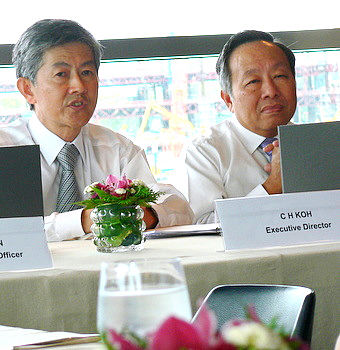

On 6 May, the company issued a statement, noting that the trading volumes and the Company’s share price have been trending upwards recently.

It said that it had been notified that its “substantial shareholders have been approached with a non-binding expression of interest in a possible transaction involving the shares or business of the Company which may or may not lead to an offer being made for the Company or its business.”

It added: “Shareholders should note that the expression of interest is preliminary in nature and there is no certainty that any transaction may be consummated in connection with the approach.”

The market, by pushing up the stock price, seems to believe that the chances of a takeover are good.

Meanwhile, Heng Long reported an improved performance as the global economy recovered.

lts revenue grew 34.8% year-on-year S$14.7 million in 1QFY2011 driven by strong momentum in global luxury goods sales.

Gross profit for the period increased 2.5 percentage points to 27.0% on higher value sales mix. As a result, net profit attributable to shareholders increased by 69.4% to S$1.5 million.

Previous stories:

HENG LONG, a global top-tier crocodile tannery: Q1 sales up 41.1%

HENG LONG: Master of science & art of tanning croc skin

Anwell Technologies sees brighter light shining on its business

Anwell Technologies, while still in the red in 1Q, has some bright spots to highlight last week:

* Revenue increase: Group sales were up 15.8% year on year to HK$246.0 million in 1Q2011, as all three business segments saw an increase in sales. The segments are: solar, optical media products and optical media equipment.

* Its optical media products business accounted for the largest portion of the Group’s revenues, contributing HK$165.0 million or 67.1% of total revenue.

This was followed by its solar division, which posted HK$62.3 million worth of sales, or a 51.7% increase.

* Gross profit up, margin up: Gross profit soared 280.3% yoy to HK$25.5 million on better margins secured across all its business segments.

Gross profit margins more than tripled from 3.2% in 1Q2010 to 10.4% in 1Q2011, led by margin improvements at its solar division.

Anwell continued to enjoy government grants. Its other operation income jumped from HK$5.5 million in 1Q2010 to HK$45.8 million in 1Q2011, as the Group recognized Government grants for several research and development projects.

The bottomline: Anwell narrowed its 1Q net loss to HK$11.5 million from HK$87.8 million a year earlier.

Recent story: ANWELL: Counting on improved business performance this year