A SHARES IN CHINA closed down 0.38% today to 2,588.71 after a report on cash positions for the country’s major lenders made its way through the markets.

Meanwhile, Hong Kong shares inched up 0.03% to close at 21,977.34.

The report in the official China Securities Journal this morning cited unnamed sources as saying China’s five biggest banks currently had loan-reserve ratios of at least 2.5%.

Nearly 70% of A shares shed share value today.

However, analysts said the financial sector news came as somewhat of a relief because the unconfirmed Big Five reserve ratio status at 2.5% and official tolerance thereof suggests that earlier rumors that regulators might raise the requirement to as high as 15% by next year seem to be somewhat overblown.

Agricultural Bank of China (SHA: 601288; HK: 1288) finished flat today at 2.60 yuan after a very topsy-turvy previous week.

The lender lost 1.1% last Friday, hitting its lowest level since it started trading on the Shanghai exchange this summer when it launched the biggest initial public offering in history, raising some 22.1 bln usd.

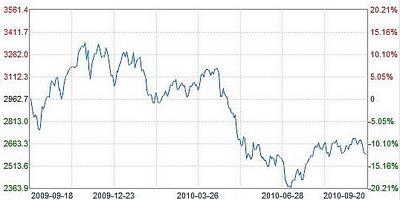

The Shanghai Composite, the benchmark index for Chinese A shares, shed 2.4% last week to 2,598.69, the biggest weekly drop in over two months, as investors fretted over possibly stricter lending requirements in the near term.

Related reports last week suggested that the China Banking Regulatory Commission (CBRC), the nation’s banking watchdog, is considering other capital requirement enhancements including a new capital surplus stipulation ranging between 0-4% of loans outstanding.

Today, banking shares were generally mixed.

Shares of China Construction Bank (SHA: 601939; HK: 939) were unchanged at 4.51 yuan while Bank of China (SHA: 601988; HK: 3988) lost 0.31% to close at 3.22 yuan.

One major index driver today was China Eastern Airlines (SHA: 600115; HK: 670), one of the country's Big Three carriers.

It was up by 8% at one point today, settling for a 5.62% gain at the 3:00 pm close to 8.08 yuan on a steadily strengthening yuan versus the US dollar.

A relatively stronger local currency makes loan repayments easier and aircraft orders more affordable, not to mention making PRC residents more willing to opt for air travel.

Analysts generally expect the index to fluctuate rangebound this week as the government seems to be taking a step back from major new lending or capital adequacy ratio restrictions.

Nor is there any significant macroeconomic news due on the near-term horizon.

They did however add that they were keeping a close eye on deteriorating Sino-Japanese relations as the latter side continues to detain the captain of a Chinese fishing vessel that recently allegedly rammed a Japanese coast guard ship near disputed islands in the South China Sea.

However, they say the bilateral spat has so far failed to significantly affect companies that have heavy exposure to trade and investment between the two nations and urge instead a close monitoring of relative exchange rates of the Chinese yuan and Japanese yen to the US dollar, as these potentially have a more significant impact on trade and investment.

See earlier: STRONG YUAN, POWER CUTS: Which China Shares Most Jolted?