ABALONE FARMS out at sea in northern China have been reeling from severe mortality of their abalones in recent months due to a prolonged summer and causes such as in-breeding and pollution.

The warm calm waters proved to be good breeding ground for disease-bearing bacteria which have killed 50% or more of some of the sea farms' abalone population.

With the market supply of abalones having shrunk, the market price of abalones has shot up. (See a news report here)

A structural change in the market is taking place, reckoned Dr Ng Cher Yew, executive chairman of Oceanus Group, the world's largest land-based abalone farmer (market cap: more than S$600 million).

Its abalones have not been affected as its farms are in south China and are land-based.

”There will be a shortage of abalones for the next two to three years,” said Dr Ng, who owns a 37% stake in Oceanus, at a Q3 results briefing on Monday for analysts and fund managers.

It takes about two years – starting with one-year old abalones – to grow to a size for sale.

One-year-olds are in short supply. Hatcheries didn’t ramp up their breeding because the market for abalones was hit by the economic recession last year.

Given the recent rise of 70-80% in the market prices of abalones from the June level, Oceanus intends to sell a lot more of its abalones, especially the large ones.

And it will breed a lot of abalones, which can be sold next year as juveniles.

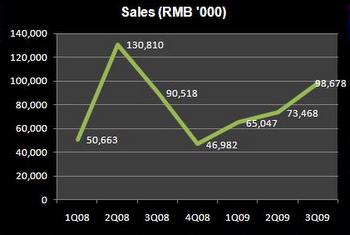

With that, sales of abalones - in tonnage and dollar value - by Oceanus are expected to continue to trend up since they touched a low in Q4 of last year.

While cash sales are expected to rise, any bottomline gain arising from an increase in the value of the biological assets is uncertain as that depends on the independent valuer that Oceanus has engaged.

The valuer will consider, among other things, the sustainability of the price spike when he does the next valuation in December. Any increase in valuation will likely be a percentage of the actual price spike.

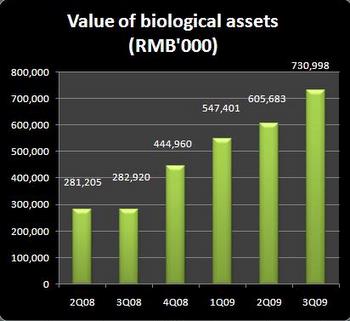

However, the impact on the bottomline is not going to be muted. Consider that Oceanus' biological assets as at end-Sept stood at RMB730 million.

Assuming the company's abalone population profile is unchanged, a 20-30% increase - as an example - in valuation adds RMB146- 219 million to Oceanus' bottomline.

The price spike comes with a downside for Oceanus: small abalone farm operators in the Fujian and Guangdong provinces that Oceanus operates, and which Oceanus wants to buy over, are saying: Pay up more for our farms!

Oceanus is not willing – not when the asking price is a few multiples of the last price it had paid, said Dr Ng.

Oceanus has instead increased the number of year-olds it grows in the cages, and is considering knocking down some buildings on its farms to build more tanks to grow abalones.

Another consequence of the price spike is that Oceanus now wants to sell more to the live market and divert less-than-planned abalones to be canned by its new processing factory.

As at end-September, Oceanus had 176.9 million abalones – one year and older - growing in cages. There were another 59.5 million uncaged ones, which are less than a year old.

|

Recent story: OCEANUS: A big appetite for growth