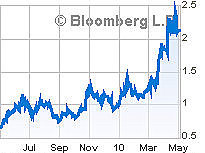

Revenue and net profit in the second half of last year rose sequentially by 60% and 200%, respectively, to approximately 1.82 bln hkd and 94 mln hkd on a strong recovery in mobile handset technology sales.

Over the past few years, the Hong Kong-listed firm (www.sim.com) has led the mobile phone and wireless communication module design industry in terms of both revenue and profit.

SIM’s CFO Mr. Richard Chan met last week with NextInsight, Aries Consulting and Greater China fund managers to explain strategies for this year.

Dialing Up the Value Chain

|

|||||||||||||||||

SIM Technology is heavily steeped in technology, and a quick look at its product line reveals as much.

These include a whole range of handset SIM products including GSM GPRS modules, GPS modules, short-range RF modules, TD-SCDMA modules and WSCDMA SHxPAM modules, among many others.

And the company has been migrating from primarily an OEM producer to a dedicated ODM firm – with its much higher unit margins – for some time.

“We are a very technical-oriented company, so in the future we will focus more and more on the ODM production model,” Mr. Chan said.

The Shanghai-based plant has a Who’s Who list of global name brand clients, so it is understandable how SIM Technology would be obsessed with quality control, effectively having to answer not only to shareholders, but also some of the most demanding and established multinational telecom names.

He said SIM was successfully repositioning its business strategy to emphasize high value handset solutions.

"We will also boost manufacturing efficiency and moving up the technology scale to ensure quality,” the CFO added.

The company and its subsidiaries offer multi-platform wireless communication terminal solutions, ranging from 2.5G, 3G to 3.5G.

In the past few years, SIM Technology has led the mobile phone and wireless communication module design industry based on both top and bottom line scale.

Second Half Blitz

|

|||||||||||||||||

SIM Technology’s revenue and profit in the second half year of 2009 increased by more than 60% and 200%, respectively over the first half of 2009.

Mobile handset solutions and wireless communication modules and modems segments recorded growth in unit shipment and revenue.

In addition, the firm enjoys a strong financial position with net cash balances of more than 590.3 mln hkd.

As proof of its confidence, SIM proposed final dividend payment of 2.2 HK cents per share, with the total dividend for the year amounting to 3.0 HK cents per share, representing a payout ratio of over 35%.

“We are poised to take advantage of the 3G rollout in China, as well as growth momentum in ODM business and smart phone solutions,” the company said.

Overall revenue in 2009 was 2.98 bln hkd, just shy of the 2.99 bln hkd top line the year earlier.

However, due to the tough operating environment (especially sluggish external demand) in the first half of last year, the overall gross margin was down to 9.7% for last year compared to 12.8% in 2008.

SIM said this was also due to price pressure on 2G products – yet another reason the firm is very eager for the full 3G launch in China – the world’s biggest handset market.

“After experiencing a very difficult operating condition in 1H-2009, we have successfully re-positioned our business strategies,” said Mr. Wong Cho-Tung, Executive Director of SIM Technology.

He said these efforts have given SIM a “favorable international recognition and a reputation for reliability among customers and in the market.”

“Thus we have received added orders from several internationally renowned customers and secured new customers for our handset solutions.”

Mr. Wong added that these developments boosted SIM’s position in the second half last year and beyond.

The management expects that the domestic telecom operators’ aggressive network roll-out efforts to develop their subscriber bases will inevitably drive the growth of the domestic handset market substantially for 2010 and beyond.

“Our R&D development capability and its full range of handset and wireless module solutions for multiple 3G standards will place us in a strong position to continue the recent growth momentum of its 3G business revenue and becoming one of the major drivers for our overall performance growth in the future," the company added.

See also: GP BATTERIES: "Grossly undervalued at P/E of 4x" says chairman