Excerpts from latest analyst reports….

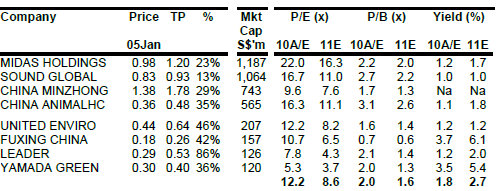

DMG highlights S-chips with potential

Analysts: Tan Han Meng, CFA, CPA; Terence Wong, CFA

During this period, share price typically experience good upswings i.e. HK: +68% (or +25% excluding outlier) and TW: +15% (or +11% excluding outlier). However, returns are mixed post dual-listing. For instance, top beneficiaries are Z-Obee (+300% since its 1st announcement) and Yangzijiang (+58%); while those with dismal performance include Hu An (-11%) and Oceanus (-15%).

Despite the patchy records, there are quite a few companies which we believe are primed for a dual listing including Fuxing China (BUY, TP S$0.255) and Leader Environmental (BUY, TP S$0.53).

We believe that S-Chips will continue to provide investors with attractive return opportunities, especially those arising from possible mispricing and potential re-rating due to lack of familiarity in these companies. Our approach is biased towards those with visible growth profiles, supported by favourable industry outlooks and compelling risk-reward tradeoffs. Past lessons also suggest much emphasis has to be placed on management track record, sustainability of growth and quality of earnings.

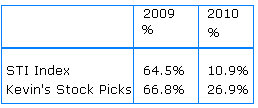

KEVIN SCULLY: Stocks you can still accumulate....

(For the full article, go to www.nracapital.com)

During 2010, I removed four stocks from my Stock Picks when they reached my price target (Ellipsiz, Hisaka, Armstrong and China Animal Healthcare).

I added six new stocks (Hock Lian Seng, Sing Holdings, Jaya, Fuxing, Juken and ASTI). The first two have underperformed and dragged down the performance of the portfolio as the Government started to introduce property curbs.

Into 2011, investors have to look at the mid-caps for performance as the blue chips are beginning to look fully valued.

I am expecting some year on year declines from the electronics sector in Q1 and Q2 but we should see the earnings cycle normalise as we move into the second half. I will therefore be monitoring closely their forward looking statements for guidance.

For now, investors can still accumulate the following (ASTI, Fuxing, Juken, Jaya and Sinomem). Most of these stocks are still in mid single digit PERs with strong balance sheets and should start to rerate and unlock their value as the liquidity moves to the mid-caps.

I will be making a few additions to the portfoilo as and when my company visits matrialise.