IPO price was 32 cents.

MANAGEMENT PURCHASES can go a long way in keeping stock prices healthy in these days of muted investor sentiment.

Data storage components maker, MAP Technology, is an example of a stock whose price is well supported by its management.

MAP’s non-executive chairman, Dr David Lee, has been buying shares in the stock every month since it was listed in July 2007.

Dr Lee is concurrently managing director and chief investment officer of Ferrell Asset Management Pte Ltd, which manages over half a billion US dollars of assets, mainly for high net worth individuals and family trusts in Asia and Europe.

Dr Lee, 46, is an academician turned fund manager. After earning first class honors in economics and a PhD in mathematical economics and econometrics from the London School of Economics, he taught at the National University of Singapore for about 5 years.

Later, he served as Overseas Union Enterprise as well as Auric Pacific’s managing director in 2006-2007.

Including Ferrell’s latest purchase of 80,000 MAP shares on 12 Nov at 33 cents apiece, Dr Lee’s stake in MAP is now 11.6%, double the 5.9% stake he held when MAP was listed.

The stock closed yesterday at 34 cents, about 6% above IPO price of 32 cents.

90 IPOs were listed in 2007 and 2008, but only 6 of these stocks were trading at or above IPO price yesterday. The six are:

| IPO Date | IPO price | Last close | Premium over IPO | |

| China Kunda | 9 Oct '08 | 22 cents | 22 cents | 0% |

| Artivision Tech | 18 Aug '08 | 20 cents | 20 cents | 0% |

| China Fibretech | 30 Jun '08 | 21 cents | 26 cents | 24% |

| MAP Tech | 26 Jul '07 | 32 cents | 34 cents | 6% |

| Travelite | 16 May '07 | 30 cents | 35 cents | 17% |

| Sihuan Pharma | 23 Mar '07 | 43 cents | 51 cents | 5% |

Robert Chia recently bought 3.4 million shares at 29.5 cents apiece. Photo by Leong Chan Teik.

MAP CEO, Mr Robert Chia, has also bought 3.4 million shares on 28 and 29 Oct 2008 at an average price of 29.5 cents. Mr Chia now holds a 1.5% stake in MAP.

Does his confidence in MAP’s stock price hint at the company’s outlook?

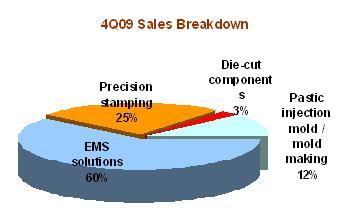

The data components maker’s fortunes are closely tied to world no.2 hard disk drive maker Western Digital, who contributes more than two thirds to its revenues.

Profit attributable to MAP shareholders for the first 9 months of 2008 had grown 32.4% year-on-year to reach US$8.3 million, driven by resilient demand for electronic manufacturing solutions for external hard disk drives.

You are welcomed to post a question or comment at our forum.