Excerpts from latest analyst reports…

DMG & Partners initiates coverage of United Envirotech, target 53 cents.

Analysts: Selena Leong & Terence Wong

Dr Lin Yucheng, CEO, United Envirotech. NextInsight file photo

We are initiating coverage on United Envirotech (UE) with a BUY and a TP of S$0.53, implying an upside of 41.3%. We like the stock as

1) the macro outlook remains positive for the China water industry;

2) our expectations that earnings will see asurge in the next two years and

3) valuations are cheaper (8.5x current P/E) than its Singapore-listed peers (12.4x) and China-listed peers (>30x).

Our TP assumes ittrades up to the industry average.

Strong track record in Membrane Bioreactor (MBR) technology. In 2008, UE isrecognised as one of the seven major international MBR providers in China (published by China Membrane technology website and China Water Net).

It has an extensive track record in MBR, especially in the chemical, petrochemical and industrial park sectors. It was the builder of the largest MBR wastewater treatment plant in China,at Jingxi, Guangzhou City. In line with the positive macro environment, we expect UE to secure more projects moving ahead.

There may be an upcoming Phase 2 for the Hegang BOT project, comprising of 50,000 tonnes treatment capacity/day, following the completion of the first phase in Sep 2010. We expect UE’s order book of over RMB500m to continue growing.

Potential tariff increase. We are optimistic that UE would be able to continuesecuring tariff increases from the various municipal governments. Its last negotiation for its Liaoyang project in Liaoning province concluded with an increase in the minimum off-take of wastewater treated, in line with the growing population in the area.

Source: DMG, July 9

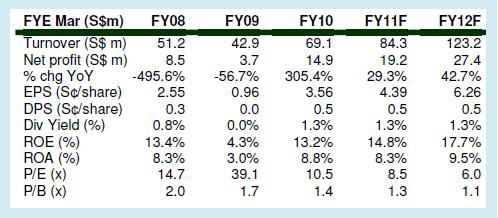

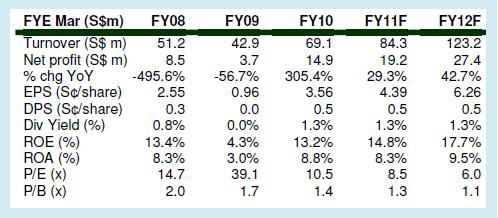

Next two years earnings to surge. UE’s Hegang BOT project in the Heilongjiang province is expected to make its maiden contribution to sales in 2HFY11, coming in at S$2.0m and equivalent to a 15.8% YoY boost in Treatment revenue.

Based on the recognition of the Hegang project, we estimate sales to come in at S$84.3m in FY11(+21.9% YoY) and S$123.2m in FY12 (+46.3% YoY). Consequently, we have forecasted earnings in FY11 and FY12 to come in at S$19.2m (+29.3% YoY) and S$27.4m (+42.7%YoY) respectively. This works out to a 4-year earnings CAGR of 34.2%.

Kim Eng Securities highlights Biosensors’ “rapidly improving financial position”

Analyst: James Koh

Background: Biosensors develops, manufacturesand markets medical devices used in interventional cardiology and critical care procedures. The company was established in1990 as a medical contract manufacturer and listed on the SGX in 2005.

Source: Kim Eng Research, July 9

Why BioMatrixTM is better: Cholesterol clogs up the coronary arteries, leading to heart failure.In this case, a metallic tube‐like device called adrug‐eluting stent (DES) is inserted into the artery to help ease the blood flow restriction.

Unlike the other types of DES in the market, BioMatrixTM uses a biodegradable polymer,which mitigates the life‐time risk of fatal bloodclotting caused by the residue polymer.

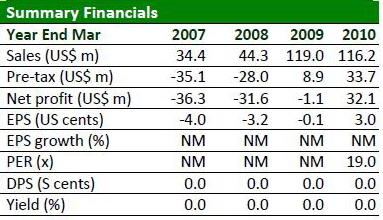

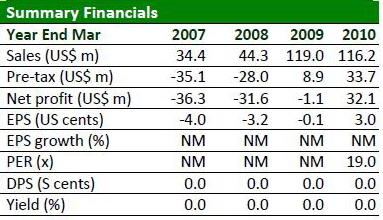

Time to reap the fruits: After spending more than five years and US$100m from R&D to launch, the group is now rewarded with a product that has shown better performance than Johnson & Johnson’s product in a reputable 24‐month trial. Total global market size is said to be US$6b. The product has already gained 8‐20% market share in Europe and Asia where it is launched.

Financials turning around: Following the launch of BioMatrixTM, the group is back in the black, posting a profit of US$32.1m for FY3/10 from a loss of US$1.1m previously. Operating cash flow is expected to remain positive in FY3/11, a sign of the company’s rapidly improving financial position.

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors