HDD PLAYERS had a tough time in the earlier part of 2009, but the sector has been showing recovery.

To HDD component maker MAP Tech, the difficult year 2009 is a time for thorough write offs and provisions, and the company looks forward to a fresh start in 2010.

The group generated operational profits of US$1.6 million during 4Q09, but reversed an outstanding tax credit arising from the provision of doubtful trade debt. This resulted in the bottom line loss of US$2.3 million.

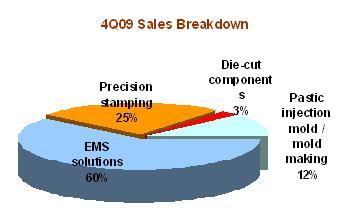

Precision stamping sales doubled to US$11.5 million (up 94.1%) in Q4, but group revenues declined by 5.3% to US$45.7 million mainly due to a contraction in EMS solutions and plastic injection molding sales, which fell 20.5% and 14.9% respectively.

The decline in revenue from EMS solution division was largely due to changes in EMS product mix and a high base arising from the one-off LCD business in 4Q08.

The decline in revenue from plastic injection molding division mainly arose from the cessation of its Malaysian operations due to the relocation of its major customer.

Gross margin declined 0.9 of a percentage point (4Q2009: 10.5%; 4Q2008: 11.4%).

Additional provision was also made in respect of trade debts arising from past transactions entered into with Jurong Technologies, which is under judicial management.

Cash and cash equivalents were a healthy US$30.9 million as at 31 December 2009.

This includes US$5.0 million from the company’s recent rights issue exercise, intended for diversification, mergers and acquisitions.

The stock last closed at 5 cents.

Related story: BROADWAY, MAP, etc: HDD recovery to benefit component makers