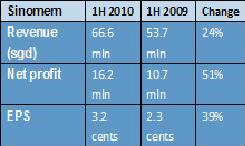

SINOMEM TECHNOLOGY Ltd (SGX: SINO/S14) believes it is in the perfect position to have several breakout years, NextInsight learns in an interview, after the firm posted a 51% jump in first half net profit to 16.2 mln sgd.

Revenue over the same January-June period rose 24% year-on-year to 66.6 mln sgd.

“As expected, we managed to solidify our recurrent income base as a majority of the BOT projects are near completion. This will enhance our liquidity position, allowing us to bid for bigger jobs,” said Sinomem Executive Chairman Dr. Lan Weiguang.

With favorable government policy encouraging cities to provide cleaner drinking water and consumers downstream demanding safer, higher quality beverages including bottled water, Sinomem is benefitting from a perfect storm of sorts, an executive told NextInsight during a recent site visit.

I first wanted to ask Sinomem Vice President Lan Chunguang about a prestigious scientific honor bestowed upon the Singapore-based firm last month, shortly after we took a half dozen fund managers to visit their facilities in the eastern Chinese city of Xiamen in May.

Sinomem, which is 62% owned by its Dr Lan Weiguang and his wife, Chen Ni, an executive director, was selected as the first corporate partner for a 63 mln sgd water research program named SPORE, which is led by NUS, Peking University and the University of Oxford.

SPORE will help develop novel technologies and products for commercialization by local companies, and as the first and exclusive corporate partner for eco-leadership and/or green leadership training programs, Sinomem will contribute as much as 3 mln sgd over the next five years, helping to study green technologies for water treatment plants, green technology parks and eco-city planning.

NextInsight: What prompted Sinomem to pursue this ostensibly non-commercial undertaking?

Mr. Lan: We were attracted to its commercial potential. We are very confident that it is a good “investment” with a lot of potential benefits down the road.

It will help raise the quality brand image of Sinomem as one of the lead industrial researchers in the program and monetization potential down the road is very promising.

It will also likely bring newfound potential to leverage on the extensive research capabilities of the participating universities and will help attract top graduates to advanced technologies in water treatment and thus expand our business network and talent pool.

Does Sinomem have trouble getting qualified engineers and technicians?

Mr. Lan: It is an issue, yes. University engineering students’ understanding of advanced technologies in water treatment, especially the combination of scientific technology as theory and engineering as practice, is inadequate as there is no dedicated field of water treatment advanced technologies which is involved in combined knowledge of different disciplines.

If they have a proper materials engineering background it is usually workable, but they still have lots to learn on the job.

If more schools would specialize in advanced technologies of water treatment then R&D cooperation possibilities would blossom.

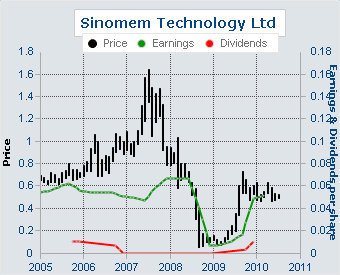

Your share price has traded within a narrow range for the past three months. What do investors need to know about Sinomem that might spark more buying interest?

Mr. Lan: We would like to say that we enjoy something close to complete immunity to the global financial crisis. Our main clients are municipal governments in China looking to provide cleaner water to their denizens.

They are doing this for two reasons: Firstly, because the central government is ordering them too.

Secondly, because end-users like you and me who demand clean drinking water are also driving the market. And if water was provided at market prices and not suppressed by subsidies, then we would anticipate a massive uptick in our orders from water purification plants looking to get into the action.

That being said, we are not turning a blind eye to overseas markets.

We have already sealed orders for wastewater treatment plants in Thailand, Pakistan and India, and also renowned Japanese firm Meiji Pharmaceutical uses our technology.

Also, we would remind investors that we have a solid, clear growth plan, with the current backbone being continuous orders from PRC-based municipal governments for our products.

And with our highly effective management training and in this climate of strong policy support from Beijing and growing demand from an increasingly environmentally aware and demanding buying public, we believe we are well-positioned to exhibit strong growth going forward.

Your 1Q revenue jumped 55% year-on-year to 32.4 mln sgd on stronger contribution from water treatment and downstream segments and your first half performance was also stellar with net profit up 52% year-on-year.

In your first quarter earnings announcement, Sinomem said that it anticipates “increased contribution from all segments...” and that the “water treatment segment will continue to be the growth driver as Sinomem targets to complete construction work of another 4 BOT water treatment plants” and in your first half statement: "we are confident of its position in China municipal water treatment as the Chinese government continued to increase its budget in the environmental protection and water resource development."

Can you give us a progress report?

Mr. Lan: We still expect to meet these expectations this year. On the project side, we are doing quite well. In July we inked two city water treatment contracts and we are likely to sign more projects in the next half of this year. This further proves that water treatment is our biggest revenue growth driver right now.

There is a lot of forward momentum for us as while China pushes for lower emissions and cleaner water, this gives us a big huge push. It’s a very supportive government policy operating environment right now.

There is a lot of forward momentum for us as while China pushes for lower emissions and cleaner water, this gives us a big huge push. It’s a very supportive government policy operating environment right now.

We also enjoy a good degree of recurring income from completed projects because we work on a BOT (build-operate-transfer) or TOT (transfer-operate-transfer) basis with our partners.

Key considerations for us before signing on the dotted line are the financial fundamentals for a project, including ROI of course.

Also, we look to maximize water-flow as that is the chief driver of our fees.

How about your downstream operations?

Mr. Lan: The 4.5 trln yuan stimulus package certainly does provide a boost. It helps with overall confidence, boosts lending, investment and consumption.

Some of our more notable clients are Wang Lao Ji, the popular canned beverage in China, as well as many bottled water brand names.

We will continue to explore opportunities for realizing the value of the downstream segment via a restructuring or disposal.

And how do you plan to expand capacity, if and when necessary?

Mr. Lan: We have no M&A plans for now. Since our pickup of the German partner in 2005 we have relied solely on organic growth.

How promising is the desalination market for Sinomem?

Mr. Lan: Very, but we have only just begun.

Our quality, price, and competitiveness ultimately determine our contract success. Some of the cash-rich property developers are trying to enter our sector, especially for wastewater treatment, but local governments usually do not endorse them because they simply don’t have the experience.

Are your shareholders happy with your dividend policy?

Mr. Lan: We believe we maintain a healthy balance between dividends and reinvestment.

See also: SINOMEM: Achieved 50%, 90% Market Share In Pharma, Dyestuff Industries