Excerpts from KGI report

Analyst: Chen Guangzhi, CFA

• We maintain our OUTPERFORM recommendation with an unchanged target price of $$1.22 based on the discounted cash flows of each project.  |

|||||

2Q21 performance review. On 30th April, Sunpower completed the divestment of M&S with a gain of RMB934mn.

The aggregate amount of the disposal of the M&S segment is RMB2.29bn, of which two tranches of special dividends of S$0.1406 a share and S$0.1006 a share were paid out in June and July.

Sunpower’s 2Q21 performance is not comparable to the same period last year as M&S only contributed 1 month of performance in 2Q21 and 4 months in 1H21.

GI segment continued to deliver a steady and healthy growth due mainly to the full quarter contribution from Shantou Phase 1 and Xintai Zhengda Project.

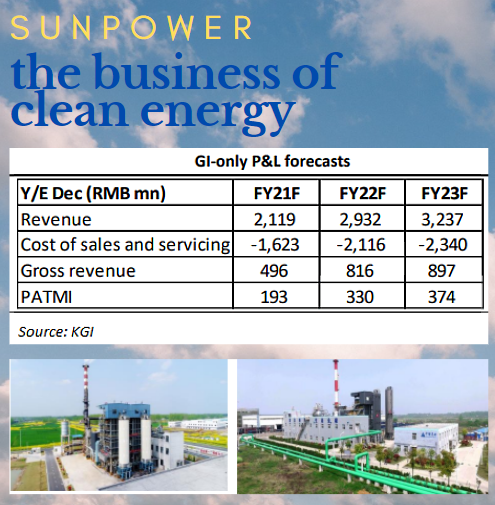

Valuation & Action: We maintain our OUTPERFORM recommendation with an unchanged target price of $$1.22, based on the discounted cash flows of each project.  Chen Guangzhi, CFA, analystAs of June 2021, there were nine GI plants under operation, two new plants under construction and two existing plants being expanded. Most of the new capacity is expected to come onstream by end-2021, with Shanxi Xinjiang to be completed in early 2022. Chen Guangzhi, CFA, analystAs of June 2021, there were nine GI plants under operation, two new plants under construction and two existing plants being expanded. Most of the new capacity is expected to come onstream by end-2021, with Shanxi Xinjiang to be completed in early 2022.Risks: Concentration risk as Sunpower’s business will solely focus on the GI business following the disposal of the M&S segment. The growth of the GI segment is mainly from the development of new plants. Rising interest rates and financing costs driven by inflation expectation could lower project rate of returns. |

The onset of carbon neutrality theme. Over the past five years, ESG (environment, social, and governance) investment was one of the mainstream themes, especially in Europe and the US. However, this is still abstract for many institutions in Asia, where most emerging countries with large populations and vast energy consumption are located.

It was not until the outbreak of COVID-19, which disrupted the supply chain and economic activities, that the ESG theme was further reinforced.

China, Asia’s largest economy and biggest energy consumer, proposed a carbon neutrality target that aims to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060. On the one hand, China will gradually slow down dirty coal consumption and raise clean energy supply in the energy mix over the next decade; on the other hand, it will also improve energy consumption efficiency, especially fossil fuels.

In the draft 14th -Five-Year Plan, the authorities continue to promote the development of the circular economy industrial parks and centralised steam facilities. Therefore, Sunpower is set to continue benefiting from the policy tailwinds.

Ramp-up of capacity. After disposing of the M&S businesses and freeing up capital, the supply of energy such as steam, power, and heat is Sunpower’s sole business.

The business driver is the capacity and utilisation rate. In the next two years, we will see new capacity from Tongshan P1, Shanxi Xinjiang, Shantou P2, and Xintai Zhengda commence operation by 2022. The amount of the new capacity accounts for 32% of the total 3,210 tonnes/h steam capacity.

Full report here.