Kim Eng Research initiates coverage of OTTO MARINE with 64-ct target

Analyst: Eric Ong

Otto Marine's yard in Batam. NextInsight photo

Otto Marine’s strong engineering and technical capabilities clearly set it apart from its peers in the offshore marine sector.

With a solid track record and an experienced management team, the Group has gained recognition in the construction of high-specification offshore support vessels. As a result, it has successfully penetrated the traditional stronghold of European shipyards.

Focus on higher-value vessels

As the search for, and the production of offshore O&G become more challenging, we believe that the demand for new vessels will continue to shift towards those with more horsepower and higher bollard pull. OM is focusing on the construction of such complex offshore vessels for deeper water operation, which generally command better margins.

People are its key asset

OM boasts a well trained in-house design team that provides turnkey solutions for its customers. This allows for a more efficient shipbuilding process by minimising errors, through the development of a precise virtual model of vessels for review and testing prior to actual production. This has in turn resulted in higher productivity and cost savings for the Group.

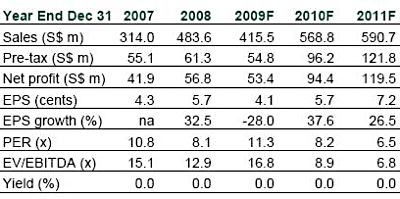

Source: Kim Eng Research, Jan 11

Chartering: Fuelling earnings growth

Moving forward, ship chartering is another key area of growth for the Group’s business; the management aims to expand this segment and turn it into a major pillar of its earnings. A long-term stable source of income from ship chartering will also complement the cyclical nature of shipbuilding business. As of 10 Dec 2009, it has already secured about S$400m in forward chartering contracts that will stretch to 2019.

The best is yet to come

We are initiating coverage on OM with a 12-month price target of S$0.64, implying upside potential of almost 38%. Our fair value is based on the SOTP valuation. We believe the market has yet to fully appreciate its prospects and evolving business model. Near-term catalysts include the on-schedule delivery of vessels and the announcement of new contracts.

DBS Vickers re-initiates coverage of HONG LEONG ASIA with $4.08 target

HL Asia stock this morning has soared past its 52-week high (above)

Analysts: Patrick Xu and Paul Yong

Earnings rebounded, by 63% y-o-y on the back of 18% growth of revenue in 9M09, driven by robust sales and higher profitability of its PRC businesses, especially Xinfei, the 2nd largest manufacturer of refrigerators in China, which benefited from Chinese governments’ stimulus policies.

We expect the earnings to grow another 24% in 2010 mostly from Xinfei, Yuchai and Tasek, driven by (i) continued subsidies to buyers of household appliances from rural areas, (ii) continued growth of auto sales in China and (iii) recovery of construction activities in Malaysia.

Key businesses seem to be undervalued. Yuchai is trading at>50% discount to its peers in terms of FY10 P/E, due to investors’over caution after the accounting issues for the previous two years. However, we understand from management that the accounting issues are already behind HLA, and we think Yuchai still has plenty room for improvement. Tasek is trading at >20% below peers average based on ex-cash FY10 P/E as well, despite stronger balance sheet.

Potential unlocking of value from Xinfei. Xinfei’s peers are trading at an average of 20x FY10 P/E, which implies S$1,470m market value if applied to Xinfei’s earnings estimates for FY10.Compared to the recent purported offer of S$980m, we believe a lot more value of Xinfei could be unlocked if it could be listed or sold at valuations close to its peers.

Resume coverage, BUY, sum-of-parts TP S$ 4.08. We pegXinfei, Yuchai and Tasek to their market values and the unlisted business segments to peer group average PE or P/B multiples. HLA is currently trading at an attractive PE of 8x (FY10) given the strong prospects of its businesses in China with potential re-rating of key segments as catalysts.

Key Risks include (i) negative policy changes in China, and (ii) lower transparency to investors