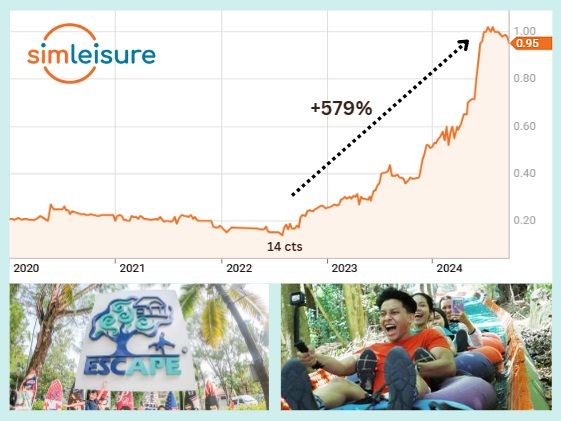

• There's a theme park operator listed on the SGX. If you are surprised, it's because the company has been low key since it started trading at 17 cents in 2019. • Still, some investors must have been enamoured with the company -- Sim Leisure (current market cap: S$157 million). Its stock price had steadily ascended astonishing heights on tiny volumes, reaching $1.00 recently (chart).  • The illiquidity of the stock is largely due to 81.3% being held by the founder (55.29%) and by a family office (26.01%). At some point, Sim Leisure should find ways to increase the public float, or you have to wonder why it stays a listed entity. • Sim Leisure, whose main attraction is Escape Penang, has quickly built up a portfolio of quite distinct attractions spread over several states in Malaysia and Singapore, the latter being where it has just taken over a KidZania franchise. Talk to its founder and executive chairman, Sim Choo Kheng, and you'll hear him articulate a distinct vision of theme parks and other leisure attractions. And it won't be just Malaysia-centric. • Read on the SGX Research article below... |

10 Questions for Sim Leisure Group

1. What is Sim Leisure’s business about and what are some of its key business segments?

|

2. Could you share more on Sim Leisure’s recent financial performance?

- Across the Group’s two main business segments:

a. Theme Park Operations in Malaysia and Singapore accounts for approximately 45% of the Group's annual revenue of RM135.5 million for the financial year ended 31 December 2023 (FY2023). It remains the core business, contributing over 60% of the Group’s profit after taxation of RM29.1 million for FY2023.

b. Design and Theming Construction segment operates primarily in the GCC region and contributed approximately 55% of the Group’s annual revenue in FY2023. It is managed through a 60%-owned subsidiary company. -

Group revenue for 1H 2024 was RM86.8 million, up 56.2% year-on-year from RM55.6 million in 1H 2023. This was mainly driven by the Design and Theming Construction segment, which generated revenues of RM54.8 million from subcontracted theming works for the Six Flags Qiddiya project, as well as theming, design and refurbishment work for new and existing attractions in the UAE.

"We are different because we are dedicated to the innovation of rides, to provide what we think matters most, i.e. providing unique novel experiences especially for the younger generation rather than copying and repeating roller coasters, named after movie characters."

-- Sim Choo Kheng,

Executive Chairman,

Sim Leisure Group - Overall, Sim Leisure Group continues to leverage its international design and theming expertise of theme park operations to drive its continued success and expansion in the leisure industry.

3. What are the key factors driving Sim Leisure’s revenue growth, and how does the company plan to sustain this growth in the future?

- We don't see ourselves as typical "theme parks," although we're often categorized that way. The term has been used by movie franchises to keep their superheroes and characters relevant, a concept dating back to the 1930s as a form of escapism. Despite its success, this model has not evolved much over almost a century.

- We are different because we are dedicated to the innovation of rides, to provide what we think matters most, i.e. providing unique novel experiences especially for the younger generation rather than copying and repeating roller coasters, named after movie characters.

4. How does Sim Leisure differentiate itself from other theme park players?

- We set ourselves apart by prioritising experiential entertainment over movie-based attractions. We see the future of family fun in three main areas:

a. Re-introducing outdoor play in nature. We emphasize fun and adventure in natural environments, encouraging a reconnection with nature.

b. Amplifying experiences using VR technology: We leverage virtual reality (VR) to enhance and transform the entertainment experience.

c. Bringing outdoor parks indoors, especially in Asia with the oversupply of malls, indoor attractions have become a viable and exciting option. - The COVID-19 pandemic has boosted trends like reconnecting with nature and reduced visits to traditional malls in favour of online shopping. Moreover, technological progress during this time has increased interest in VR entertainment.

