Dr David Lee, 47, a former NUS lecturer

The non-executive chairman of MAP is Dr David Lee, 47, who probably is the only former academic in Singapore to have founded a fund management business – Ferrell Asset Management.

Ferrell, a hedge fund which started life in 1999, has been accumulating lots of MAP shares for a long time.

Its last purchase was in early January this year, bringing its total holding to 45,644,115 shares, which is a 12.3% interest in the company.

This compares with 38.3 million shares, or a 10.3% interest, last October.

A good number of its purchases in the last couple of months were at the 30-cent level.

MAP is located in UOB Plaza 2. Photo by Leong Chan Teik

In mid-Dec last year, MAP announced the proposed disposal of its Thai subsidiary M&J Technologies for US$32 million cash.

Just as the good news began to spread, there came news to dampen the stock: Jurong Technologies was under siege from its creditor banks.

Jurong Tech holds 65.75 million MAP shares as a result of the sale of seven of its plastic injection moulding subsidiaries to MAP in 2008.

MAP stock took a tumble to as low as 18 cents on Jan 22 this year. With the approach of the results announcement date, the stock recovered somewhat and last traded on Friday at 25.5 cents. It’s down only 21% as compared to its price 12 months ago.

Stock is down 21% only in the past

12 months.

12 months.

45% jump in Q3 profit

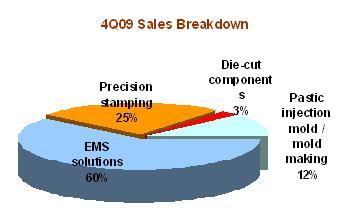

MAP Technology is into electronics hardware component manufacturing, which thrives largely on supplying data storage components to world No.2 hard disk drive maker, Western Digital.

For Q3 ended September, MAP posted a 45 per cent jump in net profit, defying the economic slowdown.

MAP posted a 32.4 per cent year-on-year earnings growth to US$8.3 million for the first nine months of 2008. Cash flow from operations was US$8.1 million.

MAP Technology’s strong showing tracks a 34 per cent year-on-year volume growth in Western Digital’s first quarter ended September 2008 shipments.

Western Digital, which took 22 per cent of the world’s hard disk market last year, is expected to contribute more than 70 per cent of MAP Tech’s sales in 2008.

Western Digital is a financially strong customer as it had US$1.2 billion in cash and cash equivalents as at end-September 2008. Western Digital reported US$211 million in net profit for the quarter ended September 2008.

Demand for electronic manufacturing solutions for external hard disk drives is expected to be MAP Technology’s key growth driver.

Recent story: MAP TECH: Heavy insider buying supports price above IPO level