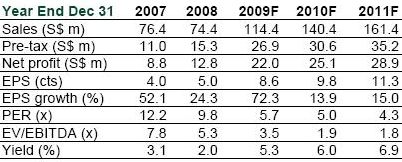

Kim Eng's forecast of Design Studio's performance.

Kim Eng Research initiates coverage of DESIGN STUDIO with 78-ct target price

Analyst - Pauline Lee: To prepare for the debut of the Integrated Resorts, many existing hotels are rushing to refurbish their rooms to capture rising demand and premium room rates.

With a decade of experience in fitting out hotel rooms, Design Studio (www.designstudio.com.sg) will be a prime beneficiary of this immediate demand surge. Earnings from hotel fit-outs, which have yet to be factored into our forecast, could potentially double DS’s earnings over the next 12 months.

Bernard Lim, CEO, Design Studio

The recent 45:55 joint-venture (DDS) with Depa from the Middle East will accelerate DS’s global expansion. By combining the group’s expertise in Asia with the strong financial and manpower resources of Depa, the JV has garnered big orders worth $137m within a year.

This JV offers tremendous earnings upside, as it acts as a springboard for the group to clinch mega projects potentially worth many times of its market capitalisation.

Massive re-rating appears imminent: While valuation is a steal, the stock offers good exposure to the IRs, buoyant residential property sales and fast-growing overseas markets like the Middle East.

Moreover, attractive dividend yield of above 5% adds to its appeal. With a 59% price upside potential to our target price of 78 cents, we are initiating coverage on Design Studio with a BUY.

Recent story: INSIDER BUYING: Abterra, Oceanus, Design Studio

For our coverage of the media briefing on the JV with Depa, read DESIGN STUDIO: Designs for the big time

Capital Tower is part of the CCT portfolio. Photo: Internet

UOB Kay Hian warns of office rental decline, maintains ‘hold’ on CCT

Analyst – Jonathan Koh: CapitaCommercial Trust (CCT) has received more enquiries from financial institutions (fund management), oil & gas companies (HQ functions) and professional services (legal and accounting) recently. However, these enquiries have not translated into take-up for office space. Management expects office rents to be on a declining trend till the end of the year.

According to Colliers, average rents for Grade A office space within Raffles Place has dropped by a severe 29.0% qoq to S$7.45psf. We continue to expect rents for Grade A office space within Raffles Place to slide further to S$6.00 psf by end-10, representing a two-third correction from the last peak.

We believe office rents will continue to be under pressure due to large new supply coming on stream in 2010 and 2011 and competition from business parks outside the Central Business District. We have assumed portfolio occupancy tapering off from 94.9% in 2Q09 to 90% by 2Q11 (previous: 88%). Maintain HOLD. Our fair price of S$1.09 is based on the Dividend Discount Model (required rate of return: 7.7%, terminal growth: 2.5%).