ABALONES DELICIOUSLY threaded on a shish kebab skewer. Stewed fresh abalones with mushrooms. These are among the offerings at a new restaurant in Orchard Central, opposite Centrepoint.

The 150-seat restaurant is part of a rapidly-expanding chain based in China. It’s a 70-30 joint venture between Oceanus Group and Ah Yat Group, the latter a household brand in Singapore and parts of Asia for its abalone dishes.

In the restaurant chain called Ah Yat Tian Xia, dishes go for just around RMB 40 (S$8).

Oceanus, which is listed on the Singapore Exchange, is an emerging name among stock investors as the company has, through aggressive acquisitions last year, become the world’s largest land-based abalone farm operator. There is no close second.

Its farms are based in China, and the stock is widely viewed as an S-chip with its unfortunate negative connotations owing to a spate of corporate governance lapses by some S-chips.

However, Oceanus’ executive chairman, Dr Ng Cher Yew, is Singaporean and its biggest shareholder with a 39 per cent stake. He is happy to tell investors that Oceanus’ operations benefit from the low-cost environment of China and its corporate governance has the oversight of himself and three independent directors - all Singaporeans.

In other words, out of six directors on the board, four are Singaporeans. Oceanus’ chief financial officer is a Malaysian who has worked in Singapore for many years and was previously the CFO of another SGX-listed company.

Ah Yat Group also owns a small stake in Oceanus, and their joint venture early this year marked the opening of their first restaurant in Shanghai. By July this year, there were already five restaurants and another 15 are to be opened by the end of the year – all in China, except the one in Orchard Central in Singapore, and one in Hong Kong.

Next year, the pace picks up sharply with the opening of 50 restaurants and 100 the following year – all in China, where abalones are considered a delicacy. Oceanus “has effectively carved out a new target market by bringing luxury food to the masses. For instance, a bowl of abalone ramen could be as affordable as RMB38 (approximately S$8). To our knowledge, none of its competitors have been able to serve delicacies at such low price points,” according to OCBC Investment Research analyst Lee Wen Ching in a report in June this year.

The uncertainty that hung over the popularity of Ah Yat Tian Xia appears to have dispersed: Long queues have been reported at the restaurants, which have broken even at the operating level. Daiwa Institute of Research analyst Chris Sanda wrote in a July report: “We have become more optimistic about the prospects for Oceanus’s restaurant joint venture, Ah Yat Tian Xia (www.ahyattianxia.cn), following our visit to Shanghai to obtain proof of concept. We believe the restaurant joint venture can earn satisfactory earnings in its own right, as well as act as a sales conduit for Oceanus.”

A listing of Ah Yat Tian Xia is on the cards when it has reached a certain size, according to Dr Ng, a move that would unlock a lot of shareholder value.

While Ah Yat Tian Xia will absorb a significant portion of the massive supply of Oceanus’ abalones, Oceanus is capturing further profit margin in the value chain through a factory that processes the abalones not only for the restaurants but also for sale in the dried form as well as in canned form.

“We have developed certain techniques and changed the production steps in order to be able to deliver abalones in perfect shape, good texture, good taste - not fishy, and so on,” said Dr Ng.

“Ours are definitely better than those from Australia and South Africa. We think we will be able to take this market by storm when our volumes go up.”

By the third quarter of this year, the new processing factory will be up and running, replacing the factory that Oceanus has leased since early this year. The new factory occupies 1 million sq m, which is equivalent to 160 soccer fields. That’s yet another aspect of the mega ambition that fuels the growth of Oceanus.

The factory will also serve as the central kitchen for the sauce that will go with the abalone dishes served by the Ah Yat Tian Xia chain. On top of that, the factory will produce some of the items that have proven popular at Ah Yat Tian Xia – such as bottled soup cooked with cordyceps and abalones - for the supermarkets in frozen or chilled form.

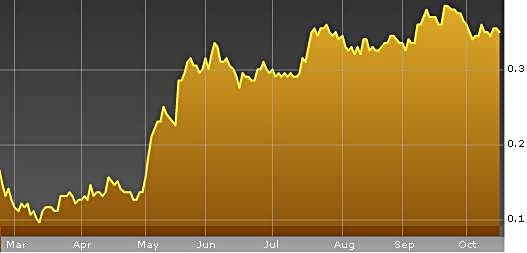

With such plans in the works, stock investors are warming up to Oceanus stock. The shares, which became listed on the Singapore Exchange through a reverse takeover of TR Networks, have been chased up from their 20-cent placement price since its listing in May last year to as high as 44.5 cents in August last year. Then the Lehman Brothers collapse triggered a market selldown in September which brought Oceanus down all the way to just 9.5 cents.

