The strong revenue growth was partially offset by reduced utilization rates in the chartering of anchor handling tugs and barges.

“We are targeting equal revenue contribution from our 3 segments,” said CFO Michael See during an analyst briefing yesterday.

He was refering to firstly, shipbuilding, repair and conversion; secondly, chartering and thirdly, special offshore services.

Otto builds high-spec anchor handling tug supply vessels, owns a fleet of 31 offshore support vessels and has 4 special vessels for seismic data collection and subsea work.

Another 7 vessels will be added to its chartering fleet in the year ahead.

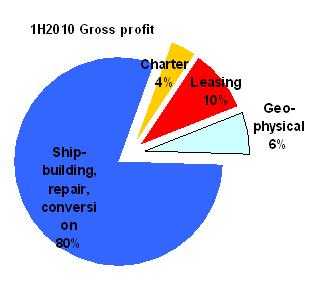

Gross profit increased 113.6% to S$89.6 million in 1H2010, translating to gross margins of 22.1% or an improvement of 5.1 percentage points margin-wise.

Current margins are more reflective of normal operating conditions as the previous period had been affected by 3 vessel cancellations, said Mr See.

Net profit attributable to shareholders grew 19.2% to S$41.2 million, affected by a foreign exchange loss of S$24.8 million, of which S$19.7 million was unrealized.

The forex loss was due to the slide in the Euro (from US$1.43 on 31 Dec 2009 to US$1.23 on 30 Jun 2010).

Mr See expects the forex loss to be reversed in the coming quarter now that the Euro is recovering. It was US$1.32 as at 4 Aug.

Otto has been aggressive in expanding its new ‘special offshore services”.

Its flurry of corporate action for the new segment just last month alone includes the following:

On 2 Jun, Otto increased its stake in its seismic vessel-operating subsidiary, Reflect Geophysical, by 7.6% to 81.6%.

Reflect Geophysical was recently awarded a seismic data acquisition contract worth at least US$8 million from Anardarko Petroleum.

The customer is one of the largest independent oil and natural gas exploration and production companies in the world.

|

|||||||||||||||||||||

On 25 Jun, it took a 19.2% stake in US-based SURF Subsea, which recently procured from a liquidator a 292-feet Class 2 DP MSV worth US$55 million.

This vessel allows Otto to offer subsea and offshore construction work, in addition to its current seismic activities.

On 30 Jun, it took a 19.9% stake in Hako Offshore for S$4.8 million in cash. Hako Offshore is integrated marine offshore services provider.

Related story: OTTO MARINE: Q1 revenue surged 286%, analysts target 58 cts for stock