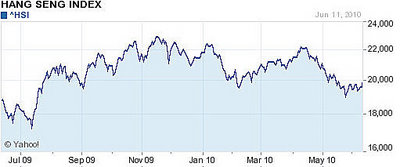

HONG KONG shares recaptured recently lost ground, with the benchmark Hang Seng Index adding 0.90% today to close at 20,051.91, a one month high.

Improving consumer sentiment figures released over the weekend in the world’s biggest economy helped buoy shares in Hong Kong, especially listed Chinese firms with heavy exposure to external demand.

Meanwhile, mainland bourses took a break today in observance of Dragon Boat Festival.

The widely monitored litmus test of the health and vitality of spending power in the US -- the Thomson Reuters/University of Michigan preliminary index of consumer sentiment -- jumped to 75.5, the loftiest reading since January 2008.

As expected, China shares in Hong Kong that traditionally rely on the buying habits of Americans as well as those benefiting from a more confident economic growth environment at home rebounded today.

Topping the list was Morning Star Resources Ltd (HK: 542), which added 23.4% to close at 0.285 hkd.

The company provides outbound tour services, books air tickets and arranges accommodations for well-heeled travelers.

Minmetals Land (HK: 230), which manages properties across southeast Asia, finished up 16.4% at 1.42 hkd.

Also hitching a ride on the bull cart today was Universal Tech (HK: 8091), an online payment solutions firm, which added 14.5% to 0.355 hkd.

Lijun Pharma (HK: 2005) also was in positive double-digit territory, adding 12.9% to 3.15 hkd.

Hong Kong listed Chinese automakers performed well as a whole following yesterday’s announcement from the Ministry of Commerce that it would prolong subsidies for trading in vehicles to the end of this year from the previous deadline of May 31.

This led to automotive parts supplier Zhejiang Prospect (HK: 8273) rising 13.3% to 1.7 hkd on the prospect of stronger demand at home and rejuvenated exports to North America on brighter consumer sentiment abroad.

Other single-digit gainers included major Nike OEM firm Yue Yuen Industrial Holdings Ltd, Aluminum Corp of China Ltd (Chalco), and Geely Auto.

The Hang Seng has strengthened for five consecutive trading days, the longest gaining streak since early March.

The Hang Seng Index slumped 6.4% in May, the most since January.

Worries over budget shortfalls in Europe and speculation the People’s Bank of China will further tighten credit have contributed to a 13% fall in the benchmark index from its November high.

Analysts expect the Hang Seng, as well as PRC-listed stocks, to exhbit a short term uptrend as markets absorb the more sanguine consumer sentiment abroad as well as track the news stimulus cycle for the China auto sector.

See last week's market report here