Ren Yuanlin, executive chairman, Yangzijiang Shipbuilding. File photo by Sim Kih

THERE ARE FEW businesses where you can be making big money building an asset - and destroying the ageing assets.

Yangzijiang Shipbuilding, one of the world’s largest shipbuilders, said yesterday it is venturing into the business of demolishing old ships.

The Singapore-listed Chinese company has entered into an agreement with several strategic partners, including a steel mill, and expects business activities to start in the first half of next year.

Yangzijiang chairman Ren Yuanlin devoted a fair amount of time at a briefing yesterday at Fullerton Hotel to discuss this new venture with analysts and fund managers, in addition to discussing the company’s Q3 results which were released yesterday.

"We have experience in ship demoliton. In the 1980s, we had a ship demolition business,” he said.

The source of the business could be the significant number of ships in China which are 25-30 years old.

Mr Ren would like the new ship demolition facility to be certified environment-friendly, so it can enjoy incentives and subsidies from the China government, resulting in a better profit margin.

Out of 20 demolition yards in China, only three currently enjoy this certification.

He hopes that this new venture, which has a paid-up capital of RMB 300 million, will grow to become an important business segment to complement the existing shipbuilding business.

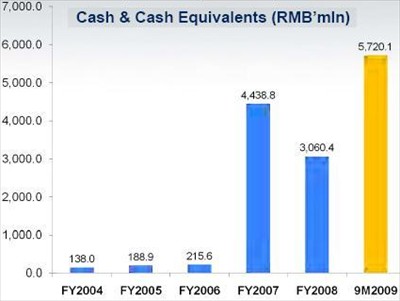

Yangzijiang has a sizeable cash pile.

In the meantime, Yangzijiang’s shipbuilding business will continue to be busy as it currently has an order book of 134 vessels worth US$5.8 billion for delivery over the next two years.

The company says its customers are ‘financially sound with credible backgrounds’ from countries such as Germany and Italy.

In Q3, Yangzijiang secured orders for eight vessels with an aggregate value of US$300 million for delivery in 2010 and 2011.

Yangzijiang is hopeful of securing some more orders - a sharp contrast to the expectations of many shipbuilders.

”We have enquiries, not from big shipping lines, but small and mid-sized ones. We have a good relationship with a number of banks in China and can act as a matchmaker for these ship buyers,” said Mr Ren.

He said, going forward, gross profit margins could drop but not drastically. Key ship parts such as engine systems have fallen in price as has steel – the key raw material – but these are offset by rising labour costs and possibly RMB appreciation.

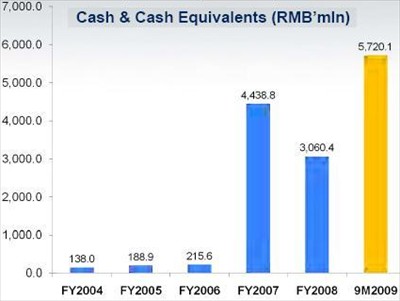

Yangzijiang yesterday reported net profit of RMB1.6 billion for the first nine months of this year, up 39%. Revenue rose 31% to RMB 7.2 billion.

Net profit margin was 22.9%, up from 21.6% previously.

Yangzijiang's profit in RMB million, and profit margin trend (above). Its stock trades at a historical PE of 8.7X.

Here are some highlights from the rest of the Q&A session with answers from Mr Ren translated from Mandarin:

Q What is the state of the shipbuilding industry?

Mr Ren: There is overcapacity in China which won’t go away very fast. Last year, it had seemed that some shipyards would have to close but they are still around. If you look at the big shipping lines, they are posting severe losses or fall in profits. We have yet to see the end of the downturn in the shipbuilding industry.

Q Will you continue to build a few ships without having any confirmed purchase?

(Note: Yangzijiang started building two ships ‘on speculation’ in Q2, and found buyers for them in Q3. Yangzijiang has started recognizing revenue from these two ships.)

Mr Ren: We will – maybe next year, and a maximum of two vessels. There are shipowners who want the delivery to be within a short time frame of around 12 months because of concern about RMB appreciation and inflation.

Q Can you give us an idea of the potential for the ship demolition business?

Mr Ren: We have to build the yard first before we can try to obtain the environment-friendly certification. I would like to emphasise the importance of obtaining the certification in enhancing the business' profitability.

A yard I know made RMB3 billion in revenue and RMB700 m in profit.

I would like the ship demolition segment to be a growth driver in Yangzijiang’s earnings. Initially, our stake in the JV is 20%, so the profit contribution will not be significant, until we increase our stake.

For the press release on Yangzijiang's latest financal results, which were released yesterday, click here.

For the powerpoint of the presentation to analysts, click here.

Recent story: YANGZIJIANG: Why (still) no order cancellation

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors