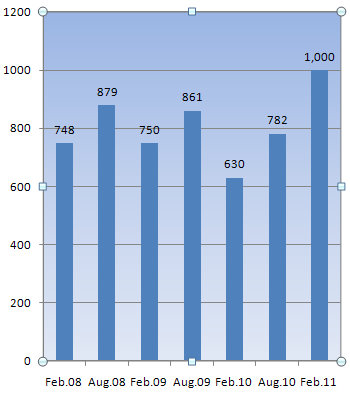

Sunpower Group has announced that, as at Feb 11, it has an order book of RMB 1 billion, a record figure.

This suggests the growth momentum is continuing after the company's 34.9% jump in net profit to RMB 86.6 million. Revenue grew 25% to RMB940.8 million.

The gross margin and net margin were 25.9% and 9.8%, respectively.

The Sunpower chairman and his management were in town to meet fund managers and the media after the results announcement, and we organized a meeting last Saturday for NextInsight readers.

Recognising that Singaporeans are unfamiliar with Sunpower’s business, its chairman, Guo Hong Xin, spent a lot of time to explain the its products and the industries they are used in.

In a nutshell, Sunpower designs and manufactures a wide range of systems for enegy saving, energy efficient and environment protection.

Major customers include BP, Shell, Sinopec and the Shenhua Group.

The high reputation of its client base was highlighted by Mr Guo, who also emphasized that Sunpower products are of high-technology and uses high quality materials.

Sunpower has 69 patents, which arose from its R&D efforts geared towards finding improved solutions for specific clients’ challenges.

With such engineering prowess, Sunpower expects to benefit from the Chinese government’s push to improve the country’s environmental conditions.

"The government's increasingly stringent emission standards work in our favour as old factories have to upgrade their equipment. In addition, we are receiving orders from companies that are building and expanding their factories. Hence, these are opportunities for us to sell our products in a big market like China," said Mr Guo.

Expect Sunpower to grow further this year on the back of the RMB 1 billion orderbook.

"Although we can't give you our target growth numbers due to SGX regulations, we are certain that Sunpower will continue to grow steadily each year, in line with our 4-year revenue CAGR growth of 24.8%.

Phillip Securities, in a report last week, is forecasting a 18.2% rise in net profit this year to RMB102.4 million, translating into a PE of 7.2x FY11 earnings and 8.5 last year's earnings.

The analyst, Chan Wai Chee, has a target price of 79 cents for the stock which closed at 43.5 cents last Friday.

a) Our invitation to the event: SUNPOWER: 'Come meet our management, learn about our business....and have lunch'

b) Sunpower's Powerpoint presentation on its results is available on the SGX website.

c) Recent story: SUNPOWER, SINOMEM TECHNOLOGY: What analysts say now...

d) Last month’s company visit: WEE HUR: "Come visit our facility, meet our management, know our business... and have lunch"