In this weekly series titled JUST ASK, we invite readers to send in questions on stock investing, and personal finance. We will ask an expert (or experts) to provide answers. Below is a question from a reader which is answered by Leong Sze Hian, President of the Society of Financial Service Professionals, and Musicwhiz, a popular blogger on financial and investment topics.

How much to save to reach $2-3 m by age 50?

How much to save to reach $2-3 m by age 50?

Reader: I am a graduate in my mid-30s, and earn about $5,000 a month. My wife is of the same age, a graduate and also earning the same income. We don’t have children and we live in a HDB flat, don’t own a car, and are conservative in our lifestyle.

We hardly invest in stocks, and accumulate savings in the bank's fixed deposit accounts.

We hope to retire at 50 on savings of $2-3 million. We believe we can based on some back-of-the-envelope calculations that we have done. We don’t plan to stop working completely after 50, but will work two or three days a week.

Is it possble to achieve $2-3 million by 50? Is this enough to last us for the rest of our lives?

Leong Sze Hian

Leong Sze Hian

Dear Reader: Let’s assume that you are:

* aged 35,

* want to have $6,000 a month (60% of your combined income now) when you retire at age 50;

* the $6,000 should increase at 2% per annum to adjust for inflation;

* you want this sum until age 88.

Under the above assumptions, the capital you require at age 50 is $1,913,304, assuming your savings can achieve a 6% rate of return a year along the way.

If I assume that you have $300,000 of assets now (CPF + cash), you will need to save $4,027 monthly from now to age 50.

As the assumption is a 6% rate of return, you may have to consider investing your cash and CPF - after setting aside about 6 months of your expenses in cash, and the first $50,000 of your CPF OA/SA that cannot be invested.

If you plan to work for 2 or 3 days a week when you retire, the amount you need to save may be less, as the inflation-adjusted equivalent of $6,000 today is $8,075 in 15 years' time.

Leong Sze Hian as been a Wharton Fellow and alumnus of Harvard University, authored 4 books, quoted over 1,000 times in the media, and invited to speak more than 100 times in about 20 countries on 5 continents.

He has served as Honorary Consul of Jamaica, Chairman of the Institute of Administrative Management, the UNESCO Leadership Chair Council and founding Advisor to the Financial Planning Association of Brunei and Indonesia.

He has 3 Masters degrees in Financial Planning & Financial Services, 2 Bachelor degrees in Economics & Insurance, and 13 professional qualifications.

Musicwhiz's avatar

Musicwhiz's avatar

Dear reader: I would think that since you and your wife are gainfully employed and also living frugally, accumulating substantial wealth should not be a problem assuming nothing goes seriously wrong to derail your plans.

When I say "serious", I mean that one should at least have adequate cash buffer as well as insurance for emergencies and exigencies such as critical illness, accidents, hospitalization and/or death.

This is to ensure the spouse does not get burdened by heavy liabilities or insufficient resources to tide him/her over. If one is sufficiently covered, then just work hard and save.

However, I must emphasize that investing is necessary in order to further grow your savings and compound them at rates which are above inflation. Putting all your monies in fixed deposit sitting in a bank account will earn at most 1% per annum in the current depressed interest rate environment.

By contrast, most blue-chip equity securities pay a yield of about 3-4% during normal times, and some may have even higher yields if you care to look deeper. The catch is that one has to take a long-term view with such investments and ride out the volatility which will surely occur in financial markets.

You may even consider a passive index fund which tracks the major indices and which has very low costs as compared to actively managed mutual funds which have high upfront and switching costs.

That said, I would advise against investing in products which you do not understand - the Minibonds saga has taught all of us the folly of purchasing something in the name of high yield but with correspondingly high risk as well.

As you grow older, you may wish to park your monies in a combination of bonds and equities; as bonds give stable coupon rates and are less prone to volatility. To find out more about asset allocation, you may wish to speak to a competent financial planner.

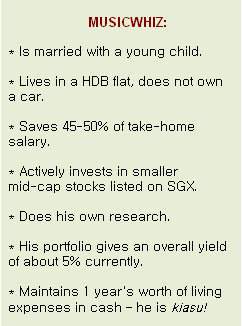

As for myself, I save 45-50% of my take-home salary, and actively invest in smaller mid-cap stocks listed on SGX. I do my own research and my portfolio is giving me an overall yield of about 5% currently.

I am married, with a young child, but do not own a car and we live in an HDB flat. My idea of growing wealthy is the "slow and steady" way of accumulating savings, investing and growing money through yield and compounding.

Call me old-fashioned but I do not endorse the idea of leverage (borrowing) to grow monies quickly, even though many in Singapore have done so with properties. This is because property prices have been on an uptrend since 1996 and so far has not shown much signs of dipping (due, in part, to Singapore's foreign worker influx policy).

But leverage can be a double-edged sword - it can magnify your returns during good times but exacerbate your losses during bad times. What you hear about and read in the news are probably many of the "success" stories, a result of people flipping properties and making money in an overall rising market.

But the horror stories of people losing their shirts are seldom narrated. So my advice is to take the slow approach to building wealth. Live within your means (you are already currently doing so), save aggressively and also invest your money (you may wish to explore this).

But always remember to have at least 6 months of emergency funds in case something unexpected happens. I usually maintain a buffer of 1 year's worth of living expenses as I am more "kiasu".

- Musicwhiz is a 30-something investor who has been investing for about 5 years in the Singapore stock market. He practices value investing and does his own research into potential companies to invest in.

Email your questions to

2) Not against stocks. I'm just relating my own experience and many others i've come acros and contact with. Property is the way for most. Stocks are too difficult for most people. Can you imagine a lot of people do not even know what NAV or PE is.

Ill-mannered and lack graciousness? Thanks. I rather be an arsehole who tell the truth .. than to be preaching something that will cause people to realise when they reach retirement age that they were wrong to believe in stocks. most in the financial industry need your money in stocks and bonds. not properties. If not, they cannot churn ur account or charge your account.

I know quite a few ordinary folks with easily $1-2 million in their stock portfolio.

2. U sound pretty much against stocks -- why?

And, no offence hor, but you sound pretty ill - mannered. U lack graciousness.

Property is the only way for most ordinary folks. Please read up more and go meet more Successful people. Don't listen to advices here from people still trying to find their financial freedom and people with vested interest.

If you venture into stocks for significant capital gains, you will need to be able to read and understand financial statements -- and understand business dynamics. And you need luck! I have made good returns and to be honest, luck played a part in my timing and choice of stock picks.

For ex., Hiap Hoe, which I could understand its financials and its future prospects and knew it to be undervalued back when it was 45 cents. It had been undervalued for a long time and who is to say it must go up? So I consider myself lucky that the market has re-rated it and there were catalysts for that to happen.