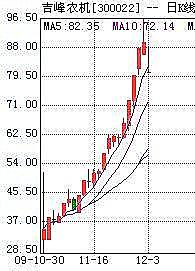

Gifore’s share price more than tripled since listing on the GEM Oct. 30. Image: Internet

SICHUAN GIFORE Agricultural Machinery Chain Co Ltd (SZ: 300022), China’s largest farm equipment chain, has become somewhat of a poster child for the fast-rising new GEM board in Shenzhen.

In just 20 trading days, the Sichuan-based firm had its shares suspended from trade 18 times due to daily range limits, and over the past three days its valuation rose consecutively by the daily limit, prompting regulators to freeze trading in shares held by major holders in the company, online Mandarin language PRC publication Tengxun Finance said.

From its initial trading day on Oct. 30 to its Thursday close, the counter saw its share price move from 28.50 yuan to touch a new high yesterday, flirting with the 100 yuan level, a more than tripling in valuation in just over a month’s time and allowing its P/E ratio to hit a high of 291 times!

And this has not only peaked the interest of GEM board investors, but bourse regulators as well.

This led the Shenzhen Stock Exchange to announce Thursday that it would maintain round the clock vigilance for any major share price or volume changes and what it called "phantom fluctuations” on the board. It pledged to implement “realistic safeguards” to protect the interests of all shareholders entrusting their money with the new capital raising platform.

The publications said that both capital market watchdogs and financial experts in Shanghai (home to China’s biggest stock market) both agreed that wariness was a necessity, and that of all the current 28 listcos on the new board in Shenzhen, Gifore’s valuation had exhibited the most erratic behavior of all and had likely lifted other counters along with its frenzied rise.

Tracking Gifore Closely: GEM-listed Gifore has seen its share price more than triple in a month. Photo: Gifore

Therefore, Shenzhen bourse regulators decided to restrict the trading of shares held in Gifore by major holders for a period of three months. It was also decided to freeze the shares of “overly active” holders of the agricultural machinery producer’s shares. Over this time period, the securities watchdog would conduct an investigation into whether any extralegal activities were conducted in connection with trading of Gifore’s shares since it listed on Oct. 30.

This is the first such action taken by market regulators for the new board which targets capital-hungry small and medium-sized enterprises looking for expansion and development money.

Many had been touting the board as China’s version of the Nasdaq, but the Shenzhen GEM will have to deal with very high price-to-earnings (P/E) ratios and skyrocketing share prices in its first month of operation before its can hope for long-term sustainability and an assurances that it can offer a relatively safe place for investors to garner stable returns – at least for those who do their homework first.

Relatively high valuations are already holding their own after a month of trading on the board, with Bode Energy Equipment (300023) recently topping the list of 28 firms on the GEM with a P/E ratio of 133.9 times.

End-November average P/E for the new board stood at a frighteningly high 114 times.

In comparison, the average historical P/E ratio of Shenzhen-listed shares is 39 times and that of stocks on the main Shanghai Stock Exchange is 27. This compares against a recent average of just 17 times for Hong Kong-listed shares.