- By proactively investing in emerging trends, we continue to differentiate ourselves from our competitors. Our ESCAPE brand exemplifies our commitment to this effort as we roll out our fifth park in 12 years.

5. Does the Group have a dividend policy?

- Our Company does not adhere to a fixed dividend policy at present. Our decisions regarding dividends are contingent on factors such as cash flow, earnings, and expansion requirements.

- We aim to reward shareholders and all stakeholders, with these rewards taking various forms beyond traditional dividends. For example, offering unique experiences and tokens for in-park consumption and purchases at our parks and attractions or some forms of revenue-sharing opportunities through attractive fixed-return instruments associated with our new ventures.

- Our objective is to attract a diverse group of customers, investors, and shareholders who align with our vision. As we develop the Sim Leisure community platform, we hope that some of our annual park visitors (approximately 500,000) may become shareholders and vice versa.

6. What are some recent notable developments?

- We have successfully completed and launched two new major parks recently, 1) the adventure-based 120-acre ESCAPE Ipoh Park and 2) the children role-play educational entertainment city of KidZania at Sentosa Singapore.

These new parks are expected to further enhance our top-line growth, adding onto our portfolio to five operating theme parks comprising two KidZania City facilities (in Kuala Lumpur Malaysia and Sentosa Singapore), two outdoor adventure parks under the ESCAPE brand (in Ipoh and Penang), and one indoor ESCAPE challenge park (in Selangor Malaysia).

7. Does the group have any expansion or acquisition plans and what are the strategies for it?

- We exercise caution when acquiring assets and businesses, and we believe in the efficient allocation of capital through organic growth via a revenue-sharing model with land or asset owners for all our leisure brands.

Our recently developed indoor ‘PLAY MALL’ entertainment hub concept offers an exciting mix of nine leading attraction brands including ESCAPE Challenge Adventure Park, FUNDAY Adventure Playground, the HAVEN XR Centre, SIM COASTER Ride, CARNIVAL funfair rides and skill games, MINI MINER mining experience, the DIGGER BUILDER construction play space, NAKED EYE motion simulator ride, and SNOW VILLAGE winter wonder playland, all within one location. - We are currently working on our exciting 75-acre adventure park ESCAPE @KL Base, situated in the heart of Kuala Lumpur city in Malaysia for a phase 1 launch in 2Q2025. This launch will offer various adventure games and activities, with a chairlift facility. We are also targeting further expansions of our indoor ESCAPE Challenge Adventure Parks in Putrajaya and Johor Bahru.

Barring any unforeseen circumstances, the Group is confident we can expand our park operations portfolio to a chain of eight parks/attractions, which will offer a wide range of games and activities and filled with unique experiences under the ESCAPE and KidZania brands by 2H2025.

- Moreover, we are devoted to continually introducing new activities at our ESCAPE Penang Park. This effort aims not only to uphold its status as Malaysia’s top theme park according to Tripadvisor but also to enhance the enjoyment of our visitors.

- Internationally, we aim to replicate our local successes with a revenue-sharing business model and possibly licensing our ESCAPE brand and ‘PLAY MALL’ concept. We see significant potential worldwide for the indoor ‘PLAY MALL’ entertainment hub concept, which can transform and revitalise the mall experience.

8. What are Sim Leisure’s focused markets and why? Are there plans to expand beyond these markets?

- We are currently concentrating on expanding our successful business model across Malaysia and replicating this success throughout the ASEAN region and China.

We do not consider entering the European, North American, or Middle Eastern markets to be viable, as these regions are already saturated and do not exhibit a similar population growth trajectory that Asia has.

9. What specific sustainability goals has Sim Leisure set, and how does it measure progress towards these goals?

- From its inception, the ESCAPE brand has embedded sustainability into its core values and philosophy, consistently championing a return to nature through outdoor activities. This new genre, which we pioneered, highlights our commitment to sustainability and eco-literacy as genuine selling points rather than just corporate rhetoric.

|

10. Why should investors take a closer look at Sim Leisure?

|

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials.

This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research.

For more company information, visit http://www.simleisuregroup.com

Click here for Sim Leisure’s 1H2024 Financial Results, and here for their FY2023 Annual report.