Excerpts from latest analyst reports….

Phillip Securities raises Sunpower’s target price to 56 cents

Analyst: Chan Wai Chee (head of research)

The recent result throws out the following positives.

One, the company modestly omitted to boast that 3Q2010 is the best 3Q by revenue in its history. RMB266m is better than the previous record of RMB219m of 3Q2008 by 21%.

What’s better is that 4Q has been the best quarter of the year in 2009 and 2008. There were no quarterly reporting before that.

Two, 3Q gross margins are low, as compared to other quarters. The positive is 3Q10’s 23.2% is its best as compared to 3Q09’s 20.8%, 3Q08’s 15.6%, 2H07’s 17.6% and 2H06’s 16.3%.

Similar to the stance taken in our initiation report, on a skeptical basis, let’s assume Sunpower suddenly grinds to a halt in 2020, after another 10 years from now.

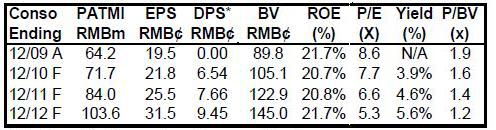

The average cash flow of FY2010F, FY2011F and FY2012F of PATMI add back depreciation and amortisation = RMB (71.7+84.0+103.6+12.8+14.3+14.8)/3 = RMB100m per year. That is, a total of RMB 1000m for the 10-year period. We assume growth would cancel out discounting of future cash flows.

Add this to FY2010F year-end current assets less total liabilities less minority interest of RMB (941.5-634.8-28.8) = RMB 278m, we get a total of RMB 1278m.

Translate this at RMB5.184=SGD1.00, we get SGD 246.5m. Divide this by 329m shares; the estimated Net Present Value is SG 75¢.

If you like what we have presented in our initiation report of the awesome reputation of Sunpower in its products, its management and its customers; you should BUY it and wait for the price to go to SG 75¢.

If you are more sceptical than skeptical, just take the STI’s overall P/E of 13.3 X Sunpower’s 2010F earnings of SG 4.2¢, then aim for SG 56¢.

We maintain our BUY call but revise upwards our target price to SG 56¢. Over today’s closing price of SG 32½¢, there is upside of 72%.

Kevin Scully says Sinomem Technology, which had strong 3Q, remains undervalued

(Visit www.nracapital.com)

Sinomem, one of long standing Stock Picks, has been languishing in a narrow range for about one year (see chart below).

The company released its Q3-2010 results last night which showed very strong growth. Highlights of the results are as follows:

a) revenue for Q3-2010 was higher by 55% to S$41.4mn while nine month revenue was higher by 38% to S$98.76mn

b) net profit was higher by 101% to S$10.2mn while nine month net profit rose 68% to S$26.3mn

c) EPS for Q3-2010 was 2.2 cents while nine month EPS was 5.4 cents

d) NAV was S$0.53 cents up from S$0.50

e) Balance sheet remains healthy with gross cash of S$41mn and net cash of S$11mn.

f) The forward looking statement is cautiously optimisitic for the water treatment segment where the Group has secured 19 projects and also for the membrane process and engineering segment even though the latter is facing more competition.

Sinomem has now delivered about 90% of my full year forecasts in the nine month period which means even on normal quarterly profit for Q4-2010, it is likely to beat my full year forecasts by 10-20%. The stock remains undervalued - please see my Stock Picks for a price target update.

Recent story: SINOMEM: Hitting high-water mark on strong demand, favorable policy