A component of the MSCI Singapore Small Cap Index since the middle of this year, Oceanus has rebounded to around 37 cents recently, with fund managers accumulating the stock. Chief among them is The Capital Group of Companies, which had accumulated 108.8 million shares, or a 6.16 per cent stake, by early July this year. It’s a very liquid stock, attracting long-term investors as well as day traders. There has rarely been a trading day when the stock did not change hands rapidly and in big volumes running into more than 10 million units.

The captivating part of Oceanus for investors is the scale that the business has rapidly grown to: As at the end of June this year, Oceanus had 255 million abalones – surely, a mind-boggling figure - growing in its 41 farms in Fujian and Guangdong provinces. Then there is the future: Ah Yat Tian Xia is targeting several hundreds of restaurants in a few years’ time.

Analysts and fund managers who have attended presentations by Dr Ng find the man to be another big selling point of the company, which has a recent market capitalisation of $618 million based on a stock price of 35 cents.

Dr Ng is a voluble speaker who can effortlessly marshal facts and figures when presenting or responding to questions about Oceanus and the abalone industry in and outside of China. I once sat in on a presentation where he spoke at a brisk pace for about 70 minutes – without anyone among the dozen or so analysts and fund managers interrupting to ask questions.

Dr Ng is no duck out of water either when diving into operational details of aquaculture since he was trained as a veterinarian at Murdoch University, Australia where he studied under a Colombo Plan scholarship. He worked for six years subsequently (1985-1991) at the AgriFood and Veterinary Authority in Singapore.

He later metamorphosed as an entrepreneur and venture capitalist, holding to this day the chairman-cum-CEO post at Springboard Harper Investment, a fund management company he co-founded. So, he understands business, and investments and animal science, and he describes the investment merits of Oceanus this way:

NextInsight file photo

* “We are in a high-margin business as the abalone is expensive.”

* “We are growing extremely fast.”

* “Our business is very visible.”

* “We are the lowest-cost producer.”

Lowest cost producer: Being located next to the ocean, Oceanus’s farms can cheaply tap sea water to rear abalones and supply them with algae harvested from the sea. The algae is abundant: A small piece out at sea will grow into a few tonnes in half a year. Oceanus ranks among the lowest cost producers in the world with breeding costs amounting to RMB35/kati as compared to RMB60-70/kati on average for PRC sea farmers, and RMB150-160 for Australian and South African farmers, according to OCBC Investment Research.

Fast growth: In 2005, Oceanus had 12 million abalones which were a year old. As of end-June this year, it had 120 million, plus another 135 million which were less than a year old. Oceanus, which not only rears but also breeds abalones, expects to produce 100-150 million newborns a year. “We are big business – not small,” quipped Dr Ng.

“And we are big in China, which consumes 70 per cent of worldwide consumption of abalone. Every abalone farmer – whether from Mexico or Australia, everywhere – are trying to sell to China. The problem for them is getting in and the cost of getting in.”

Oceanus has grown very dramatically because last year, it went on an acquisition spree of land and farms in coastal parts of Fujian and Guangdong. Explained Dr Ng: “That has given us a dominant position as a low-cost producer in China. Even if someone has the money and wants to get as big as us, that will be fairly difficult or impossible to do. What are left are the small guys who are scattered, so if a player wanted them, it would be one here and another five km away, the next 30 km away.”

In short, any purchase of the remaining farms would not be cost-efficient to other players.

High visibility: Oceanus regularly provides updates on its abalone population. The creatures are sold either as juveniles or only after they reach three years of age. Some are bred longer to fetch a much higher price.

As a matter of accounting practice, Oceanus does not recognize the value of its abalones until they reach around a year old and are then grown in cages.

Reflecting Oceanus’ aquaculture expertise, the company has recently come up with an interesting side business - rearing sea cucumbers in the tanks where its caged abalones are kept. The thing about sea cucumbers is they feed on (don’t let this spoil your enjoyment of the dish) the waste produced by abalones, helping to maintain the cleanliness of the water. About 5 kg of young small sea cucumbers were placed in each of the 3,000 abalone tanks and they gained about four-fold in weight within about five months. The sea cucumbers will either be sold for a handsome profit margin, or processed.

The main business is still abalones. In the first half of this year, Oceanus sold 581.5 tonnes of abalones for RMB 127.9 million. The tonnage is down slightly from 569.2 tonnes in the first half of last year when Oceanus enjoyed booming sales as its rivals’ farms out at sea were hit by red tide or algae bloom.

