Strong Petrochemical ED Mr. Arthur Wong (left) along with company officials and fund managers. Photo: Andrew Vanburen

CRUDE OIL trader Strong Petrochemical Holdings Ltd (HK: 852) saw its net profit in the 12 months-to-March rise to approximately 330 mln hkd, considerably higher than the 93 mln hkd recorded the previous fiscal year.

This is all the more impressive given the intense volatility of the global benchmark crude price, which fluctuated last year between extremes of 141 usd per barrel and just 40 usd.

Revenue over the same period rose to 5.99 bln hkd from 4.21 bln.

Mr. Arthur Wong, Strong Petrochemical’s executive director, recently told NextInsight, Aries Consulting and a group of Greater China fund managers that the company was able to pass on higher crude prices to clients, and that during benchmark price nadirs, increased demand from China paid off in higher volume orders.

“Our revenue is 90% derived from crude oil trading, and mainly from trading in China. While we can’t compete with the big players like Petrochina and COS (China Oil Services), we see ourselves as a niche player in China crude oil. In fact, we are one of a few small oil trading companies listed in Hong Kong,” Mr. Wong said.

The impressive revenue increase was mainly due to the surge in demand for crude oil from customers in China. The quantity of crude oil sold amounted to 8.2 mln barrels, which was 2.6 mln more barrels than the previous year.

Mr Wong said Strong Petrochemical (www.strongpetrochem.com) was quite content operating under the radar.

“We are kind of a low-profile company. We don’t take speculative positions. Our niche market is special unplanned demand, essentially filling in gaps for oil majors. This is our strength, and it is helped by our good relationships with suppliers.”

He also said the special unplanned demand market also delivered higher margin sales, much better, in fact, than the average 1-2% profit margins for the oil trade industry as a whole.

The niche market sales also allowed Strong Petrochemical to save money by foregoing long-term contract costs and the expensive software that often proved burdensome for major players engaged in more speculative or hedging strategies.

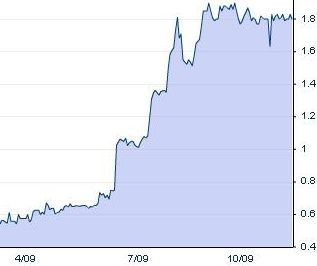

Strong Petrochemical shares have tripled from their March low.

Strong PRC economy, strong crude demand

“We are a smaller volume player and don’t use structured products. Therefore we don’t think it’s necessary to buy very expensive hedging tracking software.”

He said the company would continue to solidify its positioning to compete in its niche of satisfying unfulfilled and unplanned purchase demands from the Mainland Chinese State-owned Licensed Import Agents by supplying oil products of different varieties and specifications within a short time frame.

The major bonus to this niche was that it naturally allowed premium pricing advantages.

Strong Petrochemical is confident that China’s economy will continue to record strong growth, both due to the natural vibrancy of production and demand in the PRC as well as artificial impetuses such at the ongoing 4.5 trln economic stimulus package brokered by Beijing.

“As the plan will spur growth in the consumption of oil products, Strong Petrochemical considers that its market demand and prices are set to sustain a stable momentum, leveraging on the overall growing demand from oil products and economic recovery in the PRC,” the company said.

| |||||||||||||||||

It added that it would broaden its customer base by seeking new customers, in particular, overseas customers and non-state-owned import agents in the PRC.

He also added that the company was always looking to diversify its supply chain, but that currently it bought most of its crude from Indonesia, South East Asia, Russia and Africa.

“We also enjoy a tax-free offshore license from the Macau authorities, so have transferred the majority of such business from Hong Kong to Macau. Our Hong Kong office is more focused on chemical trading at this point,” Mr. Wong said.

Strong Petrochemical was also an astute judge of creditworthiness when it came to doing business.

China's flirting with double digit growth again this year will keep orders coming in for Strong Petrochemical. Internet photo

“When we approach a prospective client, we always first ask our banks: ‘Are they a reliable client’? So therefore our banks are our first-level gatekeepers.”

He said the company was provided 327 mln usd in bank financing by four international lenders, and that the funds were mostly used for trading purposes.

Secure funding was very important to Strong Petrochemical because it was investing in storage facilities so as to enhance its ability to meet short-term gap-filling demands from the oil majors in China and the region.

The company has begun investing in and developing storage facilities for oil products since 2007, through its investment in the Nantong and Tianjin Projects, both in China.

The group also acquired a single-hull 265,243 DWT oil tanker in June which will be used as a floating storage facility for self storage mainly, with the remaining storage leased out to external customers at market rates in order to cover operating costs.

“The tanker cost us 24 mln usd and is floating off the Malaysian coast. It is already a cash inflow revenue source for us. We’ve already paid 60% of the price for the tanker in cash, and will pay the remaining 40% by the end of this year,” Mr. Wong said.

He said the company had a very good year, and that its listing in January was an auspicious omen of good things to come.

“We were the first company to successfully list in Hong Kong in 2009.”

The company will release its April-September results on Nov. 23.