WHEN MOODY'S downgraded Saizen REIT to “Caa1” in late May this year, most investors’ knee-jerk reaction would be to shun the stock. After all, a Caa1 rating means “at risk of defaulting”.

But, guess what, the REIT’s unit price has since held steady. In fact, its market cap has more than doubled in the first half of this year, and its management has been buying loads of the stock at depressed prices in the open market.

Why has there been strong insider buying of this REIT, which invests in Japanese residential apartments which are the equivalent of the HDB in Singapore?

And why the Moody’s downgrade and what were the events that led to it?

"The downgrade reflects Saizen's exposure to significant liquidity pressures, including a material level of refinancing risk and increased difficulty faced in complying with its loan covenant," said Moody's lead analyst for Saizen’s trust, Mr Kaven Tsang, in a report issued by Moody's on 25 May 2009 when the credit rating agency downgraded Saizen’s corporate family rating to Caa1 from Ba3.

On a closer look, however, one realizes that even if Saizen has to redeem its junk bonds at less than face value, this default risk is not directly borne by investors in its REIT units (Saizen shares), recently trading at about 13 cents per unit on the SGX-ST.

Rather, the risk is carried by the end-buyers of the commercial mortgage-backed securities (CMBS) which Saizen’s bonds have been repackaged into.

The good news for Saizen REIT unit-holders is that the loans were granted non-recourse, meaning that creditors cannot seize more than the pledged property portfolio.

For Saizen, its only property portfolio that has refinancing issues is currently operated by YK Shintoku, which contributes 20-25% of annual rental income and is valued at about 11% of net assets under management.

Worst-case scenario

And that’s the worst-case scenario, said its CEO, Mr Chang Sean Pey, when discussing with Pulses the property trust’s near-term challenges and prospects recently.

Under this worst-case scenario, Saizen is unable to refinance in full the 7.95 billion yen (about S$120 million) loan due November this year that is secured by one of its 9 property portfolios.

So what exactly does Saizen REIT’s portfolio comprise of? The real estate investment trust invests in mass-market residential properties that are the equivalent of public housing in Singapore.

Specifically, it owns 166 residential apartment blocks located in 13 regional cities in Japan, with a total value of 44 billion yen (S$660 million). By revenue, Sapporo is the largest contributor, representing 26%, followed by Hiroshima (17%), and Kumamoto (14.7%).

These are outside metropolitan hotspots such as Tokyo and Osaka, but Mr Chang clarified that “regional cities” does not refer to rural areas, as some people may think.

For example, Fukuoka, Sapporo and Hiroshima, where a large number of Saizen’s properties are located, have a combined population of 4.5 million, which is similar to Singapore’s. Saizen REIT owns in total 5,995 residential apartment units, mostly small to medium-sized units, as well as small commercial and office elements on the ground or first few floors.

The properties are generally located in close proximity to business districts and transportation hubs and/or in residential neighborhoods, targeting mass-market tenants such as small families, working couples without children, working singles and students.

”In our experience, the rental and occupancy rates have been extremely stable,” said executive director, Mr Raymond Wong.

Unlike in Singapore where home ownership is as high as 90%, home ownership in Japan is relatively low, at around 60%.

High demographic mobility across provinces or across cities arising from education or job requirements has led to migration by small families or singles that put up in “Chintai Mansions”, the local term for low-cost leased apartments.

And in the 13 cities where Saizen operates, home ownership is even lower - about 50%-60%. Rural folk from countryside areas with populations of 50,000 to 80,000 are moving to metropolitan cities like Tokyo or Osaka, as well as to the regional hubs on the northern and southern sides of Japan.

These are usually singles, and they tend to marry late, so there is a strong demand for the type of apartments that Saizen REIT owns, the so-called “Chintai Mansions”.

For example, in Sapporo, where a quarter of Saizen’s rental income is derived, the typical tenant is a working single who pays monthly rent of about 45,000 yen (S$680), amounting to 25% of his monthly income.

The flats are quite tiny. The small ones are smaller than a HDB studio apartment and the medium-sized ones are smaller than a 3-room HDB flat. That’s why occupancy rates of Saizen’s property portfolio have consistently been high, at about 90% in the 9 years that Saizen has invested in leased residential apartments.

Mr Chang believes that the growing demand for and inflexible supply of ‘Chintai Mansions’ augur well for Saizen’s operational cash flow. There are no occupancy guarantees but Saizen’s large number of individual tenants smooth out rental income trends.

Stable cashflow

Rental rates have maintained at about S$2 per square foot for the past 20 years, which means operating cashflow has always been stable. Given such a stable cash flow, one begins to wonder how Saizen’s liquidity problems began.