In terms of pricing, Oceanus’ sales in the first half of this year fetched far lower price (RMB127.9 million versus RMB180.3 million in the first half of 2008) as a result of a fall in market prices due to the economic slowdown in China.

Another risk in this business has been kept at bay though - the threat of disease. In the first place, Oceanus’ farms are located over 250 km, which reduces the risk of a disease spreading far and wide across its farms.

Given Dr Ng’s training and experience as a veterinarian, Oceanus runs its operations in a scientific way to keep the threat of disease away. Suitably impressed has been the reinsurer for Oceanus’ biological assets, the RSA Group, a global insurance group serving over 20 million clients worldwide with its 22,000 staff. The insurer of Oceanus is China Fishery Mutual Insurance Association.

Mr David Oldham, Business Manager (International Marine) of RSA, said that technical visits to the Oceanus farms have been a critical part of the underwriting process. “We are impressed with the production process of abalones in Oceanus farms. We are able to easily assess the quantity and health of the livestock and gauge the risks involved in the rearing process and we conclude with a high degree of certainty that Oceanus has put in place very good risk management measures in protecting and safeguarding its biological assets.”

Diseases do break out in abalone farms in various parts of the world but Dr Ng cautions against applying the probabilities of disease outbreak elsewhere to his farms. “Disease can happen in a farm that’s not well managed, in an area where the resources are against them. If you read reports that have come out in the past regarding mortality rates, you have to ask yourself: What is the cause? The Taiwan outbreak in 2006-2007 was due to inbreeding. Nothing to do with disease. In the case of Australia, the cause was viral infection at sea.”

Such risks are very remote in Oceanus farms because inbreeding is not practised, and Oceanus has chosen farm sites that allow it to have one-way flow of water, and tanks that are separated

”Let me give you a parallel: If a small factory catches fire, how likely will a huge, well-run factory have the same problem? Very remote.”

The rapid expansion of Oceanus’ business has consumed large amounts of capital, including operating cashflows. Fundraising was inevitable to support the expansion. In May this year, Oceanus secured a $73.5 million loan from two private equity firms -- Ocean Wonder International Ltd (a wholly-owned subsidiary of AIF Capital Asia III L.P.) and Hupomone Capital Partners Singapore Pte Ltd – as well as strategic investors.

“During this difficult time of the financial crunch and economic uncertainty, we are pleased to announce that the investment interest in this financing exercise was overwhelming,” said Dr Ng.

Capital expenditure will slow down enough from next year, and sales will ramp up enough, to enable Oceanus to start paying a dividend for the first time. WestComb Securities analyst Lee Khai Chian expects Oceanus to generate positive free cash flow of RMB 340 million and RMB 780 million in FY10 and FY11, respectively.

“Since there are no borrowings, Oceanus should start to give dividend in FY10 to reward shareholders,” he said.

* OCBC Investment Research analyst Lee Wen Ching projected a decent dividend yield of 5.1 per cent next year based on the current stock price of 35 cents. She initiated coverage of Oceanus in June, with a ‘buy’ rating and a fair value estimate of 40 cents on the basis of 2x blended FY09/10F net asset value. ”Oceanus offers growth amid a recessionary environment. We expect the growing numbers and maturity of its abalone population to drive the growth of the group's earnings and asset valuations. Key risks include execution risk and spread of diseases,” she wrote. * Daiwa analyst Chris Sanda has set a target price of 39 cents for the stock, saying: “We like Oceanus for its niche specialisation, high earnings growth, prospects for high cash flow starting in 2011, and defensive fundamentals. We maintain our ‘Buy’ rating on the stock.” * DBS Vickers analyst Patrick Xu, in a July 29 note to investors, said he has a ‘hold’ rating: “We believe the current share price has fairly priced in most of its growth potential, as compared with its peers. Downside risk lies in the execution of the growth strategies.” He made no change to his earnings forecast but raised the target price to 38 cents, based on 8x FY10 adjusted EPS, as he rolled over to FY09&10 blended adjusted earnings per share. The Oceanus story continues to impress him: “Oceanus is in a fast growing ramp-up period, and we expect its 2H09 earnings to be substantially higher than 1H09. The execution of the growth strategies so far is in line with our expectations, and its recent issue of S$73.5m debt with warrants will fulfill most of its remaining capex for FY09 and at least 1H10.” |

This story was recently published in Pulses magazine, and is reproduced here with permission.

The dishes mentioned in the introduction have been updated.