This is an edited version of an article that appeared in Sharesinvestment.com on Jan 18, and is reproduced here with permission. The writer, Ernest Lim, is a shareholder of Techcomp Holdings, and a professional investment manager.

WOULD YOU BE interested to invest in a company which has never suffered a loss in its twenty two years of operation, and in fact, has registered a compound annual growth rate (CAGR) of 20% for its revenue from 2002 to 2008?

Techcomp Holdings (www.techcomp.com.hk) is one such company. It was listed on SGX Main Board in 2004.

Techcomp is a manufacturer and distributor of highly advanced scientific instruments, analytical instruments, life science equipment and laboratory instruments. These are used in laboratories for a multitude of industries such as pharmaceuticals, biotechnology, medicine, food and beverage etc.

Growth drivers from multiple fronts

Techcomp is expected to benefit from both organic and inorganic growth. For organic growth, Techcomp has commenced mass production of biological safety cabinets for NuAire. NuAire is expected to benefit positively from the strong demand of such products arising from the H1N1.

This is expected to contribute to Techcomp’s FY09 profits.For inorganic growth, Techcomp has made the following strategic business decisions whose benefits should start to accrue this FY09.

Firstly, its 50-50 joint venture (JV) with Bibby Scientific in 2008 is gaining traction. Techcomp’s existing manufacturing facilities in China would be used to produce scientific equipment products under Bibby’s existing established brands for the local and overseas market.

|

In addition, the JV will post a maiden contribution to Techcomp’s FY09 profits.

Secondly, Techcomp has acquired a 75% stake in a French company, HCC SAS (HCC) in July 09. This allows Techcomp to acquire complimentary technology and leverage on the brand equity of HCC’s subsidiaries.

This acquisition is expected to be earnings accretive for FY09 results.

Going forward, management is confident of enhancing the value of HCC by reducing HCC production costs (leveraging on Techcomp’s manufacturing facilities in China), and combining HCC’s complimentary products and distribution network to Techcomp’s products and thus, able to offer customers a broader product offering.

Both the acquisition of HCC and the JV with Bibby Scientific would enable Techcomp to gain a foothold in the European market and would bode well for Techcomp over the long term.

During the early part of 2008, Techcomp was covered by as many as six brokerage houses.

Unfortunately, interest in Techcomp soon faded and currently there are no analysts covering this company.

Thus, the investment community is still not familiar with Techcomp yet.

However, for those investors who understand and believe Techcomp’s prospects, they may find such times to be rare opportunities to accumulate the shares before the investment community discovers Techcomp.

Illiquidity is a problem for Techcomp. Over the latest 3-month period, there is only one trading day where volume crosses more than 300,000 shares traded.

Techcomp is not traded for some of the days. Thus, investors have to consider this carefully as they may not be able to enter or exit Techcomp easily.

Conclusion

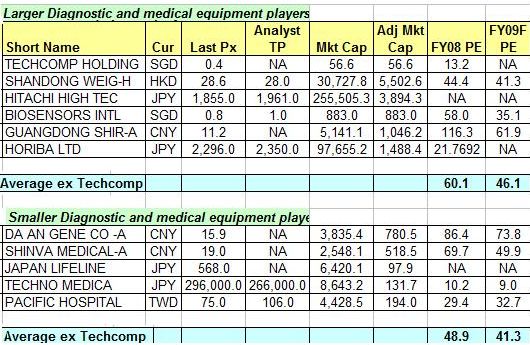

With reference to the table above, its peers are trading in excess of 40x FY09F PE. If we assume Techcomp to replicate its seasonal nature (i.e. 2H net profit accounts for 80% of its full year profits), back of the envelope calculation would yield a FY09F PE of 5.8x which is a substantial discount to its peers. If Techcomp is able to continue its steady growth pace, it is likely to catch the attention of the investment community in due course.

Ernest Lim is an assistant treasury and investment manager. Prior to joining his present employer in 2009, he was with Legacy Capital Group Pte Ltd, a boutique asset management and private equity firm, as an investment manager since 2006. He received a Bachelor of Accountancy (Honours) from Nanyang Technological University in 2005. He is a Chartered Financial Analyst as well as a Certified Public Accountant Singapore.

NextInsight's story on the 20th anniversary of Techcomp: TECHCOMP: From HK$50K to S$70 million in 20 years