They began when it decided to use commercial mortgage-backed securities (CMBS) to finance its property investments. These were loans originated by the former western investment banks such as Morgan Stanley, Deutsche Bank and Credit Suisse.

These loan originators lent money to Saizen REIT and other borrowers. The loans were pooled into a portfolio held by a special purpose vehicle that serves the function of a bond issuer.

The portfolio is tranched into bonds with differing credit ratings, ranging from Aaa to junk bonds, and sold to peoples from different walks of life, including pension funds and high net worth individuals.

That began in the US and worked very well in many places. The cheap, ample debt fueled a real-estate boom that sent prices soaring to record levels.

The CMBS market took off in Japan in 2002, and there was a lot of demand for CMBS papers until late 2007, when the CMBS market suddenly shut down.

Saizen’s debt consisted wholly of CMBS, and its ill-timed IPO in 9 November 2007 turned out to be immediately before the CMBS market shut down. Mr Chang first felt the crunch hard when attempting to refinance two loans of US$100 million with Morgan Stanley.

According to its IPO prospectus, this was scheduled to happen in December 2007. But when the time came, the US investment bank’s CMBS department had already ceased operations.

Bankers only renewed loans or lent to existing customers. After talking to over 30 bankers, Saizen’s management managed to convert 25% of its total outstanding debt to bi-lateral loans (that is, single lender to a single borrower).

On 29 May 2009, it managed to borrow 400 million yen (a S$6 million short-term bridging loan) from a Japanese financial institution. Unfortunately, a poor credit rating exacts high interest liability, and interest rate for the bridging loan is a hefty 15% a year.

The management intends to repay the loan with internal cash resources as soon as practicable. Its property portfolio operated by Yugen Kaisha JOF, valued at 2.3 billion yen (S$35 million) as at 31 January 2009, has been pledged as security for the loan.

In April, unit-holders approved the company’s plans for a rights cum warrants issue, where 497.2 million new rights units at nine cents apiece were issued on the basis of 11 right units for every 10 existing units held by unit-holders.

The rights issue raised net proceeds of about S$41.1 million for the repayment of loans. The tough financial markets caused some distressed sellers of ‘Chintai Mansions’, such as a property company that is going under, to put on sale their investment property portfolio.

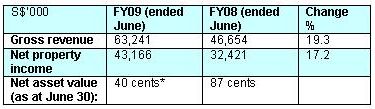

As a result of the sell-down, Saizen’s real estate valuation has come off some 20% compared to the time of its IPO in November 2007. In 3Q09, Saizen’s gross revenue edged up 2.4% to 1.08 billion yen, but it reported a loss of 4.95 billion yen due to the recognition of “net fair value loss on investment properties” of 5.4 billion yen.

Excluding the loss, the company would have made a net gain of 345.9 million yen from its operations.

The fall in real estate values did not affect the rental rates and occupancy of Saizen’s properties, which have remained extremely stable.

Rather, the fall in real estate values was due to a decline in investment demand, as investors had been facing great difficulty in getting debt financing for real estate, according to Mr Chang. Saizen’s management believes that valuation of the company’s property portfolio will recover due to a short supply of “Chintai Mansions”.

Even when property development activity increased in the past few years of economic recovery, these had been for condominiums equipped with lifestyle facilities for sale to homeowners.

There is no retail demand for ‘Chintai mansions” as Japanese do not aspire to own tiny apartment units with spartan design features. Instead, housing demand for such developments comes mainly from commercial property owners like real estate trusts.

As a result, new for-lease developments are few and far in between, as property developers always want to sell the property for immediate cash flow in full, rather than collect rental in a trickle over decades.

According to Mr Wong, current real estate values of ‘Chintai Mansions’ are below replacement value, so it does not even make economic sense for property developers to build a new ‘Chintai Mansion’ as an investor can easily buy another ready-built apartment block at a lower price. And Saizen REIT’s board members are putting their money where their mouth is.

Despite its troubles, including a freeze on dividend distribution until its financing issues are resolved, Saizen’s management has been accumulating the company’s shares.

Mr Wong’s latest purchases from the open market were 1.2 million units on 9 and 15 June, which increased his deemed stake to 1.8%. Mr Chang purchased 50,000 units on 18 May 2009, raising his direct stake to 0.05% while executive chairman, Mr Arnold Ip, scooped up 200,000 rights, and held about 1% after the rights units were listed on 5 June.

This article was published in the Aug edition of Pulses and is reproduced here with permission