PROPERTY AND FINANCIAL stocks once again took the harness, pulling the benchmark Shanghai Composite Index up 1.41% today to close at 2,627.97.

Over 90% of listed firms were winners today after A shares returned to trade after a five-day long holiday break.

Hong Kong shares also added 1.00% to finish at 22,340.84.

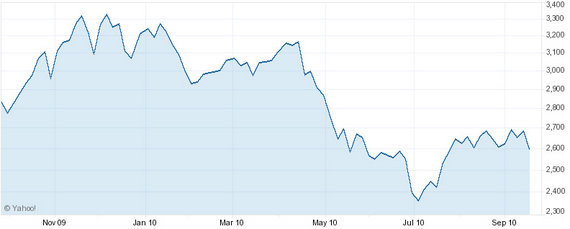

The benchmark A-share index clearly took directional cues from recent bullishness in offshore bourses, with the Shanghai Composite closing at a near two-week high.

Truncated trading weeks will not go away anytime soon as the PRC celebrates its 61st birthday on October 1, with local stock markets to enjoy a Golden Week holiday next week.

The benchmark index performed above its 60-day moving average at 2,587 points for the previous six weeks, with analysts saying this trend should provide strong support ahead of the upcoming National Day break.

And what a difference six days makes.

Optimism and market participation were back in vogue with Shanghai-listed A-share turnover surging to 90 bln yuan today after hitting just 66 bln yuan last Tuesday – the most recent trading day.

The recent US dollar weakness versus notable currencies including the Chinese yuan has mean no slowdown in the global gold rush, with the precious metal once again reaching near record levels.

This helped Shandong Gold Mining (SHA: 600547) finish up 5.0% at 46.88 yuan, and Chenzhou Mining Group Co Ltd (SZA: 002155) add 6.6% to 27.80.

Listed metals firm shares were also cheered on by recent bullish commodities prices on the London Metals Exchange.

LME prices for both base and precious metals -- save nickel and tin -- have risen across the board of late with copper especially strong.

This spurred on China’s biggest copper firm Jiangxi Copper (SHA: 600362; HK: 358), which rose by 5.2% today to finish at 31.02 yuan and Shanghai-based Aluminum Corporation of China (Chalco) (SHA:601600; HK: 2600) added 2.8% to close at 9.89.

Another listed copper giant Zijin Mining Group (SHA: 601899; HK: 2899) closed up 2.6% 6.42 yuan.

The ongoing tense political standoff between Japan and China centering around the recent detention of a Chinese shipping vessel captain in disputed waters and last week’s arrest of four Japanese nationals accused of unlawfully photographing a Chinese military facility in northern China got the rumor mill churning that China, supplier of 95% of the world’s rare-earth minerals, had already implemented an export embargo of the metals to Japan.

Both sides denied that a trade freeze in the critical metals used in core electronics manufacturing had been put into effect, but this did not prevent Inner Mongolia Baotou Steel Rare-Earth (SHA: 600111) from rising by its 10% daily limit to 70.88 yuan, and Minmetals Development (SHA: 600058) adding 8.3% to 21.99.

Analysts expect trading volume to once again taper off as the week progresses and the Golden Week holiday approaches this Friday, with the Shanghai Composite seen ranging between 2,600-2,650 points this week.

Real estate firms bounced back in afternoon trading following announcements from two ministries saying Beijing has prohibited deadbeat firms from bidding for more land if they fail to develop land within one year of winning bids.

The move is seen somewhat favorable to large-scale developers and helps to discourage speculators from sitting on vacant sites in anticipation of higher property prices.

Beijing also restated its strong support of public housing construction, another bullish driver for large-scale listed residential property developers.

Poly Real Estate Group (SHA: 600048) added 4.5% to 11.26 yuan while China Vanke (SZA: 000002), the country’s largest listed property developer, took the news less optimistically, finishing down 0.4% at 8.12 yuan.

See yesterday's: FUND MANAGER Makes Killing On 'Special Treatment' A Shares